Current Aml Regulations in Uzbekistan 🌍

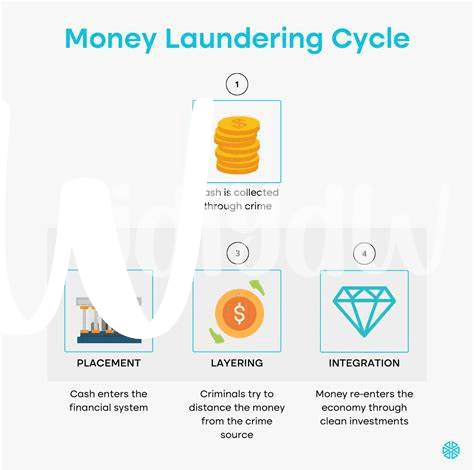

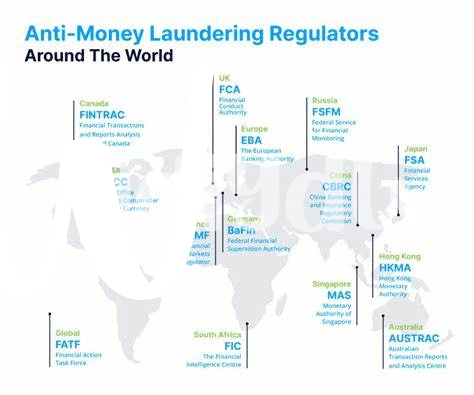

– Within the regulatory landscape of Uzbekistan, the current Anti-Money Laundering (AML) guidelines play a pivotal role in overseeing financial transactions and combating illicit activities. These regulations serve as a foundation for maintaining transparency and accountability within the financial sector. With a focus on preventing money laundering and terrorist financing, Uzbekistan’s AML regulations aim to safeguard the integrity of the country’s financial systems. Compliance with these standards is essential for financial institutions and entities operating within the jurisdiction, ensuring the protection of both the economy and the public.

– By upholding stringent AML requirements, Uzbekistan demonstrates its commitment to fostering a secure financial environment and deterring criminal activities. The enforcement of these regulations underscores the government’s dedication to promoting financial integrity and stability, thereby enhancing trust and confidence among stakeholders. As the regulatory landscape continues to evolve, staying abreast of these AML regulations is crucial for businesses and individuals engaging in financial transactions within Uzbekistan. Establishing a robust framework for AML compliance is instrumental in combating financial crimes and preserving the integrity of the financial system.

Impact of Bitcoin on Financial System 💰

Bitcoin’s presence in the financial system of Uzbekistan is undoubtedly reshaping the landscape. Its decentralized nature and borderless transactions challenge traditional financial structures, offering both promise and uncertainty. As Bitcoin gains traction, financial regulators are grappling with the need to adapt regulations to address potential risks while fostering innovation. The ability of Bitcoin to facilitate fast, low-cost international transactions has sparked interest among individuals and businesses, but it also poses challenges for AML compliance. Finding a balance between harnessing the benefits of Bitcoin and mitigating risks requires a nuanced approach that considers the evolving dynamics of the financial system.

The increasing integration of Bitcoin into the financial system raises questions about how to effectively regulate and monitor its use. As cryptocurrencies continue to gain prominence, regulators are exploring strategies to ensure compliance without stifling innovation. Technological advancements in AML compliance tools offer solutions to enhance monitoring and tracking of Bitcoin transactions, providing a more robust framework for regulatory oversight. However, the evolving nature of cryptocurrencies presents unique challenges that necessitate ongoing collaboration between industry stakeholders, regulators, and law enforcement agencies to establish a secure environment for crypto transactions.

Proposed Changes and Future Prospects 🚀

Proposed Changes and Future Prospects in the realm of AML regulations for Bitcoin in Uzbekistan bring about a wave of anticipation. As the landscape evolves, stakeholders are poised to adapt to emerging paradigms, fostering a symbiotic relationship between innovation and compliance. The envisioned alterations hold promises of increased transparency and efficiency, paving the way for a more robust regulatory framework. Embracing these changes, the future prospects indicate a maturation of systems, propelling the nation towards a more integrated and secure crypto ecosystem. The synergy between regulatory updates and technological advancements heralds a new era in AML compliance, signaling a transformative journey towards a harmonized approach in safeguarding financial integrity in the digital era.

Technological Advancements in Aml Compliance 🔍

In the realm of Anti-Money Laundering (AML) compliance, ongoing technological advancements are reshaping the landscape, offering efficient tools for monitoring and enforcing regulatory guidelines. From sophisticated algorithms to blockchain analytics, these innovations are crucial in combating illicit activities within the crypto sphere. Embracing such technological progress is imperative for ensuring a secure and transparent environment for both investors and regulatory bodies. To delve deeper into the interplay between technology and AML compliance, explore this insightful article on the future of bitcoin AML regulations in Vietnam. Bitcoin Anti-Money Laundering (AML) Regulations in Vietnam.

Challenges and Opportunities for Compliance 🤔

Navigating the landscape of AML regulations poses both challenges and opportunities for compliance in the realm of Bitcoin in Uzbekistan. While the decentralized nature of cryptocurrencies presents hurdles in tracking and monitoring transactions, it also opens doors for innovative solutions to enhance security and transparency. Collaborative efforts between regulatory bodies, industry players, and technology experts are vital in ensuring a secure crypto environment that fosters trust and legitimacy. Balancing these challenges with proactive strategies can pave the way for a robust AML framework in the evolving digital financial ecosystem.

Collaborations for a Secure Crypto Environment 👥

Collaborations between regulatory bodies, financial institutions, and tech experts are essential for fostering a secure crypto environment. By working together, stakeholders can develop robust frameworks that balance innovation with compliance. These collaborations pave the way for effective monitoring and enforcement mechanisms, ensuring that the crypto space remains resilient against illicit activities. Moreover, sharing best practices and insights can contribute to harmonizing global efforts in combating financial crimes within the digital asset realm. Ultimately, a collaborative approach not only enhances security measures but also fosters trust and confidence among investors and users in the evolving landscape of cryptocurrencies.

Insert link to bitcoin anti-money laundering (aml) regulations in Uruguay with anchor bitcoin anti-money laundering (aml) regulations in the United States using the