Understanding the Legal Landscape 📜

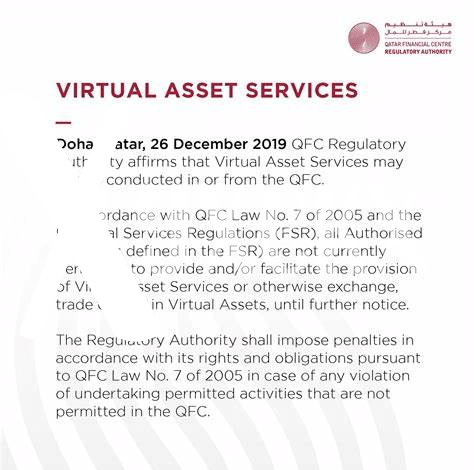

Understanding the legal landscape surrounding Bitcoin investments is crucial for individuals looking to venture into this digital asset realm. In Qatar, the regulations pertaining to cryptocurrency investments can vary, requiring investors to stay informed and compliant with the local laws. By delving into the legal framework, investors can navigate the intricacies of acquiring and holding Bitcoin securely within the confines of Qatari regulations.

Below is a simplified overview of the legal landscape for Bitcoin investments in Qatar:

| Legal Aspect | Brief Description |

|——————|————————————————————–|

| Regulatory Bodies | Identifies key authorities overseeing Bitcoin investments |

| Permissible Actions | Outlines actions allowed for investors within the law |

| Compliance Measures | Suggests steps for ensuring adherence to legal requirements |

Benefits of Investing in Bitcoin 💰

When considering investing in Bitcoin, one can potentially benefit from its decentralized nature, which provides a degree of independence from traditional banking systems. The opportunity for significant returns on investment, albeit with risks, is another allure for many investors venturing into the cryptocurrency market. The transparency of transactions on the blockchain ensures a level of accountability that traditional financial systems may lack, appealing to those seeking more visibility in their investments. Additionally, the convenience of 24/7 trading and global accessibility further enhances the appeal of Bitcoin investment, allowing individuals to diversify their portfolios beyond traditional assets. Bitcoin’s potential as a hedge against economic uncertainties and inflation also adds to its attractiveness for investors looking to safeguard their wealth.

Risks to Be Aware of 🚨

Bitcoin investments present unique risks that investors need to be aware of. One of the primary concerns is the volatile nature of the cryptocurrency market, with prices capable of fluctuating drastically in a short period. This volatility can lead to substantial gains, but it also exposes investors to the risk of significant losses. Additionally, the regulatory environment surrounding cryptocurrencies like Bitcoin is constantly evolving, creating uncertainty about how governments may choose to regulate or tax these assets. Security is another critical risk factor, as cyber threats targeting digital wallets and exchanges can result in the loss of funds. It’s essential for investors to carefully assess these risks before committing to Bitcoin investments.

Recommended Platforms for Qatar Residents 🌐

When it comes to choosing the right platforms for Bitcoin investments in Qatar, residents have several options to consider. Look for platforms that offer user-friendly interfaces, secure transactions, and reliable customer support. It’s essential to choose a platform that complies with Qatar’s regulations and has a good reputation in the cryptocurrency community. Some popular choices among Qatar residents include those with a strong track record of security and customer satisfaction. By selecting a reputable platform, you can confidently navigate the world of Bitcoin investments in Qatar and potentially reap the benefits of this digital currency. For more insights on regulatory guidance for Bitcoin investments, you can check out this informative resource: Regulatory Guidance on Bitcoin Investments in Russia.

Steps to Stay Compliant with Regulations 🔒

Compliance with regulations is essential for Bitcoin investors in Qatar to navigate the evolving financial landscape effectively. To ensure adherence to regulatory requirements, investors should prioritize identity verification procedures on authorized platforms. These platforms typically implement stringent Know Your Customer (KYC) processes, safeguarding against fraudulent activities and promoting a secure investment environment for all users. Moreover, staying vigilant about updates to regulatory frameworks and promptly adjusting investment strategies in response to changes will help mitigate potential compliance risks.

| Compliance Precautions | Details |

|---|---|

| Identity Verification | Complete KYC procedures on authorized platforms |

| Regulatory Updates | Stay informed and adjust strategies accordingly |

Future Outlook for Bitcoin Investments 🌟

When looking ahead at the future of Bitcoin investments, the potential for growth and innovation is vast. As the landscape continues to evolve, more and more investors are recognizing the value and opportunities that come with cryptocurrency. The increasing integration of Bitcoin into traditional financial systems and the rise of regulatory frameworks are paving the way for a more secure and stable investment environment. With a focus on education and awareness, investors in Qatar have the opportunity to capitalize on the potential benefits while navigating the associated risks. Keeping a pulse on market trends and regulatory developments will be key in staying ahead of the curve and maximizing investment potential. As the market matures, the future outlook for Bitcoin investments in Qatar holds promise for those willing to embrace the changing landscape. For more guidance on regulatory aspects in other countries, such as Romania, refer to the regulatory guidance on bitcoin investments in Romania.