Overview of Ethiopian Laws Regulating Digital Currencies 🌍

Ethiopia’s legal framework concerning digital currencies reflects a dynamic landscape that is gradually evolving to address the complexities of virtual assets. The regulatory framework in place seeks to provide a structured approach to overseeing transactions involving digital currencies, aiming to ensure transparency and safeguard against illicit activities. As Ethiopia navigates the realm of digital currencies, there is a delicate balance between fostering innovation and mitigating risks associated with these decentralized forms of financial exchange. By understanding the nuances of Ethiopian laws governing digital currencies, individuals and businesses can better comprehend the parameters within which they can engage in Bitcoin transactions within the country.

Impact of Current Regulations on Bitcoin Transactions 💸

Ethiopia’s regulations on digital currencies have had a significant impact on Bitcoin transactions in the country. These regulations, while aimed at ensuring financial stability and security, have posed challenges for cryptocurrency users in Ethiopia. Restrictions on the exchange and trading of digital assets have limited the accessibility and usability of Bitcoin for individuals and businesses. However, despite these challenges, there are opportunities for growth in the digital currency market in Ethiopia. By exploring alternative ways to facilitate Bitcoin transactions within the scope of existing regulations, users and investors can potentially overcome the obstacles imposed by current laws. It is crucial to consider Ethiopia’s approach in comparison to other countries’ policies towards digital currencies to understand the broader implications and possibilities for future developments in the regulatory landscape. Anticipating potential changes and advancements, stakeholders in the cryptocurrency community in Ethiopia can navigate these challenges and work towards a more inclusive and sustainable financial ecosystem.

Challenges Faced by Ethiopian Cryptocurrency Users 🤦♂️

Ethiopian cryptocurrency users face a myriad of challenges in navigating the regulatory landscape. The lack of clear guidelines often leads to uncertainty and potential legal risks when engaging in Bitcoin transactions. Additionally, limited access to banking services and infrastructure complicates the process of buying and selling digital currencies. Security concerns, such as potential hacking and scams, are prevalent in the Ethiopian cryptocurrency community. Moreover, the fluctuating value of cryptocurrencies poses a significant risk for users, especially in a market with limited safeguards and consumer protections. These challenges underscore the need for tailored solutions to address the specific needs and concerns of Ethiopian cryptocurrency users.

Opportunities for Growth in the Digital Currency Market 💡

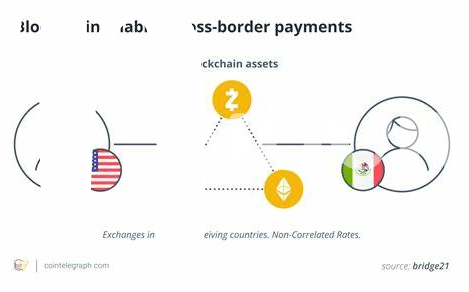

In the fast-evolving landscape of digital currencies, the Ethiopian market holds significant opportunities for growth. As more individuals and businesses explore the potential of cryptocurrencies like Bitcoin, there is a growing need for supportive regulations and infrastructure to facilitate their use. This presents a ripe environment for innovative solutions and investment in the digital currency space. A forward-thinking approach to regulation and adaptation of best practices from global counterparts can further bolster the growth of the market. By fostering a conducive environment for digital currency adoption, Ethiopia can position itself as a progressive player in the international digital economy. To learn more about cross-border Bitcoin regulations in Eswatini, visit bitcoin cross-border money transfer laws in Eswatini.

Comparing Ethiopia’s Approach to Other Countries’ Policies 🌐

Ethiopia’s approach to regulating digital currencies differs from many other countries’ policies. While some nations have embraced cryptocurrencies and created clear guidelines for their use, Ethiopia’s regulations may be viewed as more restrictive. This can impact the ability of Ethiopian cryptocurrency users to engage in transactions effectively compared to their counterparts in countries with more accommodating policies. Examining how different nations approach digital currencies can provide valuable insights into the potential benefits and challenges of various regulatory frameworks. By comparing Ethiopia’s stance on cryptocurrencies to other countries, we can gain a broader understanding of the global landscape of digital currency regulation and its implications for users and businesses worldwide.

Future Outlook: Potential Changes and Developments 🔮

In the ever-evolving landscape of digital currencies, the potential changes and developments on the horizon for Ethiopia’s regulatory framework hold significant weight. As the global interest in cryptocurrencies grows, it becomes imperative for Ethiopian policymakers to adapt swiftly to ensure a conducive environment for innovation and investment in this sector. Anticipated revisions in existing laws could streamline bitcoin transactions, providing more clarity and security for users while fostering the growth of a dynamic cryptocurrency market within the country.

For broader insights into how jurisdictions worldwide are approaching the regulation of cross-border bitcoin transfers, it is enlightening to compare Ethiopia’s stance with that of other nations. To delve deeper into this comparative analysis, exploring the bitcoin cross-border money transfer laws in Fiji and Estonia can offer valuable perspectives on varying regulatory approaches and their impact on the cryptocurrency ecosystem. The possibilities of harmonizing these diverse strategies present exciting opportunities for cross-country collaborations and advancements in the realm of digital finance.