Current Bitcoin Aml Regulations in Paraguay ⚖️

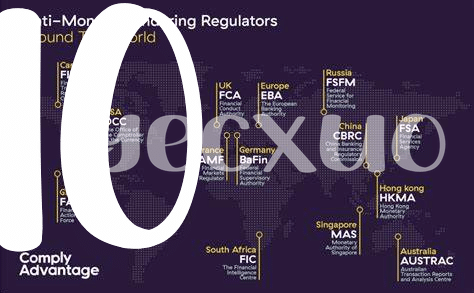

Paraguay has progressively adapted to the evolving landscape of Bitcoin AML regulations, aiming to enhance transparency and combat illicit activities within the cryptocurrency sector. By requiring virtual asset service providers to register with the financial intelligence unit, Paraguay seeks to strengthen its AML framework and promote accountability. Additionally, ongoing efforts to monitor and supervise crypto transactions reflect the country’s commitment to aligning with international standards while fostering innovation in the digital economy.

Trends Shaping the Future of Bitcoin Regulation 📈

In recent years, the landscape of Bitcoin regulation has been witnessing dynamic shifts influenced by various factors. One significant trend is the increasing collaboration between regulatory bodies and industry stakeholders to establish clearer frameworks that balance innovation and compliance. This trend signifies a growing recognition of the importance of fostering a conducive regulatory environment for the sustainable development of the cryptocurrency ecosystem. Additionally, the evolving global regulatory approaches towards digital assets, including Bitcoin, reflect a desire to adapt to the changing financial landscape and address emerging challenges while fostering responsible innovation. This proactive approach indicates a maturing understanding of the potential benefits and risks associated with cryptocurrencies, paving the way for more nuanced and effective regulatory measures in the future.

The evolving trends in Bitcoin regulation not only reflect the regulatory authorities’ efforts to mitigate potential risks but also signify a shift towards a more collaborative and inclusive approach to shaping the future of digital finance. As the regulatory landscape continues to evolve, it is essential for industry participants to stay informed and actively engage in dialogue with regulators to ensure that the regulatory frameworks align with the realities of the digital economy. By embracing transparency, compliance, and innovation, stakeholders can contribute to the development of a robust and sustainable regulatory ecosystem that fosters the growth of Bitcoin and other digital assets. Ultimately, the collaborative efforts between regulators, industry players, and other stakeholders are crucial in shaping a future where Bitcoin can thrive within a clear and supportive regulatory framework.

Impact of Regulatory Changes on Bitcoin Adoption 🌍

The evolving regulatory landscape surrounding Bitcoin is poised to significantly influence the future course of the cryptocurrency’s adoption. As global jurisdictions grapple with formulating AML regulations tailored to digital assets, the impact on Bitcoin adoption is multi-faceted. One key aspect is the level of clarity and consistency in regulatory frameworks, which can either spur or hinder mainstream acceptance of Bitcoin. Moreover, the way in which regulatory changes address security concerns and foster transparency within the Bitcoin ecosystem will play a pivotal role in shaping individuals and institutions’ willingness to embrace this innovative form of currency. The interplay between regulatory developments and the perception of Bitcoin’s legitimacy will ultimately sway the trajectory of adoption on a global scale.

Challenges and Opportunities in Complying with Aml Rules ⛓️

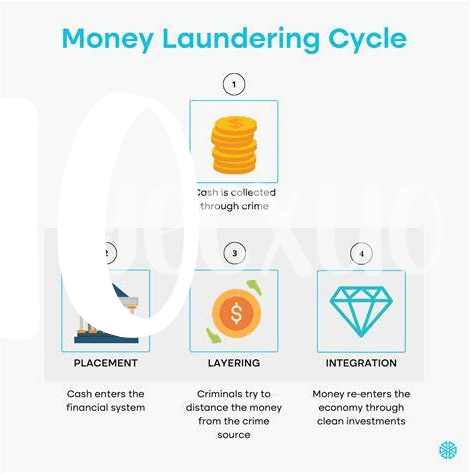

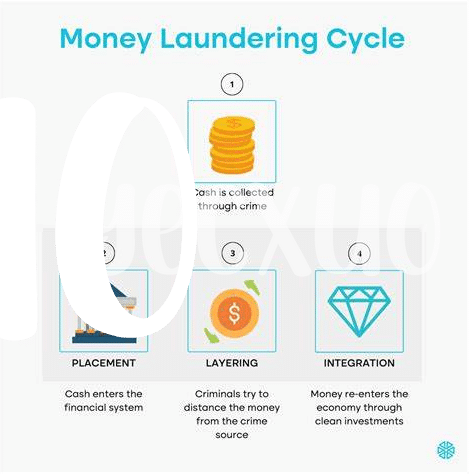

Challenges often arise when it comes to complying with Anti-Money Laundering (AML) rules in the realm of Bitcoin regulation. Ensuring adherence to these stringent regulations demands a deep understanding of the evolving landscape and constant vigilance to stay ahead of potential risks. However, within these challenges lie opportunities for innovation and growth. By investing in robust compliance mechanisms and embracing technological advancements, companies can not only meet regulatory requirements but also enhance their overall security measures and reputation in the market. Striking a balance between compliance and innovation presents a unique opportunity for industry players to differentiate themselves and establish trust among stakeholders. Collaborating with regulatory bodies and industry peers can facilitate the exchange of best practices, ultimately leading to a more secure and resilient ecosystem for Bitcoin transactions.

Cryptocurrency exchange licensing requirements in Armenia

Collaborative Efforts to Improve Regulatory Clarity 💪

In recent times, stakeholders within the Bitcoin ecosystem have been actively joining forces to enhance the clarity of regulatory frameworks and guidelines. By fostering collaborative efforts among industry players, lawmakers, and regulatory bodies, significant progress is being made towards streamlining compliance processes and ensuring a more robust regulatory landscape for Bitcoin AML regulations in Paraguay. This collective approach not only facilitates smoother interactions between various stakeholders but also paves the way for constructive dialogue and effective implementation of regulatory measures. This concerted effort towards improving regulatory clarity signifies a positive step forward in creating a conducive environment for the sustainable growth and development of Bitcoin within the country.

Potential Outcomes of Evolving Bitcoin Aml Regulations 🔮

The evolving Bitcoin AML regulations hold the power to shape the landscape of digital currency transactions worldwide. As regulations adapt to the dynamic nature of cryptocurrencies, we may foresee a more secure environment for investors and traders alike. Clarity in AML requirements can pave the way for increased trust and participation in the Bitcoin market, leading to a more robust and sustainable ecosystem for digital assets and transactions. The potential outcomes of these regulatory changes not only impact how Bitcoin is used and traded but also influence the broader perception and adoption of cryptocurrencies within traditional financial systems.

Cryptocurrency exchange licensing requirements in Andorra