Potential of Bitcoin Funds 📈

The potential of Bitcoin funds in Timor-Leste holds the promise of transforming traditional financial landscapes, offering new avenues for investment and growth. As digital currencies continue to gain traction globally, investors are drawn to the potential returns and diversification benefits that Bitcoin funds can offer. In this dynamic financial environment, understanding the unique opportunities and risks associated with Bitcoin funds is crucial for informed decision-making and maximizing investment potential.

Timor-leste’s Growing Interest 🌱

Timor-leste’s growing interest in Bitcoin funds has been steadily gaining momentum in recent years. As more individuals and businesses begin to realize the potential benefits of investing in cryptocurrency, the demand for Bitcoin funds has seen a significant rise. This surge in interest is not only driven by the opportunity for financial growth but also by the desire to stay ahead in the evolving digital landscape. With a proactive approach to embracing this new financial frontier, Timor-leste is poised to leverage the advantages that Bitcoin funds offer for economic empowerment and innovation.

As the spotlight shines brighter on the potential of Bitcoin funds, Timor-leste finds itself at a pivotal moment where embracing this digital asset could lead to transformative advancements in financial inclusion and technological adoption. With a keen eye on the future and a growing curiosity about the possibilities that Bitcoin funds hold, Timor-leste is positioning itself as a key player in the global cryptocurrency market. As the nation continues to navigate its way through the opportunities and challenges presented by Bitcoin funds, its growing interest serves as a testament to the evolving landscape of modern finance and the power of digital currencies to shape economies.

Benefits for Local Economy 💼

Bitcoin funds can provide a significant boost to the local economy in Timor-Leste by attracting new investors and stimulating economic growth. As more individuals and businesses begin to embrace Bitcoin as a form of investment, it can lead to increased capital inflow and create opportunities for local entrepreneurs to access funding. Additionally, the transparency and security features of Bitcoin can help improve financial transactions within the community, fostering a more efficient and trust-based economy. This influx of digital currency has the potential to modernize financial practices and promote economic development in Timor-Leste.

Challenges and Risks to Consider ⚠️

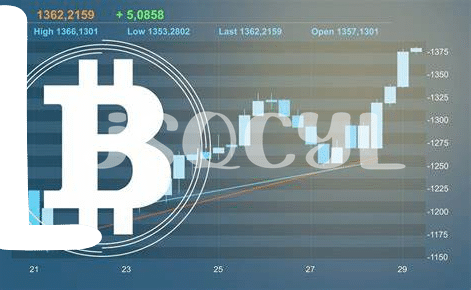

When delving into the realm of Bitcoin funds in Timor-leste, it is crucial to acknowledge the various challenges and risks that come with this innovative investment option. Volatility, security concerns, and regulatory uncertainties are among the key factors that potential investors must carefully consider. Despite the potential for substantial gains, staying informed and being cautious are essential strategies for navigating the complex landscape of cryptocurrency investments. Keeping a watchful eye on market trends and seeking expert advice can help mitigate risks and maximize the benefits of investing in Bitcoin funds.

bitcoin investment funds regulation in tanzania

Regulatory Environment and Future Outlook 🌎

The regulatory environment surrounding Bitcoin funds in Timor-leste plays a crucial role in shaping their future outlook. As regulations evolve and become clearer, investors can gain more confidence in the cryptocurrency market. This, in turn, can lead to increased adoption and investment opportunities. Looking ahead, a supportive regulatory framework can pave the way for a thriving ecosystem where Bitcoin funds can flourish, contributing to the country’s economic growth and financial stability.

Investment Strategies for Success 💰

When it comes to achieving success in investing in Bitcoin funds, a diversified portfolio is key. Understanding market trends, staying informed about regulatory changes, and adopting a long-term investment mindset are crucial. Investors should also consider dollar-cost averaging, risk management strategies, and staying updated on the latest developments in the crypto space. By being strategic and proactive, individuals can maximize their returns and navigate the volatile nature of cryptocurrency investments effectively.

bitcoin investment funds regulation in Tajikistan