Tax Obligations for Peer-to-peer Bitcoin Traders 📊

Navigating the world of peer-to-peer Bitcoin trading in Sao Tome involves understanding the tax obligations that come with it. It’s essential for traders to stay informed about the tax implications of their transactions to ensure compliance with local regulations. By being aware of these obligations, traders can make informed decisions that will help them manage their tax responsibilities effectively.

Impact of Regulatory Changes on Trading Dynamics 💼

Regulatory changes can significantly impact the dynamics of Bitcoin trading in Sao Tome. Traders must adapt swiftly to evolving policies and guidelines, which can alter market trends and strategies. Understanding the legal framework and staying updated on regulatory shifts are crucial for navigating the peer-to-peer trading landscape effectively. Compliance with regulatory adjustments can influence trading volumes and user behavior, shaping the overall ecosystem of Bitcoin transactions in the region.

Strategies to Maximize Profits While Staying Compliant 💸

When navigating the world of peer-to-peer Bitcoin trading, it is crucial to implement strategic approaches that not only aim to maximize profits but also ensure compliance with existing regulations. By employing a blend of prudent risk management techniques and market analysis, traders can fine-tune their trading strategies to capitalize on opportunities while adhering to tax obligations. Embracing innovative tools and technologies can also streamline the tax reporting process, enabling traders to focus on their core trading activities with ease and efficiency.

Potential Risks and Challenges in the Trading Process ⚠️

When engaging in peer-to-peer Bitcoin trading in Sao Tome, traders may encounter various risks and challenges inherent in the process. These could include security vulnerabilities, potential fraud, lack of regulatory protection, and market volatility. It’s crucial for traders to stay informed and adopt risk management strategies to navigate these obstacles effectively. To gain further insights into regulatory aspects, particularly for traders in Samoa, check out this article on peer-to-peer bitcoin trading laws in Samoa.

Leveraging Technology for Efficient Tax Reporting 🖥️

In the realm of cryptocurrency trading, embracing innovative technology can revolutionize the tax reporting process. By harnessing the power of cutting-edge software and platforms, traders in Sao Tome can streamline their tax obligations with precision and efficiency. Automation tools not only simplify reporting but also ensure accurate tracking of transactions, enabling traders to comply with tax regulations seamlessly. Embracing technology for tax reporting not only saves time but also minimizes the room for errors, leading to a more efficient and compliant trading experience.

The Future Outlook for Peer-to-peer Bitcoin Trading 🌐

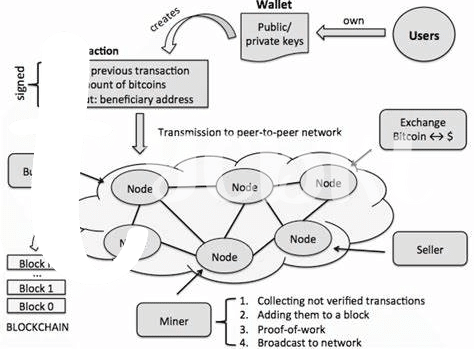

As the landscape of peer-to-peer Bitcoin trading continues to evolve, it is essential to consider the trends that may shape its future. Innovations in blockchain technology, changing regulatory frameworks, and increasing mainstream adoption are likely to impact the dynamics of this market. Additionally, the integration of artificial intelligence and automation tools could streamline trading processes and enhance security measures, paving the way for a more efficient and transparent ecosystem. Embracing these developments while staying mindful of evolving regulations and best practices will be crucial for traders looking to navigate the ever-changing landscape of peer-to-peer Bitcoin trading.

Peer-to-peer Bitcoin Trading Laws in Senegal