🚀 What Sets Bitcoin and Ethereum Apart?

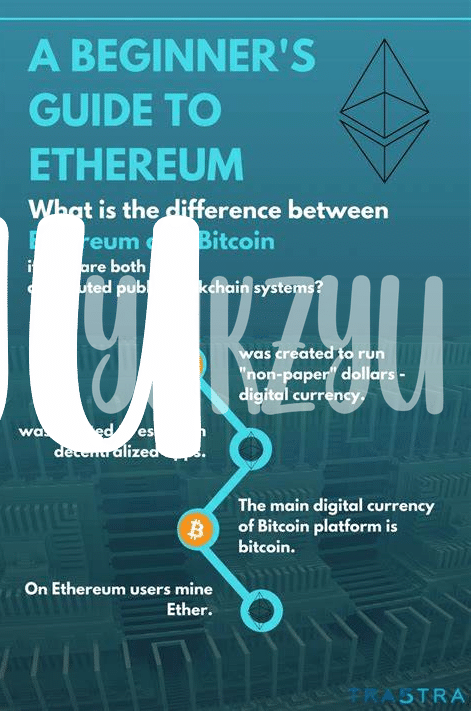

Imagine stepping into a world where two superheroes of digital currency exist – one is a trailblazer, the grandfather of all cryptocurrencies, known as Bitcoin. It’s like digital gold, a pure currency form that lets you send money across the globe without a middleman. On the other side, we have Ethereum, a younger, more adventurous hero. Ethereum doesn’t just move money; it runs a whole ecosystem of apps and contracts that operate without any boss – imagine a vending machine that operates itself, and you’ve pretty much got the idea.

While both are stars in the digital sky, they sparkle with different lights. Bitcoin keeps things straightforward – it’s all about sending and receiving money securely and anonymously. Ethereum, however, dreams bigger. It’s not satisfied with just moving money; it wants to revolutionize how agreements work. Through smart contracts, Ethereum automates these agreements, ensuring they’re executed when conditions are met, no need for lawyers or intermediaries. Here’s a simple breakdown of their key features:

| Feature | Bitcoin | Ethereum |

|---|---|---|

| Primary Use | Digital Currency | Smart Contracts & DApps |

| Launched In | 2009 | 2015 |

| Blockchain Type | Decentralized, focused on anonymity and security | Decentralized, supports smart contracts and decentralized applications |

| Currency Symbol | BTC | ETH |

This unique character of each sets the stage for a diverse landscape of possibilities. While Bitcoin aims to redefine money, Ethereum’s sights are set on changing how the internet works, making it a more secure and efficient place for everyone.

💡 Ethereum’s Smart Contracts Vs. Bitcoin’s Simplicity

Imagine you are at a playground. On one side, you have a jungle gym packed with slides, monkey bars, swings, and all sorts of exciting stuff – that’s Ethereum. On the other side is a classic, sturdy swing set – simple but beloved. That’s Bitcoin. Ethereum, with its smart contracts, is like that jungle gym. It’s designed for people who want more than just a back-and-forth ride. These smart contracts are like automatic agreements that run when certain conditions are met, making everything from voting systems to trading games possible without needing a middleman. It’s a playground that’s always adding new toys.

On the flip side, Bitcoin keeps it simple. It was the first on the playground and has a special place in people’s hearts. It’s like the swing set that doesn’t try to be anything else because people love it for what it is. Bitcoin’s simplicity is its strength. It was made to do one thing really well: provide a secure way to exchange money over the internet. And just like how we trust the durability of a well-made swing set, people trust Bitcoin to be a safe place to put their money. This is why, despite all the new, flashy equipment at the crypto playground, the swing set remains a favorite for many. For those looking to explore the differences between Ethereum and other cryptocurrencies like Ethereum Classic, https://wikicrypto.news/the-role-of-tether-in-facilitating-international-transactions offers a deep dive into their unique characteristics.

💰 Comparing Costs: Transaction Fees and Times

When you’re thinking about diving into the world of digital money, two giant names pop up: Bitcoin, the big brother everyone knows, and Ethereum, the tech-savvy sibling. Imagine you’re sending money or buying something online – you’d probably consider how much it’ll cost you in fees and how long it’ll take, right? That’s where the differences between these two get really interesting. Bitcoin, being the older of the two, has a rep for being a bit slow on the move, kind of like that reliable old car in the garage that’s never let you down but isn’t winning any races. It processes transactions in about 10 minutes, and fees can vary widely depending on how busy the network is. Ethereum, on the other hand, is like a zippy sports car – faster, with transactions taking a few minutes, but sometimes the cost of gas can really add up, especially when the network is busy. So, depending on your need for speed and how much you’re willing to pay for it, both have their perks and quirks.

🌐 Ethereum’s Expanding Universe Vs. Bitcoin’s Stability

Imagine two neighborhoods: one is constantly evolving, with new buildings and parks popping up, while the other prides itself on its time-tested charm and steadiness. This is a bit like the contrast between Ethereum and Bitcoin. Ethereum is like a bustling city under constant construction, introducing new and innovative projects, especially those related to decentralized applications (dApps) and finance (often called DeFi). Its ability to support smart contracts allows developers to create all sorts of applications beyond mere currency transactions, making it a continuously expanding universe. For those intrigued by the world of dApp development or the advancements in Ethereum, checking out eth classic could provide some valuable insights.

On the flip side, Bitcoin maintains its position with a focus on being a digital gold, a secure and stable investment. It’s like that well-established neighborhood, not keen on rapid changes or adding too many new features, which appeals to those looking for reliability in their digital currency investment. Bitcoin’s simplicity is its strength, offering a straightforward approach to cryptocurrency that has attracted millions of users worldwide. Amidst the evolving landscape of digital currencies, Bitcoin stands as a beacon of stability, offering a safe haven for investors who prefer a less complicated yet proven asset. This fundamental difference in philosophy and approach underpins the unique investment profiles and opportunities each presents.

📈 Investment Perspectives: Growth Potential and Risks

Investing in digital currencies like Bitcoin and Ethereum is a bit like riding a roller coaster – thrilling with potential ups and downs. Picture Bitcoin as the original powerhouse, drawing investors with its pioneering status and promise of a digital gold standard. Its value tends to swing based on market demand, not unlike stocks or precious metals. In contrast, Ethereum offers a broader canvas, not just a currency but a platform for smart contracts and decentralized applications, hinting at endless possibilities for technological innovations. This makes Ethereum’s growth tied not just to investor sentiment but to actual use cases and tech developments. However, both come with their share of risks. Bitcoin’s dance is mainly with market volatility, while Ethereum wades through both market shifts and the technical hurdles of scaling and security upgrades. It’s a balance of potential high rewards against the backdrop of equally significant risks.

| Currency | Growth Potential | Risks |

|---|---|---|

| Bitcoin (BTC) | High, based on market adoption and demand | Market volatility, regulatory changes |

| Ethereum (ETH) | Very high, based on technological use cases and adoption | Market volatility, technical challenges |

🌍 the Future: Ethereum’s Upgrades Vs. Bitcoin’s Path

Peeking into the future, Ethereum and Bitcoin seem to take unique paths that stir up quite the buzz. Ethereum, known for its constant innovation, is on the brink of more upgrades that make it even more appealing. Picture a digital world where transactions are not just faster but cheaper and more environmentally friendly, thanks to Ethereum’s shift towards a proof-of-stake model. This model is a big deal because it means the network will consume less energy and potentially handle transactions more efficiently. It’s like upgrading from an old, slow bus to a speedy, eco-friendly train. On the other hand, Bitcoin is playing it cool, sticking with its original game plan. It’s like the trusty old tree in the backyard that doesn’t change much but grows steadily over time. Bitcoin continues to focus on being a secure and reliable store of value, something that people can trust amidst the whirlwind of change.

Regarding investments, these paths lead to different experiences. Ethereum’s adventurous route with continuous upgrades, like the ones you can read about in this ethereum mining pool, could mean a lot of growth potential, attracting those who are keen on technological advancements and fast-paced changes. Meanwhile, Bitcoin’s steadiness attracts those looking for a safe haven, a place to park their investments with less drama. The choice between Ethereum’s evolving landscape and Bitcoin’s unwavering path paints an intriguing picture for the future, inviting enthusiasts to ponder where they’d like to place their bets in the ever-evolving world of cryptocurrency.