Introduction to Bitcoin Aml Regulations in Argentina 🌍

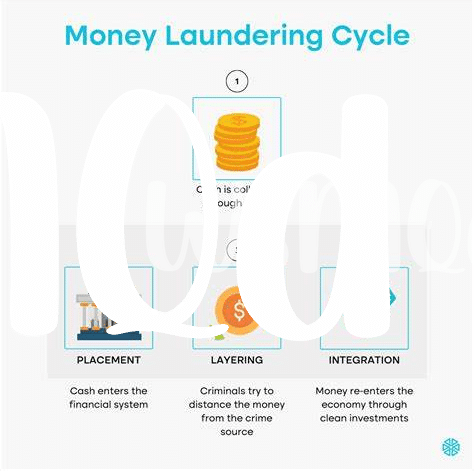

Bitcoin has been making waves in the financial world, especially in Argentina where discussions around Anti-Money Laundering (AML) regulations are gaining momentum. With a growing interest in cryptocurrencies, understanding the evolving landscape of Bitcoin AML regulations in Argentina is crucial. This introduction sets the stage for exploring how regulatory changes in this space can impact the future of Bitcoin transactions and compliance in the country.

Current Status of Aml Regulations in Argentina 💼

The current landscape of Anti-Money Laundering (AML) regulations in Argentina presents a dynamic environment shaped by evolving digital financial trends and global governance standards. As authorities seek to modernize financial oversight, the regulatory framework governing AML practices undergoes continuous review and iteration. This regulatory agility is essential in navigating the complexities of blockchain technologies, ensuring that AML measures are robust and adaptable to the ever-changing digital economy. In Argentina, the emphasis on compliance and proactive risk management underscores a commitment to bolstering financial integrity and security while fostering innovation in the realm of cryptocurrency transactions.

Implications of Future Bitcoin Aml Regulations 💡

In navigating the landscape of future Bitcoin AML regulations in Argentina, we are bound to witness a transformation in the way financial transactions are monitored and secured. These regulations will not only impact how individuals and businesses engage with cryptocurrencies but also have far-reaching implications on the overall financial ecosystem. From enhancing transparency to mitigating risks of illicit activities, the future implications of Bitcoin AML regulations in Argentina hold the potential to establish a more secure and compliant environment for digital asset transactions.

Challenges and Opportunities for Bitcoin Compliance 🚧

Challenges and opportunities arise for Bitcoin compliance as evolving regulations shape the landscape. Navigating the intricate web of anti-money laundering requirements presents a hurdle for businesses in Argentina. However, proactive measures can turn these challenges into lucrative opportunities. By implementing robust compliance frameworks, companies can build trust with regulators and consumers, paving the way for sustainable growth in the cryptocurrency industry. Embracing innovative technologies and fostering a culture of compliance can set businesses apart in this rapidly changing environment. To delve deeper into overcoming AML hurdles for Bitcoin entrepreneurs, check out this insightful guide on Bitcoin AML regulations in Antigua and Barbuda.

Key Players in Shaping Bitcoin Aml Regulations 🤝

In the dynamic landscape of Bitcoin Aml regulations in Argentina, various key players are actively involved in shaping the future direction of compliance measures. From government regulatory bodies to financial institutions and industry experts, these stakeholders are pivotal in influencing the development and implementation of AML guidelines specifically tailored for the Bitcoin sphere. Collaboration and dialogue among these key players are essential to strike a balance between fostering innovation in the cryptocurrency space while ensuring robust safeguards against financial crime. By understanding the perspectives and roles of these influential entities, the regulatory framework can evolve effectively to meet the evolving challenges of combating money laundering within the realm of Bitcoin transactions.

Future Outlook: Adapting to Regulatory Changes 📈

As we look ahead to the future of Bitcoin AML regulations in Argentina, it is crucial for stakeholders to prepare for the evolving regulatory landscape. Adapting to these changes requires a proactive approach, staying informed about the shifting requirements, and implementing robust compliance measures. By fostering collaboration between industry players, regulators, and policymakers, the ecosystem can work towards a harmonized framework that balances innovation with effective risk mitigation strategies. Embracing emerging technologies and best practices will be key to navigating the complexities of regulatory changes and ensuring a secure environment for Bitcoin transactions in Argentina.

In this dynamic environment, staying ahead of regulatory developments is vital for businesses and individuals involved in the Bitcoin ecosystem. By monitoring global trends, engaging with regulatory authorities, and leveraging technological solutions, stakeholders can position themselves to adapt swiftly to changing AML requirements. Emphasizing transparency, accountability, and adherence to best practices will be essential for fostering trust and credibility within the industry. As the regulatory landscape continues to evolve, a proactive and collaborative approach will be instrumental in shaping a sustainable future for Bitcoin AML compliance in Argentina.