Current State of Bitcoin Remittances in Ireland 🌍

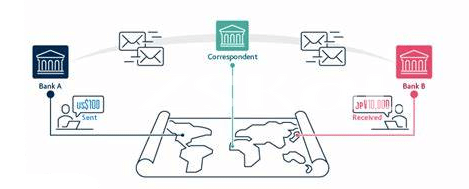

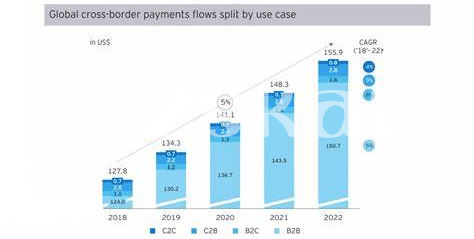

The adoption of Bitcoin for remittances in Ireland is steadily increasing, marking a shift towards innovative digital solutions for cross-border transactions. As more individuals discover the convenience and cost-effectiveness of using Bitcoin for remittances, traditional money transfer methods are facing competition. The current state showcases a growing interest among Irish residents in utilizing Bitcoin as a means to send money abroad securely and swiftly.

The landscape of Bitcoin remittances in Ireland reflects a changing financial ecosystem where digital currencies play a significant role in facilitating international money transfers. With a focus on accessibility and efficiency, Bitcoin offers a decentralized alternative to traditional remittance platforms, empowering individuals to send funds globally with ease. As this trend continues to evolve, the future holds promising prospects for Bitcoin remittances in Ireland, shaping the way people approach cross-border transactions in the digital age.

Impact of Legislative Changes on Bitcoin Remittances 💼

Legislative changes hold significant weight in shaping the landscape for Bitcoin remittances in Ireland. As regulations evolve, they directly influence how these transactions are carried out, affecting both providers and users. The impact is not confined to a single entity but reverberates throughout the ecosystem, requiring adaptation and compliance to ensure seamless operations. With each new regulation introduced, there is a ripple effect felt across the Bitcoin remittance sector, prompting stakeholders to recalibrate their strategies and approaches accordingly.

Navigating the intricate web of legislative changes demands a proactive approach from all involved parties. As Ireland continues to refine its regulatory framework, the dynamics of Bitcoin remittances undergo a continuous transformation. Understanding the nuances of these legislative updates is crucial for fostering a sustainable environment that fosters innovation while safeguarding the interests of all participants. Adapting to the evolving regulatory landscape is essential for the long-term viability and growth of Bitcoin remittances in Ireland.

Advantages of Using Bitcoin for Remittances 👍

Bitcoin offers a fast and cost-effective solution for remittances, especially when compared to traditional banking methods. Users can send funds across borders quickly, with lower fees and without the need for intermediaries. This direct peer-to-peer transfer cuts out the delays and costs associated with traditional banking channels. Additionally, Bitcoin’s decentralized nature ensures greater security and privacy for both senders and recipients, as transactions are recorded on a public ledger but remain pseudonymous. Moreover, the accessibility of Bitcoin transactions 24/7 enables timely transfers that align with the global nature of remittance needs today. The ability to send micropayments using Bitcoin further enhances its appeal for remittances, allowing for flexibility in the amount being sent. Finally, the transparency of blockchain technology increases trust between parties, offering a level of traceability that is often lacking in traditional remittance methods.

Challenges Faced by Bitcoin Remittances in Ireland 🛑

Challenges faced by Bitcoin remittances in Ireland include regulatory uncertainties and concerns over security and stability. The lack of clear guidelines from authorities can create hesitancy among users and service providers, hindering the widespread adoption of Bitcoin for remittance purposes. Additionally, the volatile nature of cryptocurrency prices poses a risk for both senders and recipients, impacting the reliability of transactions in a remittance context. Addressing these challenges requires a collaborative effort between industry stakeholders and policymakers to establish a supportive framework that ensures transparency, security, and trust in Bitcoin remittance transactions.

To learn more about the Bitcoin cross-border money transfer laws in Iran and how they shape the future of remittances, visit bitcoin cross-border money transfer laws in iran.

Future Trends and Possibilities for Bitcoin Remittances 🚀

In the constantly evolving landscape of financial transactions, Bitcoin remittances are positioned to revolutionize the way money is sent across borders. The future holds exciting possibilities for Bitcoin remittances in Ireland, with advancements in technology and a shifting regulatory environment paving the way for greater accessibility and efficiency. As more individuals and businesses recognize the benefits of using Bitcoin for remittances, we can expect to see continued growth in this sector. Innovations such as blockchain technology and smart contracts have the potential to streamline the remittance process, reducing costs and increasing speed. Additionally, the integration of Bitcoin into existing financial infrastructure could open up new avenues for cross-border transactions, creating a more interconnected global economy. Embracing these future trends and possibilities for Bitcoin remittances presents a unique opportunity to reshape the way we think about sending money internationally, ultimately leading to a more inclusive and efficient financial system.

Recommendations for a Sustainable Bitcoin Remittance Ecosystem 💡

When considering the future of Bitcoin remittances in Ireland, it is crucial to establish a framework that supports a sustainable ecosystem for such transactions. Investing in robust security measures and compliance protocols will not only enhance consumer confidence but also ensure the legitimacy of Bitcoin remittance services. Additionally, fostering partnerships with financial institutions and regulatory bodies can lead to the development of innovative solutions that cater to the specific needs of the Irish market.

To further strengthen the Bitcoin remittance ecosystem in Ireland, it is imperative to prioritize customer education and awareness initiatives. By equipping users with the necessary knowledge and resources to navigate the intricacies of cryptocurrency transactions, we can empower individuals to make informed decisions when engaging in cross-border money transfers. Furthermore, fostering a culture of transparency and accountability within the industry will help build trust and credibility among stakeholders, ultimately contributing to the long-term viability and success of Bitcoin remittances within the Irish legislative landscape.

Insert link to bitcoin cross-border money transfer laws in Guyana with anchor “bitcoin cross-border money transfer laws in Honduras.” bitcoin cross-border money transfer laws in Honduras