Advantages of Investing in Tax-free Accounts 🌟

Investing in tax-free accounts offers a unique opportunity for individuals looking to grow their wealth without the burden of taxes eating into their profits. By utilizing these accounts for bitcoin investments, investors can benefit from potential tax savings, allowing their returns to compound over time. This advantage not only maximizes the growth potential of investments but also provides a level of financial security by reducing the tax implications associated with traditional investment accounts. Additionally, tax-free accounts can offer a strategic way to diversify one’s investment portfolio and navigate the volatility of the market with a long-term perspective in mind.

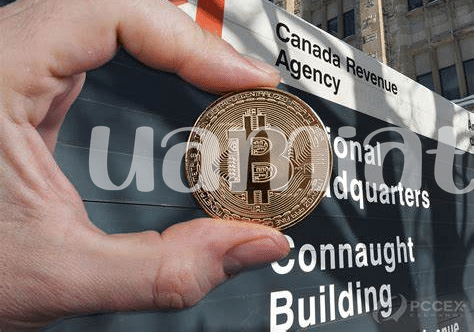

Understanding the Regulations on Bitcoin Investments 💡

When it comes to navigating the regulatory landscape surrounding Bitcoin investments, it’s essential to stay informed and compliant with the evolving guidelines. From reporting requirements to tax implications, understanding these regulations is crucial for making informed decisions and mitigating potential risks. By keeping abreast of the latest developments and seeking expert advice, investors can navigate the complex regulatory environment and ensure their Bitcoin investments are in line with legal requirements.

Strategies for Maximizing Returns in Tax-free Accounts 💰

Strategies for Maximizing Returns in Tax-free Accounts focus on leveraging market trends and adopting a diversified investment approach. By regularly monitoring the cryptocurrency market and making strategic adjustments to the portfolio, investors can capitalize on potential growth opportunities. Additionally, considering factors such as risk tolerance and long-term investment goals can help in crafting a well-rounded investment strategy tailored to individual preferences. Engaging in thorough research and staying informed about the latest developments in the Bitcoin space can further enhance the chances of achieving optimal returns.

Risks Associated with Investing in Bitcoin 🚫

Investing in Bitcoin comes with its own set of risks that investors should be aware of. One of the primary risks is the extreme price volatility that is characteristic of the cryptocurrency market. Bitcoin prices can fluctuate wildly in short periods, leading to potential significant gains or losses for investors. Additionally, the lack of regulation and oversight in the cryptocurrency space can expose investors to scams, hacking incidents, and other fraudulent activities. It is crucial for investors to conduct thorough research and exercise caution when investing in Bitcoin to mitigate these risks.

When considering investing in Bitcoin, it is essential to weigh these risks against the potential rewards. Understanding the risks associated with Bitcoin investments allows investors to make informed decisions and implement appropriate risk management strategies. By staying informed and staying vigilant, investors can navigate the risks involved in Bitcoin investments and potentially achieve favorable returns in the long run.

Comparing Different Tax-free Savings Account Options 🔄

When it comes to choosing the right tax-free savings account for your Bitcoin investments, there are several key factors to consider. Each option has its own set of features, benefits, and limitations. Some accounts may offer higher interest rates but have stricter withdrawal rules, while others may provide more flexibility but with lower returns. It’s essential to compare different tax-free savings account options carefully to find the one that best aligns with your investment goals and risk tolerance. By conducting thorough research and consulting with financial experts, you can make an informed decision that maximizes the growth potential of your Bitcoin holdings.

Future Outlook for Bitcoin Investments 📈

As more people become aware of the potential of Bitcoin investments, the future outlook for this digital currency appears promising. The increasing acceptance of Bitcoin in various sectors and the growing interest from institutional investors are contributing to its upward trend. Market analysts predict that with the continued adoption and integration of blockchain technology, the value of Bitcoin is likely to surge in the coming years.

For further insights into the tax implications of Bitcoin trading in Chile and whether Bitcoin is recognized as legal tender in Nauru, click here: is bitcoin recognized as legal tender in Nauru?