Current State of Bitcoin Investment Funds 📈

Bitcoin investment funds have witnessed a surge in popularity, with more investors exploring opportunities in the digital asset space. The current state reflects a growing acceptance of Bitcoin as a legitimate investment option, leading to the emergence of various funds tailored to meet investor needs. As the market matures, regulatory frameworks will play a crucial role in shaping the future landscape of Bitcoin investment funds, providing a sense of security and trust for investors venturing into this innovative asset class.

Regulatory Challenges and Opportunities 💼

In the realm of Bitcoin investment funds, addressing regulatory challenges and seizing opportunities are paramount. Navigating the evolving regulatory landscape requires a delicate balance between compliance and innovation. Embracing these challenges presents unique opportunities for fostering trust, investor protection, and market growth. The transparency and security afforded by robust regulations can attract more institutional investors and pave the way for sustainable growth in the sector. Ultimately, achieving a harmonious regulatory framework will be crucial in unlocking the full potential of Bitcoin investment funds.

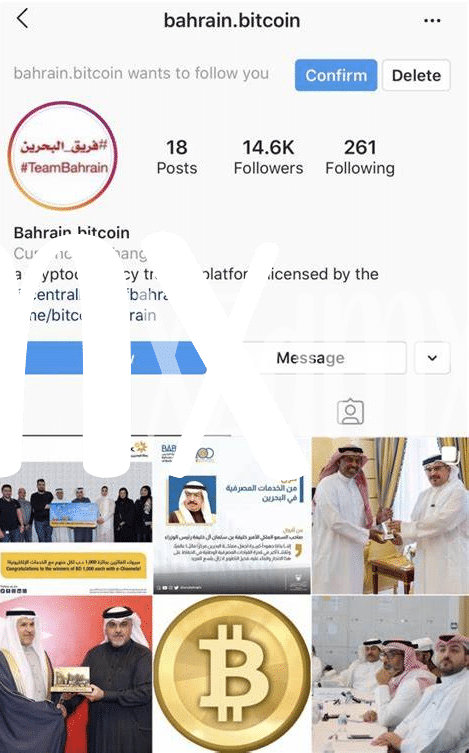

Impact of Global Trends on Bahrain 🌍

Global trends play a crucial role in shaping the landscape of financial markets, and Bahrain is no exception. As the world becomes increasingly interconnected, the impact of trends such as digitalization, sustainable investing, and regulatory harmonization is felt in Bahrain’s investment sector. Adapting to these global shifts presents both challenges and opportunities for Bahrain, as it positions itself to navigate the evolving dynamics of the financial world.

Potential Benefits for Investors and Economy 💰

Investors and the economy stand to benefit significantly from the evolution of Bitcoin investment funds. Improved accessibility, diversification opportunities, and potentially higher returns can attract a broader range of investors. As more funds flow into the market, this can stimulate economic growth and innovation within Bahrain’s financial sector. Moreover, the transparency and efficiency of blockchain technology can enhance trust and security, fostering a more robust investment environment. By embracing these advancements, Bahrain can position itself as a leader in the digital asset space.

bitcoin investment funds regulation in bahamas

Role of Technology and Innovation ⚙️

The integration of technology and innovation within the realm of Bitcoin investment funds is revolutionizing the traditional financial landscape. With advancements in blockchain technology and smart contracts, the efficiency and transparency of fund management are significantly enhanced. Investors can now benefit from real-time tracking and secure transactions, ensuring greater trust and security in their investment journey. Moreover, these technological innovations open up new avenues for diversification and access to previously untapped markets, ultimately reshaping the future of investment opportunities.

Future Outlook and Recommendations 🚀

The future of Bitcoin investment funds regulation in Bahrain holds immense potential for fostering a more transparent and secure investment environment. As digital assets continue to gain traction globally, embracing forward-thinking regulatory frameworks will be crucial to attract investors and ensure market stability. Recommendations include implementing robust oversight mechanisms and staying abreast of technological advancements to maintain Bahrain’s competitive edge in the evolving landscape of cryptocurrency investments.

bitcoin investment funds regulation in andorra