Current Aml Regulations in Algeria 🌍

Algeria’s current AML regulations reflect the country’s commitment to combating financial crimes and ensuring transparency in the financial sector. The regulatory framework in place aims to prevent money laundering and terrorist financing activities while promoting the integrity of the financial system. By adhering to these regulations, financial institutions and businesses operating in Algeria contribute to a more secure and stable economic environment, fostering trust and credibility among stakeholders.

Impact of Bitcoin on Financial Landscape 💰

Bitcoin’s emergence has significantly reshaped Algeria’s financial landscape, introducing both opportunities and challenges. The decentralized nature of Bitcoin has sparked debates on its potential to revolutionize traditional banking systems. While some view it as a disruptive force that could lead to financial freedom and inclusion, others express concerns about its perceived anonymity, which could facilitate illicit activities. Despite these uncertainties, the increasing adoption of Bitcoin in Algeria has sparked discussions on how regulators can effectively balance innovation and security. As the digital currency market continues to evolve, the impact of Bitcoin on the financial landscape is undeniable, urging stakeholders to navigate this dynamic landscape with vigilance and adaptability.

Challenges of Regulating Digital Currencies 🔍

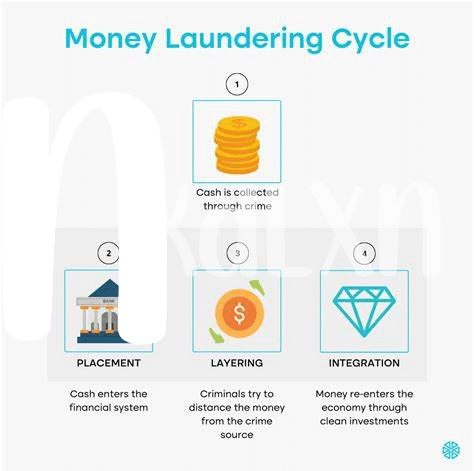

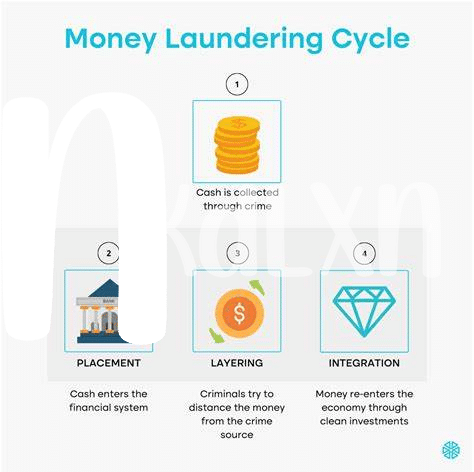

Navigating the landscape of digital currencies presents a unique set of obstacles for regulatory authorities. The inherent anonymity and decentralized nature of cryptocurrencies like Bitcoin pose challenges in effectively monitoring and enforcing compliance measures. Ensuring transparency and accountability while preserving the innovative potential of these digital assets requires adaptable regulatory frameworks that can keep pace with evolving technologies and emerging trends in the global financial ecosystem. Addressing these challenges will be crucial in establishing a balanced approach to regulating digital currencies and mitigating risks associated with illicit activities in the virtual financial realm.

Future Possibilities for Aml Laws 🚀

In the ever-evolving landscape of financial regulations, the future holds promising possibilities for AML laws in Algeria’s Bitcoin market. As technology continues to advance, there is a growing opportunity to enhance compliance measures and address the challenges associated with regulating digital currencies. These futuristic AML laws aim to strike a balance between fostering innovation in the realm of cryptocurrencies while ensuring robust safeguards against illicit activities.

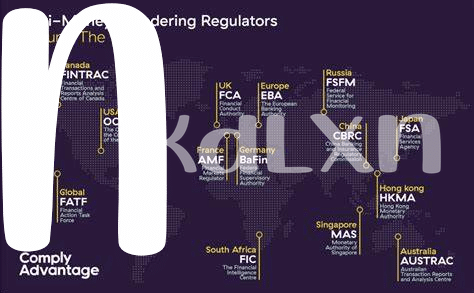

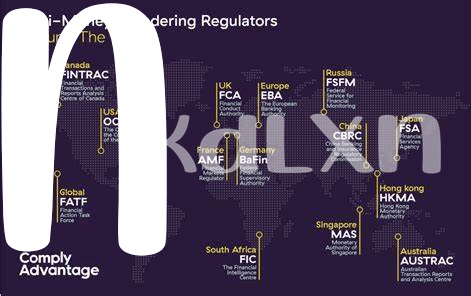

Collaborations among various stakeholders, including regulatory bodies, financial institutions, and technology experts, will be essential in shaping the future of AML regulations in Algeria’s Bitcoin market. By working together cohesively, these partnerships can contribute significantly to establishing effective oversight mechanisms that adapt to the dynamic nature of the digital financial world. For further insights on compliance best practices in safeguarding Bitcoin investments, explore the article on bitcoin anti-money laundering (AML) regulations in Argentina on Wikicrypto.News.

Role of Technology in Compliance Efforts 🤖

Technology is catalyzing a paradigm shift in how financial institutions approach compliance efforts worldwide. In the context of AML regulations in Algeria’s evolving Bitcoin market, technological tools are proving to be game-changers. From advanced data analytics to blockchain forensic tools, these innovations are empowering regulators to track, monitor, and analyze cryptocurrency transactions with greater precision and efficiency. Automation features embedded in compliance software streamline due diligence processes, reducing manual errors and enhancing overall efficacy. Embracing technology in compliance not only boosts regulatory oversight capabilities but also fosters a more agile and proactive approach to combating financial crimes in the digital realm.

Collaborations for Effective Oversight 🤝

Collaborations play a pivotal role in ensuring effective oversight of Bitcoin transactions in Algeria. By establishing partnerships between regulatory bodies, financial institutions, and technology providers, a more comprehensive approach to monitoring and enforcing AML regulations can be achieved. These collaborations enable the sharing of expertise and resources, leading to a more streamlined and efficient process for detecting and preventing illicit activities within the Bitcoin market. By learning from international best practices, such as those outlined in the Bitcoin anti-money laundering (AML) regulations in Antigua and Barbuda, Algeria can further enhance its oversight mechanisms and adapt to the evolving landscape of digital currencies.