Antigua’s Innovative Approach to Bitcoin Regulation 🌴

Antigua boasts a forward-thinking approach to regulating Bitcoin, setting itself apart with its innovative strategies. In a landscape where traditional frameworks often struggle to adapt, Antigua’s stance embraces flexibility and openness to new ideas. By actively engaging with industry stakeholders and leveraging technological solutions, the island nation is paving the way for a more progressive and effective regulatory environment. This unique approach not only fosters the growth of Bitcoin but also positions Antigua as a key player in shaping the global market landscape.

Balancing Aml Measures Without Stifling Innovation 💡

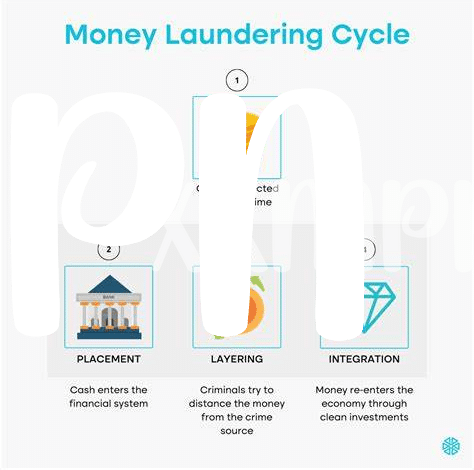

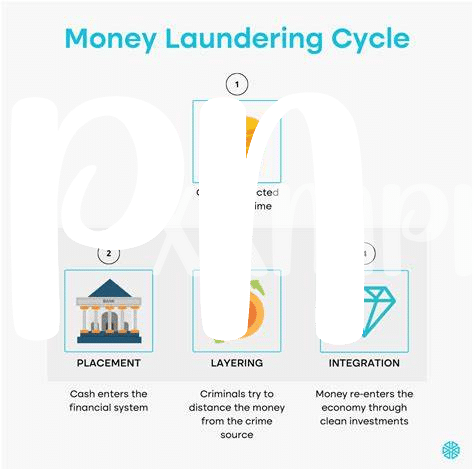

In order to foster innovation while maintaining effective anti-money laundering (AML) measures in place, it is crucial for regulatory bodies to strike a delicate balance. This equilibrium allows for the growth and evolution of the Bitcoin market, encouraging new ideas and advancements without compromising on security and compliance protocols. By creating a regulatory environment that supports both innovation and AML best practices, Antigua sets a precedent for other jurisdictions to follow, showcasing a model that prioritizes progress while safeguarding against illicit activities.

Embracing a forward-thinking approach, Antigua’s unique stance on regulating Bitcoin exemplifies a harmonious relationship between compliance and innovation. This proactive strategy not only demonstrates the country’s commitment to fostering a thriving Bitcoin ecosystem but also highlights the importance of adaptability in an ever-evolving financial landscape.

Community Engagement in Shaping Effective Regulations 🗣️

In Antigua, the active involvement of the community in shaping regulations has proven to be a key factor in crafting effective measures for Bitcoin oversight. By fostering an environment where stakeholders, including businesses and the general public, have a voice in the regulatory process, Antigua has been able to strike a balance between safeguarding against money laundering risks and encouraging innovation in the digital currency space. This collaborative approach not only helps to ensure that regulations are practical and relevant to the ecosystem but also promotes a sense of ownership and accountability among those directly impacted by the rules.

The Role of Technology in Monitoring Compliance 📊

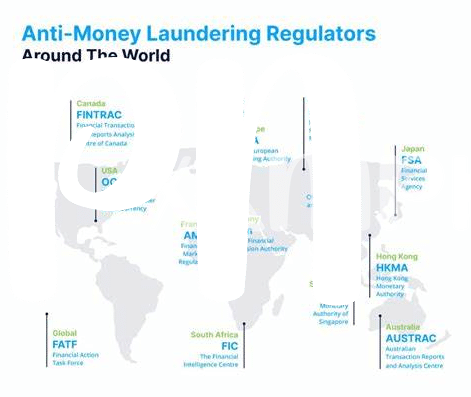

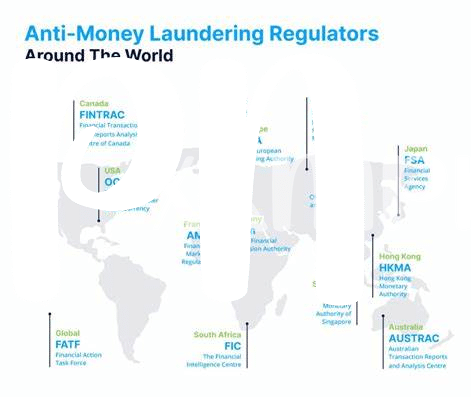

Antigua’s forward-thinking approach incorporates cutting-edge technology to bolster compliance monitoring efforts. By embracing advanced tools and systems, regulators can efficiently track and analyze transactions, identifying suspicious activities more effectively. The integration of technological solutions not only enhances oversight but also streamlines regulatory processes, contributing to a more secure environment for Bitcoin transactions. Automated monitoring mechanisms enable real-time surveillance, enabling authorities to quickly respond to potential risks. This integration of technology with regulatory practices showcases Antigua’s commitment to staying ahead in combating illicit activities in the cryptocurrency realm. To further explore how Bitcoin AML regulations are evolving globally, one can compare the tax treatments of Bitcoin with traditional investments in Andorra through this insightful resource on bitcoin anti-money laundering (aml) regulations in Andorra.

Implementing a Progressive Regulatory Framework 🚀

Within the dynamic landscape of Bitcoin regulation, Antigua stands out for its forward-thinking approach. Embracing the spirit of innovation, the country has been proactive in crafting a regulatory framework that not only addresses current challenges but also anticipates future developments. By continually adapting and evolving its regulations, Antigua is setting a precedent for progressive governance in the cryptocurrency space.

This commitment to a progressive regulatory framework not only fosters a conducive environment for blockchain technology to thrive but also enhances investor confidence. As Antigua navigates the complexities of regulating Bitcoin, its emphasis on adaptability and inclusivity paves the way for sustainable growth and global influence in the digital asset market. By staying ahead of the curve, Antigua is not only shaping its own future but also contributing to the evolution of regulatory practices worldwide.

Antigua’s Potential Impact on the Global Bitcoin Market 🌍

Antigua’s unique approach to regulating Bitcoin is poised to make waves in the global market. By fostering a conducive environment for innovation and compliance, Antigua sets a precedent for other nations to follow suit. This strategic positioning has the potential to influence not only the perception of Bitcoin but also its integration into conventional financial systems. As Antigua fine-tunes its regulatory framework, the ripple effects on the broader Bitcoin market are becoming increasingly evident, paving the way for a more inclusive and regulated ecosystem.

To delve deeper into how different countries are approaching Bitcoin regulation, check out the latest on **tax implications of Bitcoin trading in Zimbabwe**.