Understanding the Role 🌐

Sebi, the Securities and Exchange Board of India, plays a vital role in regulating various aspects of the financial market, including the increasingly prominent realm of Bitcoin transactions. As the apex regulatory body in India, Sebi is tasked with ensuring investor protection, market integrity, and the orderly functioning of the securities market. When it comes to Bitcoin, Sebi’s role involves monitoring and overseeing the implications of digital currency on traditional financial systems and ensuring that necessary safeguards are in place to prevent misuse and protect investors’ interests.

By understanding Sebi’s role in regulating Bitcoin money transfers, stakeholders can gain insights into how the evolving landscape of digital currencies intersects with traditional regulatory frameworks. This understanding not only sheds light on the regulatory challenges posed by cryptocurrencies but also underscores the importance of regulatory bodies in adapting to technological innovations to maintain market stability and investor confidence.

History of Sebi 📜

The history of Sebi is rich and complex, tracing back to its establishment in the early years of India’s financial landscape. Over the decades, Sebi has evolved to become a pivotal player in regulating and overseeing the securities market, striving to maintain transparency and investor protection. Through various milestones and reforms, Sebi has solidified its position as a robust regulatory body, adapting to the changing dynamics of the financial world.

Within the corridors of Sebi lie a legacy of decisions and interventions that have shaped the Indian financial ecosystem. From its inception to navigating through market fluctuations and technological advancements, Sebi’s journey is a testament to its commitment to upholding market integrity and ensuring fair practices. As Sebi continues to steer the financial markets towards growth and stability, its historical trajectory serves as a guiding light for the future landscape of regulatory governance.

Regulations on Bitcoin 📝

Cryptocurrency enthusiasts have been closely watching the evolving landscape of digital asset regulations. As governments around the world grapple with how to oversee the burgeoning popularity of Bitcoin and other cryptocurrencies, SEBI’s role in India’s regulatory framework is particularly noteworthy. SEBI’s approach to regulating Bitcoin transactions involves a delicate balance between fostering innovation and safeguarding investors. The regulations put in place aim to mitigate risks associated with money laundering, fraud, and market manipulation. By setting guidelines for exchanges and traders, SEBI seeks to create a transparent and secure environment for Bitcoin transactions. These regulations not only impact the cryptocurrency industry but also have broader implications for the future of financial technology and digital economy.

Impact on Money Transfers 💸

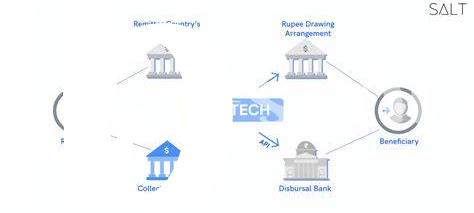

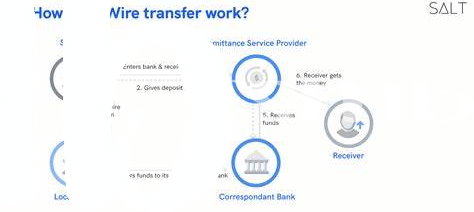

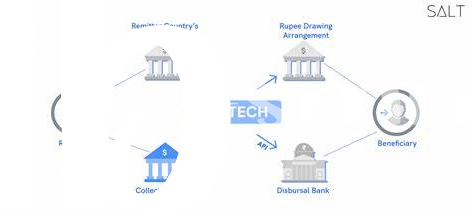

The increasing popularity of Bitcoin has significantly impacted the landscape of money transfers, offering users a decentralized alternative to traditional banking services. With the rise of cryptocurrencies, the role of organizations like Sebi in regulating these transactions has become more crucial than ever. As Bitcoin continues to gain traction globally, its influence on cross-border money transfers cannot be underestimated. The ease and speed of transactions, coupled with lower fees compared to conventional methods, have made Bitcoin an attractive option for individuals and businesses looking to move funds internationally. However, this evolving digital currency landscape brings along new challenges and uncertainties that regulators like Sebi must address to ensure the stability and security of financial systems. To gain further insights into Bitcoin’s impact on cross-border money transfers and the regulatory environment in different countries, including Ireland, check out this informative article on bitcoin cross-border money transfer laws in Ireland.

Challenges Faced 🤔

Challenges in regulating Bitcoin transactions are multifaceted. One key issue is the decentralized nature of cryptocurrencies, making it challenging for traditional regulatory bodies like Sebi to monitor and enforce compliance effectively. Additionally, the relatively nascent and rapidly evolving nature of the cryptocurrency landscape poses difficulties in keeping regulations up to date with the latest developments. Moreover, the anonymity associated with Bitcoin transactions raises concerns about potential misuse for illicit activities, adding another layer of complexity to regulatory efforts. Addressing these challenges requires a nuanced approach that balances innovation and consumer protection while mitigating the risks associated with unregulated financial transactions and ensuring the stability of the financial system.

Future of Bitcoin Regulation 🚀

The future of Bitcoin regulation is poised to bring about significant shifts in the financial landscape. As governments and regulatory bodies continue to grapple with the challenges posed by digital currencies, we can expect to see a more nuanced approach towards regulating Bitcoin transactions. This evolving regulatory framework will likely impact how Bitcoin is used for cross-border money transfers, with a particular focus on enhancing security measures and ensuring compliance with anti-money laundering regulations. As we move towards a more interconnected global economy, the future of Bitcoin regulation holds the potential to shape the way we conduct financial transactions in the digital age.

Bitcoin cross-border money transfer laws in Guyana