🎈 Introduction to Bitcoin Interest Accounts

Imagine a world where your digital gold, Bitcoin, could not only sit securely in a vault but also grow over time, just like a seed sprouts into a tree. This isn’t a fantasy; it’s the reality offered by Bitcoin interest accounts. Just as a bank pays you interest for the money in your savings account, these innovative services reward you for depositing your bitcoins with them. It’s a win-win. You get to keep your digital currency safe while earning extra bitcoins on the side.

Safety and growth, two key desires for any Bitcoin enthusiast, are at the heart of these accounts. With the digital currency landscape ever-evolving, these accounts stand as a beacon for those looking to make their bitcoins work for them. By depositing your bitcoins into one of these accounts, you’re essentially lending your coins to the platform, which, in turn, pays you back with interest.

| Benefit | Description |

|---|---|

| Growth | Your bitcoin balance increases over time without you having to trade. |

| Safety | Platforms often employ robust security measures to protect your digital assets. |

It’s a modern approach to growing your investment, blending the traditional wisdom of saving with the innovative edge of cryptocurrency.

🛡️ How Safe Are Your Bitcoins in These Accounts?

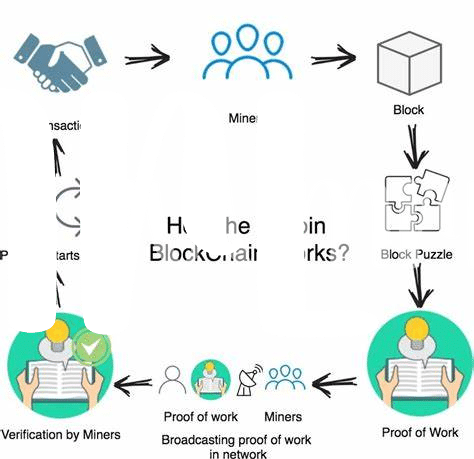

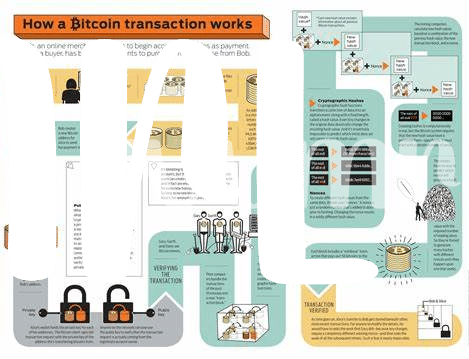

When you park your Bitcoins in an interest account, imagine it like planting a seed and watching it grow. But, just like in a garden, there are things we need to watch out for—things that can harm our growing seed. The big question is, are these Bitcoin plants in a safe garden? Mostly, yes, but it depends on how well the garden (or in this case, the platform) is protected. Some digital gardens have strong fences and guards (security measures), while others might leave the gate wide open. To dig deeper into how these platforms keep your Bitcoins safe from the digital version of pests and thieves, consider how blockchain technology not only powers cryptocurrencies but also adds layers of security. This tech is pretty nifty, acting like an unbreakable digital ledger, keeping track of all the Bitcoin transactions. For an insight into how blockchain fortifies your digital assets, a visit to https://wikicrypto.news/blockchain-security-safeguarding-your-crypto-assets-in-defi is highly recommended. So, while your Bitcoins can indeed grow safely, the choice of platform is crucial. Pick a platform like you’d pick a garden: one that’s well-kept, secure, and promises your seed a chance to turn into a healthy plant.

📈 Comparing Interest Rates Across Top Platforms

When you start looking around for places to grow your Bitcoins, you’ll notice something interesting – not all platforms offer the same interest rates. 🤔 It’s a bit like shopping for the best savings account; only in this case, your savings are in digital gold. Some platforms might dangle a high rate in front of you, yep, the kind that makes you go “Wow, that’s generous!” But here’s where the smarter approach kicks in. It’s not just the biggest number that matters but what comes with it. Think of it like a fruit market; some apples might look super shiny on the outside but what’s the taste and nutrition like? Similarly, a higher interest rate might come with a catch or two – maybe it’s a less secure platform, or they require you to lock up your bitcoins for longer than you’re comfortable with.

🔍 It’s about finding that sweet spot. Some platforms offer special rates for short periods as a promotion, while others might reward you more if you’re willing to part with your bitcoins for longer stretches. And then there are those that provide a steady, no-nonsense rate – not too high, not too low, but just right for keeping your digital stash growing safely over time, kind of like the steady climb of a well-chosen hiking path. Remember, in this dynamic terrain of bitcoin interest, it’s not a one-size-fits-all. What works wonders for one might not suit another’s steps. So, take your time, compare those rates, check the fine print, and gear up for a journey that’s tailored just for you.

💡 Tips for Maximizing Your Bitcoin Earnings

To make the most out of your Bitcoin interest accounts, thinking smart and staying informed are your best tools. First, consider diversifying your investments. Just like you wouldn’t put all your traditional money in one bank, spreading your Bitcoin across different platforms can reduce risk and increase your earning potential. Regularly checking out the interest rates offered by various platforms is crucial too; they can change, and you want to be earning as much as possible. Another smart move is to reinvest your earned interest. By doing so, you’re essentially earning interest on your interest, which can significantly boost your Bitcoin savings over time. Being cautious with lock-up periods is also key. These are periods when you can’t access your Bitcoin without facing a penalty. Make sure they align with your financial plans. For those looking to widen their Bitcoin knowledge, checking out bitcoin educational courses and the blockchain can provide valuable insights into making informed decisions. Finally, consider the impact of withdrawal fees and transaction costs on your earnings. These can vary greatly between platforms and can eat into your profits if not managed wisely. By taking these steps, you’re positioning yourself to better navigate the complexities of Bitcoin interest accounts and maximize your earnings.

🚫 Common Pitfalls to Avoid with Interest Accounts

Diving into the world of Bitcoin interest accounts can feel like hitting a jackpot, especially when you see those interest rates. 🌟 But, hold your horses! There are a few sneaky pitfalls you’ll want to sidestep to keep your digital gold safe. Firstly, not all that glitters is gold—some platforms might dangle high rates in front of you, but they come with a catch. 🎣 Maybe it’s a lock-in period where your bitcoins are stuck, or the rates fluctuate wilder than a rollercoaster. Secondly, let’s talk about the fine print. It’s as thrilling as watching paint dry, but hidden fees and conditions can nibble away at your earnings like a sneaky mouse. 🐭 And don’t even get me started on the security aspect. If a platform’s security is as strong as a cardboard fortress, it’s a no-go. Remember, a bit of homework and caution can turn these pitfalls into stepping stones towards your Bitcoin earning goals.

Here’s a quick table to summarize:

| Pitfall | What to Watch Out For |

|---|---|

| Deceptive Interest Rates | Lock-in periods, rate fluctuations |

| Hidden Fees/Conditions | Unexpected charges that eat into earnings |

| Security Concerns | Platforms with weak protection measures |

🎯 Choosing the Best Account for Your Goals

When you’re on the journey to finding where to park your digital coins for some earnings, knowing your own financial landscape can be your best compass. Imagine you’re exploring the vast world of bitcoin and defi ecosystems, and you stumble upon a treasure map. This map doesn’t lead to a chest of gold but to something equally valuable – understanding how the blockchain works and which bitcoin interest account aligns perfectly with your financial horizons. It’s all about striking a balance between the returns you’re aiming for and the level of risk you’re comfortable with. Like choosing the right gear for a deep-sea dive, selecting the ideal account demands a blend of caution and adventure.

Diving into the sea of options requires a clear head and a detailed plan. Start by sketching out your financial goals – short, medium, and long-term. Are you looking for steady growth over years or quick gains? Also, consider how hands-on you want to be with your investment. Some platforms offer automatic reinvestment features, making your journey somewhat more hands off. Remember, the crypto world is vibrant and constantly evolving. Staying informed and adaptable is as crucial as choosing the right platform. By aligning your goals with the unique offerings of each account, you chart a course towards maximizing your bitcoin earnings, armed with the confidence that comes from thorough research and strategic planning.