Understanding the Importance of Insurance Coverage 🛡️

Insurance coverage serves as a protective shield in the uncertain realm of Bitcoin transactions, offering a safety net against potential risks that may arise. Beyond mere financial protection, insurance provides peace of mind, ensuring that businesses can navigate the volatile landscape of digital assets with confidence. With the increasing prevalence of cryptocurrency transactions, understanding the importance of insurance coverage has become paramount for safeguarding investments and ensuring continuity in the face of unexpected events.

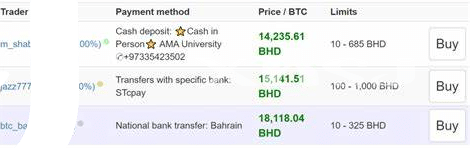

Exploring Available Insurance Options in Bahrain 🌍

When it comes to exploring available insurance options in Bahrain, it’s crucial to delve into the diverse array of policies tailored to meet the unique needs of individuals engaging in Bitcoin transactions. From comprehensive coverage to specific policies targeting digital asset protection, understanding the nuances of each option is essential. Bahrain provides a burgeoning landscape of insurance offerings, each with its own benefits and considerations. By carefully evaluating these options, individuals can make informed decisions to safeguard their digital assets effectively.

Factors to Consider When Choosing an Insurance Policy 💡

When it comes to choosing an insurance policy for your Bitcoin transactions, there are several key factors to consider. Understanding the coverage limits, policy exclusions, and claims process is crucial. Additionally, assessing the financial stability and reputation of the insurance provider is important for peace of mind. Evaluating the cost of the policy against the level of protection it offers is also essential. By weighing these factors carefully, you can select an insurance policy that best suits your needs and mitigates potential risks effectively.

Risks and Benefits of Insuring Bitcoin Transactions 💰

When considering the realm of insuring Bitcoin transactions, it is crucial to weigh the inherent risks against the potential benefits. By insuring these transactions, individuals and businesses have the opportunity to mitigate losses in case of unforeseen events such as cyber attacks or theft. On the flip side, there are associated costs and complexities that must be carefully evaluated. Understanding the delicate balance between risk and reward is key in deciding whether to opt for insurance coverage in the realm of Bitcoin transactions.

Steps to Evaluate the Adequacy of Insurance Policies 🧐

When assessing insurance policies for Bitcoin transactions in Bahrain, it’s crucial to first understand the specific coverage provided. Start by evaluating the scope of protection offered by each policy to ensure it aligns with the risks associated with digital currency transactions. Next, consider the policy’s terms and conditions, including coverage limits and exclusions, to determine if it meets your unique needs. Additionally, examine the reputation and financial stability of the insurance provider to gauge their reliability in settling claims promptly and efficiently. By diligently evaluating these factors, you can make an informed decision on the adequacy of insurance policies for safeguarding your Bitcoin transactions.

Future Trends in Insurance for Bitcoin Transactions 🔮

In the rapidly evolving landscape of cryptocurrency transactions, the future trends in insurance for Bitcoin transactions are poised to revolutionize risk management practices. Emerging technologies, such as blockchain, are reshaping the way insurance is approached in safeguarding digital assets. The integration of smart contracts and AI-driven tools is likely to streamline insurance processes and enhance trust in the realm of Bitcoin transactions.

For a deeper insight into insurance coverage for bitcoin wallets and exchanges in Austria, please visit insurance coverage for bitcoin wallets and exchanges in Argentina.