Early Adoption 🌱

In the early days of Bitcoin’s introduction in Mauritania, individuals and businesses cautiously began to explore the possibilities of this digital currency. Enthusiasts saw its potential to revolutionize traditional financial systems and enable seamless cross-border transactions. This period of early adoption was marked by experimentation and a sense of pioneering spirit as more people recognized the advantages that Bitcoin offered. While initial adoption was gradual, it laid the groundwork for future developments in the country’s approach to cryptocurrency regulations and paved the way for broader acceptance among the population. As more users ventured into the world of Bitcoin, the landscape of financial transactions in Mauritania began to undergo a subtle yet significant transformation.

Regulatory Challenges 🚫

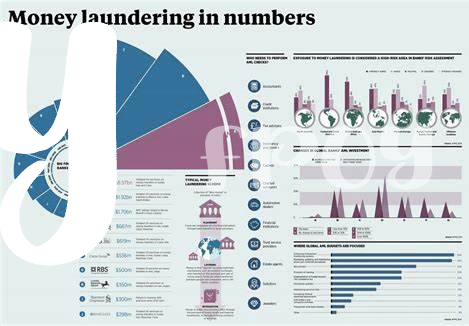

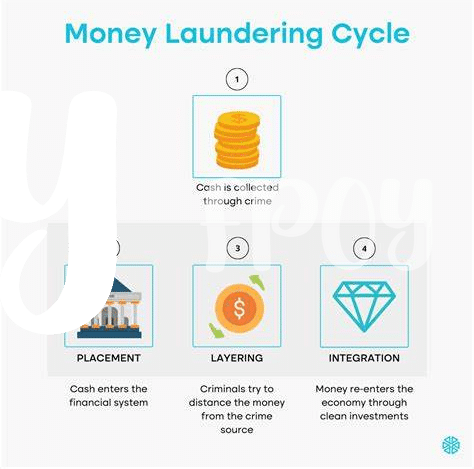

Regulatory challenges in the realm of Bitcoin AML regulations present a formidable hurdle for Mauritania. The evolving nature of virtual currencies calls for a dynamic framework that can keep pace with the innovative world of cryptocurrencies. Striking a balance between fostering financial innovation and safeguarding against illicit activities proves to be a delicate task for regulators. The decentralized and borderless nature of Bitcoin adds layers of complexity, requiring agile responses from authorities to stay ahead of potential risks. As the landscape continually shifts, staying abreast of regulatory developments and enhancing collaboration between stakeholders become essential pillars in navigating the challenges posed by AML regulations in the Bitcoin sphere.

Impact on Financial Landscape 💰

With the evolving Bitcoin AML regulations in Mauritania, the financial landscape is undergoing significant transformations. The integration of these regulations is reshaping how individuals and businesses engage with Bitcoin, leading to a more secure and transparent ecosystem. As the regulatory framework matures, financial institutions are adapting to ensure compliance, ultimately fostering trust and legitimacy in the use of Bitcoin within the country. These changes are not only impacting the way transactions are conducted but also influencing the overall perception of cryptocurrencies as a viable asset in the financial market.

Innovation in Compliance Tools 🧠

In the realm of digital currencies, innovations in compliance tools play a crucial role in ensuring the integrity and security of transactions. With the dynamic nature of cryptocurrencies like Bitcoin, the need for advanced technologies to uphold anti-money laundering regulations has become paramount. These compliance tools are designed to monitor and analyze transactional activities, enabling financial institutions and regulatory bodies to detect and mitigate potential risks effectively. By embracing technological advancements in compliance, the financial industry in Mauritania is poised to enhance transparency and accountability in the evolving landscape of cryptocurrency transactions. To delve deeper into the impact of AML laws on Bitcoin transactions, check out the informative article on bitcoin anti-money laundering (AML) regulations in Malta.

Global Harmonization Efforts 🌍

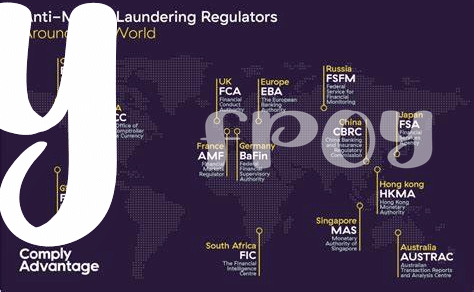

Within the realm of Bitcoin AML regulations, there is a growing emphasis on global harmonization efforts, aiming to create cohesive standards across borders. By working towards aligning diverse regulatory frameworks, stakeholders seek to enhance transparency, mitigate financial risks, and foster cross-border collaboration. This endeavor not only streamlines compliance measures for businesses operating internationally but also sets the stage for a more secure and resilient financial ecosystem. As countries strive to bridge regulatory gaps and promote consistency in AML practices, the global harmonization efforts play a pivotal role in shaping the future landscape of cryptocurrency compliance.

Future Predictions 🔮

As the landscape of Bitcoin AML regulations continues to evolve, the future holds exciting possibilities. Increased collaboration between regulators and industry players is expected to enhance compliance measures while fostering innovation in monitoring and enforcement tools. Moreover, as global harmonization efforts gain momentum, the regulatory framework surrounding Bitcoin in Mauritania is likely to become more streamlined and cohesive. These developments signal a promising future for the integration of cryptocurrencies into the traditional financial system.

Insert link to bitcoin anti-money laundering (aml) regulations in mauritius with anchor bitcoin anti-money laundering (aml) regulations in mauritius using the