Impact of Bitcoin Remittances 💡

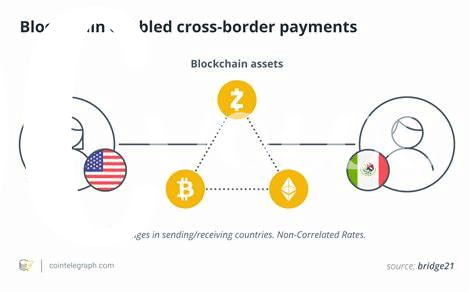

The rise of Bitcoin remittances is reshaping traditional money transfer systems, offering a decentralized and efficient alternative. This digital currency enables near-instant cross-border transactions at lower costs compared to traditional methods. With Bitcoin, individuals can send and receive money globally without the need for intermediaries, revolutionizing the remittance landscape. The impact of Bitcoin remittances extends beyond financial transactions, as it also promotes financial inclusion by providing access to banking services for the unbanked population. Its borderless nature presents a paradigm shift in the way remittances are conducted, empowering users with greater control over their finances.

As the adoption of Bitcoin remittances continues to grow, it poses both opportunities and challenges for the financial sector. Its decentralized nature and potential for rapid transactions have the potential to streamline remittance processes and reduce costs. However, regulatory concerns and volatility in cryptocurrency markets present hurdles that need to be addressed. Despite these challenges, the future of Bitcoin remittances holds promise for transforming the way money is transferred globally, offering a glimpse into the future of financial transactions.

Legal Considerations in Oman 📜

When it comes to the legal landscape in Oman regarding Bitcoin remittances, there are intricate considerations that need to be carefully navigated. The regulatory framework in Oman is continuously evolving, and staying compliant with the laws is crucial for any Bitcoin remittance operator or user in the country. Understanding the specific requirements, licensing procedures, and potential implications is essential to ensure a smooth operation within the boundaries set by Omani laws. As the adoption of digital currencies like Bitcoin grows globally, Oman’s legal system is also adapting to accommodate these innovative financial technologies, presenting both opportunities and challenges for individuals and businesses looking to explore the realm of Bitcoin remittances.

Challenges and Opportunities 💼

In the evolving landscape of Bitcoin remittances in Oman, various challenges and opportunities emerge. One challenge lies in navigating the regulatory frameworks to ensure compliance with local laws. Additionally, volatility in the cryptocurrency market poses a risk for users engaging in remittances. On the other hand, the decentralized nature of Bitcoin offers opportunities for faster and more cost-effective cross-border transactions. As the industry matures, collaborations between fintech companies and traditional financial institutions can enhance the accessibility and security of Bitcoin remittances. Overall, addressing challenges while leveraging opportunities can pave the way for sustainable growth and adoption of Bitcoin remittances in Oman.

Future Trends in the Industry 📈

The cryptocurrency industry is continuously evolving, with emerging technologies and innovations paving the way for exciting future trends. As the demand for faster, more secure, and efficient cross-border transactions grows, Bitcoin remittances are poised to play a significant role in shaping the industry’s landscape. From decentralized finance (DeFi) solutions to enhanced privacy features, the future of Bitcoin remittances holds promises of increased accessibility and transparency. Additionally, developments in blockchain technology are expected to streamline the remittance process, reducing costs and enhancing the overall user experience. By staying informed and adaptable to these emerging trends, stakeholders in the industry can position themselves for success in the dynamic world of digital finance. For more insights on the impact of regulatory frameworks on cross-border transactions, including Bitcoin remittances, check out the article on bitcoin cross-border money transfer laws in north korea.

Adoption and Acceptance in Oman 🌍

Amidst the evolving landscape of financial transactions in Oman, there is a gradual but noticeable shift towards the acceptance and adoption of Bitcoin remittances. This transformation is not merely a reflection of global trends but also a response to the changing needs and preferences of individuals in the region. As more people become familiar with the concept of cryptocurrencies, there is a growing curiosity and openness towards exploring the possibilities that Bitcoin remittances offer. The gradual acceptance can be attributed to the transparency, security, and efficiency that such transactions provide, appealing to a tech-savvy population seeking modern solutions for their financial needs. While challenges and regulatory considerations still exist, the increasing interest and engagement with Bitcoin remittances signal a potential shift towards mainstream acceptance in Oman. As awareness spreads and confidence grows in the reliability of these transactions, the future holds promising prospects for the broader adoption of Bitcoin remittances within the Omani financial landscape.

Recommendations for Navigating the Landscape 🗺️

When navigating the landscape of Bitcoin remittances in Oman, it is essential to stay updated on the evolving legal framework and compliance requirements. Engaging with local authorities and regulatory bodies to ensure adherence to laws and regulations is crucial. Additionally, fostering relationships with key stakeholders in the industry can provide valuable insights and opportunities for collaboration. Considering the fluctuating nature of cryptocurrency regulations globally, staying informed on cross-border money transfer laws specific to Bitcoin in different jurisdictions is imperative. For example, understanding the bitcoin cross-border money transfer laws in North Macedonia and Nigeria can offer valuable perspectives for navigating the regulatory landscape effectively. Embracing technological advancements and exploring innovative solutions that enhance security and transparency in Bitcoin transactions can further optimize the remittance process. Continuously educating oneself on industry trends and best practices will be instrumental in successfully navigating the landscape of Bitcoin remittances in Oman.

Please insert the link to bitcoin cross-border money transfer laws in North Macedonia with anchor – bitcoin cross-border money transfer laws in Nigeria.