Introduction to Bitcoin Banking 💡

Bitcoin banking has revolutionized the financial landscape by providing a decentralized digital currency system. Its innovative technology allows for secure and efficient transactions without the need for traditional banks. Users can have greater control over their funds and enjoy lower transaction fees. Embracing Bitcoin banking introduces a new way of conducting financial activities, offering opportunities for individuals and businesses to transact in a borderless and transparent manner. This digital currency opens doors to financial inclusion and access to services for those underserved by traditional banking systems.

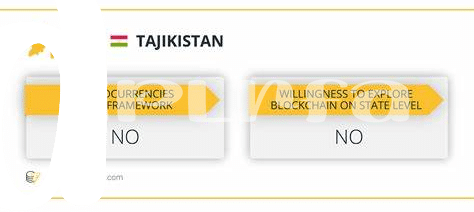

Regulatory Compliance in Tajikistan 💼

In Tajikistan, navigating regulatory compliance in the realm of Bitcoin banking requires a nuanced understanding of the evolving legal landscape. As the government grapples with adapting existing financial regulations to encompass digital currencies, businesses operating in this space face a complex web of compliance requirements. From licensing stipulations to anti-money laundering protocols, staying abreast of the latest regulatory developments is imperative for ensuring a lawful and secure Bitcoin banking environment in Tajikistan.

Furthermore, fostering transparency and accountability through proactive compliance measures not only mitigates regulatory risks but also paves the way for greater institutional acceptance of Bitcoin banking within the country. Collaborating with regulatory bodies, leveraging technological solutions for compliance monitoring, and engaging in industry dialogue can collectively contribute to a more robust compliance framework that fosters trust and stability in the burgeoning Bitcoin banking sector of Tajikistan.

Security Measures and Best Practices 🔒

In the realm of Bitcoin banking, safeguarding user assets is paramount. Implementing robust security measures can protect against unauthorized access and cyber threats. Encryption technology, multi-factor authentication, and regular security audits are fundamental components in ensuring a secure banking environment. Moreover, best practices such as utilizing hardware wallets, keeping software up-to-date, and educating users on potential risks can fortify the overall security posture of a Bitcoin banking system. By integrating these measures seamlessly into operations, banks in Tajikistan can instill trust and confidence in users, fostering a secure and reliable platform for Bitcoin transactions.

Benefits of Bitcoin Banking 💰

Bitcoin banking offers a range of advantages that cater to the needs of both businesses and individuals. One key benefit is the ability to make fast and secure transactions, cutting out intermediaries and reducing transaction costs. Additionally, users can access their funds at any time, opening up new opportunities for financial inclusion. Furthermore, the decentralized nature of Bitcoin banking provides a level of transparency and autonomy that traditional banking systems often lack. To delve deeper into the impact of regulatory changes on Bitcoin banking services regulations in Tanzania, check out this informative article: bitcoin banking services regulations in Tanzania.

Challenges and Risks to Consider ⚠️

When venturing into the realm of Bitcoin banking in Tajikistan, it is crucial to navigate through a myriad of challenges and risks. One must consider the volatility of the cryptocurrency market, potential regulatory changes, cybersecurity threats, and the overall stability of the financial ecosystem. Being proactive in monitoring and adapting to these risks is essential to ensure a secure and compliant Bitcoin banking experience in Tajikistan.

Future Outlook and Trends 🔮

As Bitcoin banking continues to gain traction in Tajikistan, the future outlook and trends suggest a promising landscape ahead. With advancements in technology and increased adoption, the sector is poised for significant growth. Key trends to watch out for include the development of more user-friendly interfaces, enhanced security protocols, and greater regulatory clarity to ensure sustainable growth. Embracing these trends will be crucial for the continued success and evolution of Bitcoin banking services in Tajikistan.

bitcoin banking services regulations in Spain