Historical Backdrop 🕰️

In the early stages of Mauritius’ regulatory landscape, the inception of AML laws paved the way for a structured approach to combatting financial crimes. Rooted in the need for transparency and accountability, these laws reflected the growing concern for illicit activities in the financial sector. Over time, as technological advancements reshaped financial transactions, the evolution of AML laws in Mauritius was inevitable to keep pace with the changing dynamics.

Through historical context, we witness the gradual development of AML laws in Mauritius, aligning with global standards and best practices. The journey from initial regulatory frameworks to current sophisticated protocols highlights the commitment towards creating a secure and compliant financial environment. This historical backdrop serves as a foundation for understanding the progression of AML laws and their significance in shaping the financial landscape of Mauritius.

Regulatory Shifts 📜

Regulatory Shifts 📜

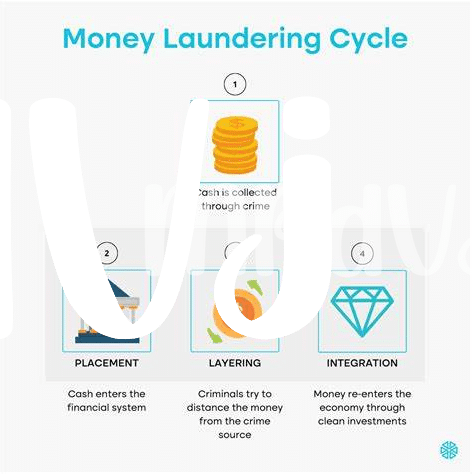

Amidst the evolving landscape of AML laws in Mauritius, regulatory shifts have been instrumental in shaping the trajectory of Bitcoin integration within the financial realm. The adaptation of regulatory frameworks to encompass digital currencies signifies a crucial step towards fostering transparency and accountability in the cryptocurrency sector. By delineating guidelines for compliance and monitoring, these regulatory shifts not only aim to mitigate risks associated with money laundering and fraudulent activities but also aim to instill confidence among stakeholders regarding the legitimacy of Bitcoin transactions. The dynamic nature of regulatory adjustments underscores a proactive approach towards addressing the challenges posed by emerging financial technologies, paving the way for a more secure and regulated environment for Bitcoin operations.

Technology Integration 📱

The integration of modern technology within the context of AML laws in Mauritius has revolutionized compliance mechanisms. From advanced data analytics to blockchain solutions, the landscape is evolving rapidly. Digital identity verifications and real-time transaction monitoring are becoming essential components of regulatory frameworks. Moreover, the automation of compliance processes through AI-driven systems is streamlining reporting and risk assessment procedures. As technology continues to reshape the AML landscape, staying abreast of emerging tools and trends is paramount for businesses and regulatory authorities alike.

This digital transformation not only enhances the efficiency and effectiveness of AML measures but also poses new challenges. Ensuring the security and privacy of sensitive financial data remains a primary concern. Additionally, the need for upskilling the workforce to navigate these tech-enabled systems is crucial. Despite the hurdles, embracing technology in AML processes opens doors to novel opportunities for innovation and collaboration within the financial sector. The synergy between technology and regulatory compliance in Mauritius reflects a progressive approach towards combating financial crime in the digital age.

Impact on Businesses 💼

The evolution of AML laws in Mauritius has had a significant impact on businesses operating in the cryptocurrency space. With increasing regulatory scrutiny, companies dealing with Bitcoin transactions have had to adapt their compliance measures to align with the new requirements. This shift has led to improved transparency and accountability within the industry, enhancing trust among stakeholders and investors.

For businesses in Mauritius looking to navigate the changing landscape of AML regulations in the cryptocurrency sector, understanding the importance of compliance is crucial. Implementing robust anti-money laundering practices not only ensures adherence to legal frameworks but also serves as a competitive advantage in the market. Companies can learn from the experiences shared in resources such as [bitcoin anti-money laundering (aml) regulations in Mauritania](https://wikicrypto.news/ensuring-aml-compliance-when-buying-bitcoin-in-marshall-islands) to strengthen their AML protocols and safeguard their operations.

Challenges and Opportunities 💡

The evolving landscape of AML laws in Mauritius for Bitcoin presents a mixed bag of challenges and opportunities for businesses operating within the jurisdiction. On one hand, navigating the complex regulatory environment can be daunting, requiring meticulous compliance measures and ongoing adaptability to changing requirements. However, these challenges also open up opportunities for innovation and growth. Businesses that proactively address compliance issues and embrace new technologies stand to gain a competitive edge in the market. Moreover, the increasing global scrutiny on AML practices presents an opportunity for Mauritius to position itself as a trusted hub for cryptocurrency activities, attracting investments and fostering economic development in the long run.

Future Outlook 🔮

In focusing on the future outlook of AML laws in Mauritius for Bitcoin, it is crucial to anticipate a continued trend towards enhancing regulatory measures to combat financial crimes effectively. With advancements in technology and increasing globalization, regulatory bodies in Mauritius are likely to place greater emphasis on strengthening AML frameworks to align with international standards. Businesses operating in the cryptocurrency space may face heightened compliance requirements, but this also presents opportunities for innovative solutions and partnerships to emerge. As Mauritius navigates the evolving landscape of AML regulations, staying proactive and adaptable will be key for both regulators and industry players.

Link to bitcoin anti-money laundering (AML) regulations in Malta with anchor bitcoin anti-money laundering (AML) regulations in Marshall Islands: bitcoin anti-money laundering (AML) regulations in Marshall Islands.