Unveiling Satoshi Nakamoto: the Mysterious Creator 🕵️

Imagine diving into the world of digital treasure without knowing the name of the captain who drew the map. That’s the story with the creation of Bitcoin, which was introduced to the world by a person, or possibly even a group of people, under the pseudonym Satoshi Nakamoto. Back in 2008, a paper surfaced on the internet laying out the blueprint for what would become the first decentralized digital currency. Yet, the true identity of Satoshi remains one of the internet’s most captivating mysteries. Despite the countless attempts to unveil this digital maestro, Satoshi’s anonymity stands as a testament to the core values of privacy and autonomy that are woven into the very fabric of Bitcoin.

| Year | Event |

|---|---|

| 2008 | Satoshi Nakamoto releases the Bitcoin whitepaper. |

| 2009 | Bitcoin network goes live with the release of the first open-source Bitcoin client and the issuance of the first bitcoins. |

| 2010 | Last known communication from Satoshi Nakamoto. |

💡 While Satoshi’s departure left many questions unanswered, the legacy left behind has sparked a revolution. The idea of Bitcoin challenges traditional financial systems and introduces a world where transactions can happen across the globe without the need for intermediaries. Satoshi’s vision has grown beyond mere currency, inspiring a wave of innovation in digital finance. Though we may never learn the true identity behind the name, Satoshi Nakamoto’s creation continues to shape our digital future.

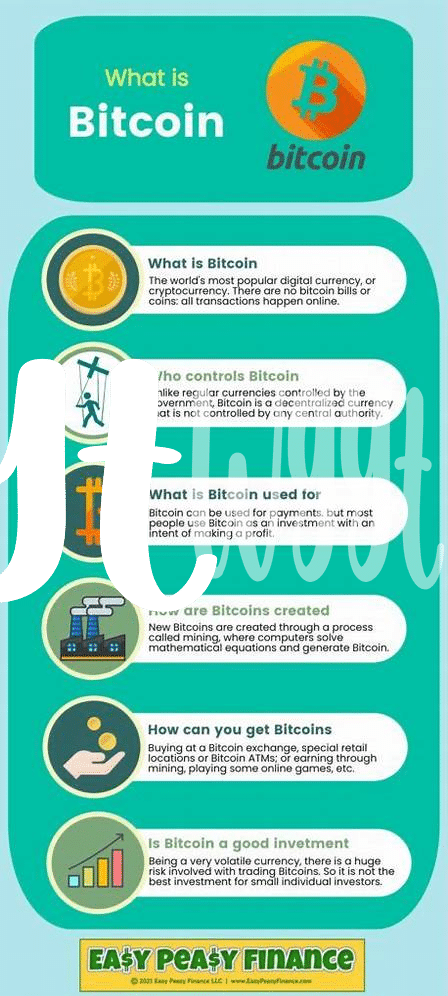

Bitcoin 101: Understanding Digital Money Basics 💡

Imagine a world where your money is entirely digital – no bills, no coins, just digital currency that you can send to anyone, anywhere, without needing a bank in the middle. That’s the fundamental idea behind Bitcoin, a kind of money that exists solely online. Created by the mysterious Satoshi Nakamoto, this digital currency offers a way to make transactions across the globe without the hassle of exchange rates or bank fees. You can think of it like sending an email; instead of sending a message, you’re sending value directly to another person. This system runs on a network of computers that keep track of all the transactions, ensuring everything is fair and secure. It’s like having a team of mathematicians in your pocket, making sure your money is safe. And just like emails make information flow seamlessly around the world, Bitcoin lets value flow the same way. For more insights into Bitcoin’s role in the future markets, visit here.

The Very First Block: a Historic Moment ⏳

Imagine taking a small step that starts a whole new adventure. This is what happened on January 3, 2009, when something very special was created online—a digital “coin” that no one could touch, but everyone could use. This wasn’t just any digital coin; it was the very first of its kind, called Bitcoin. Think of it as the first piece in a giant puzzle. This piece, known to computer buffs as a “block,” opened the door to a whole new way of thinking about and using money. It was like planting a tiny seed that would grow into a huge tree.

This moment was more than just historic; it set the stage for a revolution in how we handle money. Unlike traditional money kept in banks, this digital money could be sent directly from person to person, anywhere in the world, without needing a middleman like a bank. The technology behind it made it safe and private, ensuring that people could trust it with their transactions. Just like the first step on the moon left a footprint for all time, this first block in Bitcoin’s chain created a path for a future where digital currency could be as common as emails.

How Bitcoin Works: Simple Transaction Explained 💳

Imagine you’re sending a virtual letter, but instead of paper, you use digital coins. That’s essentially how Bitcoin transactions work. Every time you use Bitcoin to buy something or send it to a friend, your transaction joins a digital line of similar activities, all securely wrapped up by complex puzzles only powerful computers can solve. This process, known as mining, not only confirms your transaction is legitimate but also creates new Bitcoins, keeping the whole system running smoothly. Imagine a world where every time money changes hands, it’s recorded in a giant, open book that everyone can see, but nobody can tamper with – that’s the revolutionary idea behind Bitcoin. It’s like having an indestructible ledger where every penny’s journey is tracked. Want to get on board with this digital revolution? Figuring out how to buy bitcoin in 2024 is a great place to start, unlocking a world where sending money is as simple and secure as sending a message.

The Ripple Effect: Bitcoin’s Impact on Economy 🌍

Bitcoin has reshaped the way we think about money and our financial system. Before, all our transactions relied on banks and traditional currencies, with a whole lot of red tape in between. Then came this digital currency, not controlled by any state or corporation, but by a network of computers across the globe. This shift has sparked interest not just among tech enthusiasts but also in the financial world. Suddenly, there’s a new way to think about saving, spending, and investing. By cutting out the middleman, Bitcoin promises to make transactions faster and cheaper, a promise that has grabbed the attention of businesses and individuals alike.

| Impact Area | Description |

|---|---|

| Banking and Finance | Bitcoin offers an alternative to traditional banking, challenging the status quo. |

| International Trade | With its global reach, Bitcoin simplifies cross-border transactions, reducing costs and time. |

| Investment | It has become a new asset class, attracting both individual and institutional investors. |

| Innovation and Technology | Bitcoin has spurred innovations in blockchain technology and digital transactions. |

This isn’t just about making transactions easier; it’s a whole new way for the economy to operate. While Bitcoin has its ups and downs, its very existence challenges the traditional financial ecosystem, pushing for a future where money is more democratic, accessible, and in the hands of the people. With every transaction, Bitcoin is slowly but surely leaving its mark on the economy, encouraging us to rethink what money is and what it could be.

Future Predictions: Where Is Bitcoin Heading? 🔮

As we gaze into the crystal ball to predict the future of Bitcoin, it’s like embarking on an exciting expedition into uncharted territories 🌌🔍. Amidst the digital landscape, Bitcoin, the pioneer of cryptocurrencies, stands at a crossroads, beckoning a future filled with both vast opportunities and challenges. Imagine a world where digital wallets become as commonplace as smartphones – a reality not too far off. Bitcoin, with its decentralised nature, promises to redefine financial transactions, making them more accessible, efficient, and secure. As we venture further, the comparison between Bitcoin and traditional assets, especially gold, becomes increasingly relevant. For those intrigued by how Bitcoin measures up against time-tested gold in 2024, a deep dive into what are bitcoin wallets in 2024 offers a comprehensive insight. This exploration is crucial in understanding Bitcoin’s position in the financial ecosystem and its potential to become a new-age store of value. The journey ahead for Bitcoin is rife with potential technological advancements, regulatory milestones, and global economic shifts. Each of these factors plays a pivotal role in shaping Bitcoin’s trajectory, potentially steering it towards wider acceptance or confronting it with hurdles. Yet, the resilience and ingenuity of the Bitcoin community suggest an era of innovation and transformation, promising to keep the essence of Satoshi Nakamoto’s creation vibrant and evolving. As we look to the horizon, the voyage of Bitcoin is far from over; instead, it’s just gearing up for the next leap forward, promising an intriguing blend of mystery, opportunity, and the relentless pursuit of reimagining money 💫🚀.