Regulatory Landscape 🌎

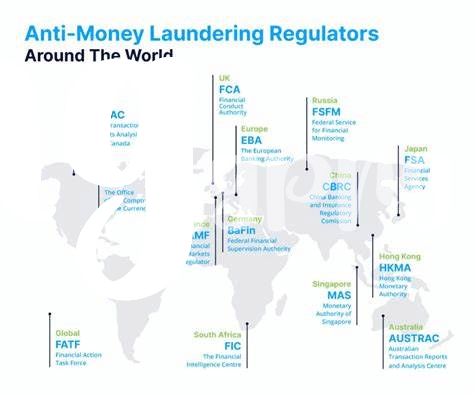

The regulatory landscape surrounding Bitcoin in Mexico is evolving, presenting various challenges for implementation. With increasing global attention on Anti-Money Laundering (AML) regulations, ensuring compliance has become crucial. Mexico’s efforts to align with international standards add layers of complexity to the regulatory framework. Balancing innovation and compliance remains a key focus for policymakers and industry stakeholders alike. As Mexico navigates these regulatory waters, stakeholders must collaborate effectively to promote a transparent and secure environment for Bitcoin transactions.

Compliance Complexities 🤔

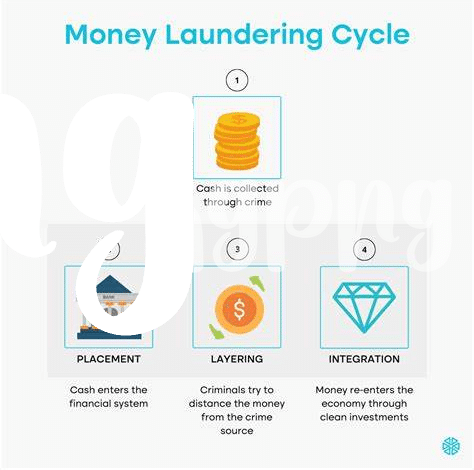

Navigating the realm of AML rules on Bitcoin in Mexico poses intricate challenges that demand keen attention. The interplay between regulatory requirements and the decentralized nature of cryptocurrencies brings forth a complex landscape that requires adept handling. Compliance complexities arise from the need to align traditional regulatory frameworks with the innovative realm of blockchain technology, leading to nuanced considerations in implementing effective AML strategies. These demand a nuanced approach that balances regulatory mandates with the unique characteristics of digital assets, fostering a dynamic environment where compliance meets innovation for the seamless operation of crypto-related activities.

Within this dynamic landscape, staying abreast of evolving compliance standards and harnessing technological tools become imperative to navigate the intricacies of AML regulations effectively. The fusion of regulatory mandates with technological solutions forms a cornerstone in overcoming compliance challenges, fostering a robust framework that upholds integrity in the crypto ecosystem. The quest to streamline compliance processes amidst rapid technological advancements underscores the pivotal role of proactively addressing compliance complexities to fortify the foundations of the digital economy securely.

Technological Hurdles ⛓️

Navigating the realm of implementing AML rules on Bitcoin in Mexico requires overcoming significant technological obstacles. From ensuring secure transactions to combating cyber threats, these hurdles underscore the importance of robust technological solutions in safeguarding the integrity of financial transactions. Embracing innovative technologies and fostering collaboration between regulatory bodies and industry stakeholders will be pivotal in addressing these challenges and ensuring a more secure and compliant cryptocurrency ecosystem in Mexico.

Enforcement Challenges ⚖️

Enforcement challenges surrounding the implementation of AML rules on Bitcoin in Mexico are multifaceted. One primary obstacle involves ensuring that the regulations are effectively enforced across the diverse landscape of cryptocurrency transactions. The borderless nature of Bitcoin transactions complicates traditional enforcement mechanisms, requiring innovative approaches to monitor and regulate illicit activities. Additionally, the anonymity and decentralized structure of Bitcoin present challenges in identifying and prosecuting offenders, necessitating enhanced coordination between law enforcement agencies and financial institutions.

Addressing these enforcement challenges is crucial for upholding the integrity of the financial system and combating money laundering activities effectively. By developing streamlined processes and leveraging technology to enhance monitoring capabilities, regulators can more effectively enforce AML rules and ensure compliance within the cryptocurrency industry. For a deeper insight into the evolution of Bitcoin AML regulations in various regions, including Micronesia, explore the comprehensive analysis provided by WikiCrypto on bitcoin anti-money laundering (AML) regulations in Micronesia.

Impact on Cryptocurrency Industry 💼

The growth of AML rules on Bitcoin in Mexico has had a significant impact on the cryptocurrency industry. This regulatory shift has led to increased transparency and accountability within the sector, fostering greater trust among stakeholders. However, it has also introduced challenges for businesses operating in the cryptocurrency space, such as the need to invest in compliance measures and navigate the evolving regulatory landscape. Despite these challenges, the implementation of AML rules is ultimately aimed at fostering a more secure and sustainable cryptocurrency ecosystem in Mexico, encouraging responsible innovation and investment.

Future Outlook and Solutions 🌟

Bitcoin presents a complex landscape for AML regulations in Mexico, posing challenges that require careful consideration. As the cryptocurrency industry evolves, the future outlook envisions a need for adaptable solutions that can effectively address the changing regulatory environment. It is crucial for stakeholders to collaborate on innovative strategies that promote compliance without stifling the potential benefits of digital currencies. Embracing emerging technologies and fostering a proactive approach to enforcement will be key in shaping a sustainable framework for AML rules in the realm of Bitcoin.

To navigate the intricate web of AML regulations in the cryptocurrency sphere, it is essential to stay informed and proactive. Educating users and industry participants about compliance measures while fostering a culture of transparency and accountability can pave the way for a more secure and resilient ecosystem. By exploring the potential synergies between technology, regulation, and industry practices, stakeholders can work towards a future where AML rules on Bitcoin in Mexico are not seen as a hindrance, but rather as a catalyst for innovation and growth.