Rise of Bitcoin Adoption in Eswatini 🚀

In recent years, Eswatini has witnessed a significant increase in the adoption of Bitcoin, a digital currency shaking up the traditional banking landscape. This rise in Bitcoin usage reflects a growing interest from individuals and businesses in embracing the innovation and potential financial benefits it offers. As more people recognize the advantages of decentralized currency systems, the future of Bitcoin adoption in Eswatini appears promising, with the potential to revolutionize how transactions are conducted and perceived in the country.

Challenges & Opportunities for Traditional Banks 💼

Traditional banks in Eswatini are facing a dual challenge as the rise of Bitcoin gains momentum in the country. On one hand, they are met with the need to adapt quickly to the changing financial landscape to stay relevant and competitive. This poses a significant opportunity for them to innovate their services and offerings, potentially attracting a new generation of tech-savvy customers. However, these opportunities come hand in hand with the challenge of navigating the complexities of integrating cryptocurrency into their existing systems and complying with evolving regulations.

Impact on Financial Inclusivity and Empowerment 💸

Bitcoin banking in Eswatini holds the potential to revolutionize financial accessibility, offering unbanked populations the chance to participate in the global economy. By leveraging cryptocurrencies, individuals can securely store and transfer money without the need for traditional banking infrastructure. This shift towards digital currency empowers individuals, especially marginalized communities, to take control of their financial futures and access services that were previously out of reach.

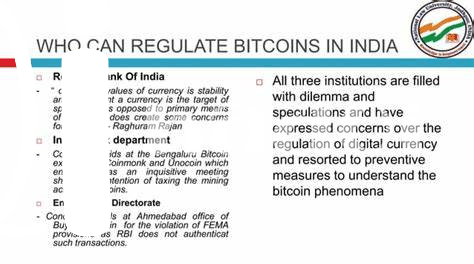

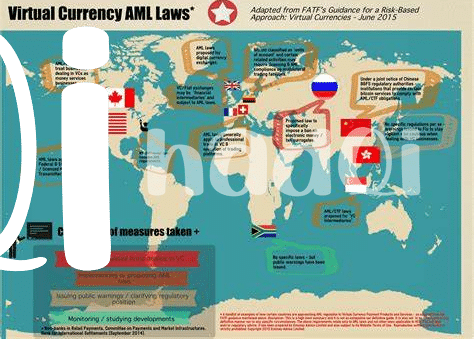

Regulations Shaping the Future Landscape 📜

Regulations play a crucial role in shaping the future landscape of Bitcoin banking in Eswatini. By establishing clear guidelines and frameworks, authorities can provide a sense of security for both consumers and businesses entering the digital currency space. Understanding and complying with these regulations is essential for fostering trust and legitimacy within the evolving financial ecosystem. To delve deeper into how regulatory frameworks influence the realm of Bitcoin banking services, you can explore this informative article on innovations in Bitcoin financial services within Estonia’s regulatory framework: bitcoin banking services regulations in Ethiopia.

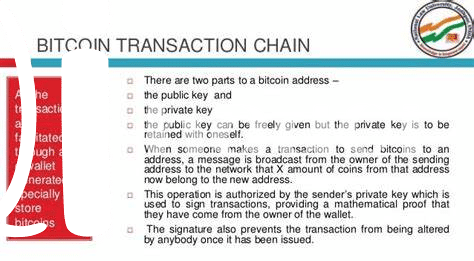

Implementing Blockchain Technology in Banking 🧱

– Blockchain technology is revolutionizing the traditional banking sector, offering increased security, transparency, and efficiency in financial transactions. By implementing blockchain technology, banks in Eswatini can streamline processes, reduce costs, and enhance the overall customer experience. This innovative approach not only enhances trust in the banking system but also lays the foundation for a more robust and resilient financial infrastructure in the country.

“Implementing Blockchain Technology in Banking” – Blockchain technology is revolutionizing the traditional banking sector, offering increased security, transparency, and efficiency in financial transactions. By implementing blockchain technology, banks in Eswatini can streamline processes, reduce costs, and enhance the overall customer experience. This innovative approach not only enhances trust in the banking system but also lays the foundation for a more robust and resilient financial infrastructure in the country.

Future Predictions and Potential Benefits 🌟

In the coming years, Bitcoin banking in Eswatini is poised to revolutionize the financial landscape, offering increased access and efficiency. With the potential benefits of faster transactions, lower fees, and enhanced transparency, users stand to gain significant advantages over traditional banking methods. Embracing this technology could lead to a more inclusive and empowered financial system, shaping a promising future for individuals and businesses alike. Interested in the regulatory framework for Bitcoin banking services? Check out the bitcoin banking services regulations in Fiji here: bitcoin banking services regulations in Estonia.