Historical Perspective 🕰️

In tracing the historical trajectory of Bitcoin in Comoros, it becomes evident that the cryptocurrency’s introduction sparked a wave of curiosity and skepticism. As one of the earliest adopters in the region, Comoros witnessed a gradual shift from traditional payment methods to the digital realm. This transition was not without its challenges, as the concept of a decentralized currency was met with uncertainty and regulatory scrutiny. However, over time, Bitcoin gained traction among a tech-savvy population eager to explore new financial frontiers. The historical perspective reveals a journey marked by experimentation, adaptation, and a growing recognition of the potential benefits that cryptocurrencies offer in a globalized economy.

Regulatory Landscape 📜

The regulatory landscape surrounding Bitcoin in Comoros has been a topic of significant interest and debate in recent years. As a relatively new and rapidly evolving technology, Bitcoin presents unique challenges and opportunities for regulators around the world. In Comoros, policymakers have been working to strike a balance between fostering innovation and protecting consumers and the financial system from potential risks associated with digital currencies.

The regulatory framework in Comoros is still evolving, with authorities taking a cautious approach to ensure that adequate safeguards are in place. The government has been engaging with industry stakeholders to better understand the implications of Bitcoin and other cryptocurrencies on the country’s financial system. As Comoros continues to navigate the complex regulatory landscape of digital currencies, it will be crucial for policymakers to stay informed and adapt to ensure that the country can fully leverage the benefits of this transformative technology.

Technological Advancements 🔧

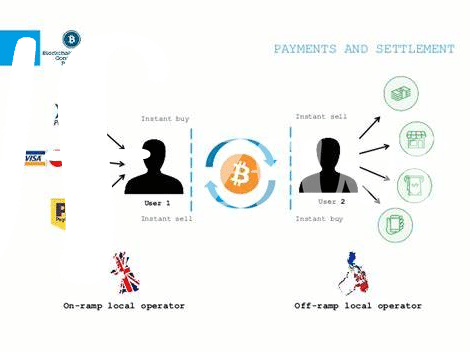

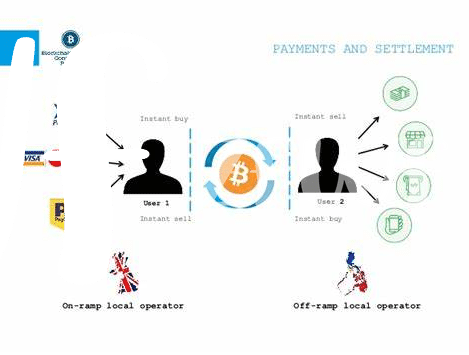

Technological advancements in the realm of digital currencies have been pivotal in revolutionizing cross-border transactions. The integration of blockchain technology has streamlined the process, making transactions faster, more secure, and cost-effective. The transparency and decentralization inherent in these advancements have significantly reduced intermediaries and associated fees, enhancing the efficiency of cross-border transfers.

Moreover, the advent of smart contracts has further enhanced the capabilities of blockchain technology in facilitating international transactions. These self-executing contracts automatically enforce and verify the terms of a contract, eliminating the need for manual oversight and increasing trust between transacting parties. As Comoros navigates the evolving landscape of Bitcoin regulations, leveraging these technological advancements will be crucial in fostering seamless and compliant cross-border transfers.

Challenges Faced 🤔

Despite the promising nature of Bitcoin cross-border transfers in Comoros, there are notable challenges that hinder their seamless implementation. One major obstacle is the lack of clear regulations and oversight, leading to uncertainty and potential risks for users. This regulatory ambiguity not only affects the legality of transactions but also raises concerns about security and compliance with anti-money laundering laws. Moreover, the volatility of Bitcoin prices poses a significant challenge, especially for individuals or businesses looking to use it for cross-border transfers due to the uncertainty in value during transactions.

This complex landscape necessitates a deeper understanding of the legal frameworks and the potential impact on cross-border transfers in Comoros. To explore more on this subject, discussions and frameworks set forth in the WikiCrypto article on maximizing efficiency through Bitcoin cross-border money transfers in China shed light on the practical implications and considerations for navigating these challenges effectively. By delving into these insights, stakeholders can better anticipate and address the hurdles associated with Bitcoin regulations in cross-border transactions.

Potential Solutions 💡

Potential solutions to the challenges faced in the realm of Bitcoin regulations for cross-border transfers in Comoros reside in a combination of proactive government policies and technological innovations. One plausible approach could involve the establishment of clear regulatory frameworks tailored to digital assets, providing a secure and legally compliant environment for transactions. Collaborative efforts between regulatory bodies, financial institutions, and tech experts could foster the development of monitoring mechanisms to track and verify cross-border Bitcoin transfers, ensuring transparency and compliance with international regulations. Additionally, promoting education and awareness campaigns among the public about the benefits and risks of engaging in Bitcoin transactions could enhance understanding and adherence to regulatory guidelines, fostering a more responsible and sustainable digital currency ecosystem in Comoros.

In parallel, leveraging advancements in blockchain technology could enhance the security and efficiency of cross-border Bitcoin transfers. Integration of smart contracts and decentralized finance (DeFi) solutions could streamline the transfer process, reducing transaction costs and processing times while ensuring data integrity and user privacy. By embracing innovation and fostering collaboration, Comoros stands to navigate the complexities of Bitcoin regulations effectively, paving the way for a more inclusive and resilient financial ecosystem in the digital age.

Future Outlook 🔮

In considering the future outlook of Bitcoin regulations on cross-border transfers in Comoros, it becomes evident that a delicate balance must be struck to foster innovation while ensuring regulatory compliance. The evolving landscape poses both opportunities and challenges for the financial sector, requiring a forward-thinking approach to adapt to emerging technologies and regulatory frameworks. Embracing flexibility and collaboration will be key in navigating the changing dynamics of cross-border transactions and maintaining the integrity of the financial system.

To delve deeper into the specific laws governing Bitcoin cross-border money transfers in different regions, it is essential to understand the distinct regulatory environments shaping these transactions. For instance, exploring the Bitcoin cross-border money transfer laws in Cabo Verde can offer insights into how regulations differ from those in China. Understanding these nuances is critical for stakeholders seeking to engage in cross-border transactions compliantly and efficiently.