Aml Regulations 🛡️

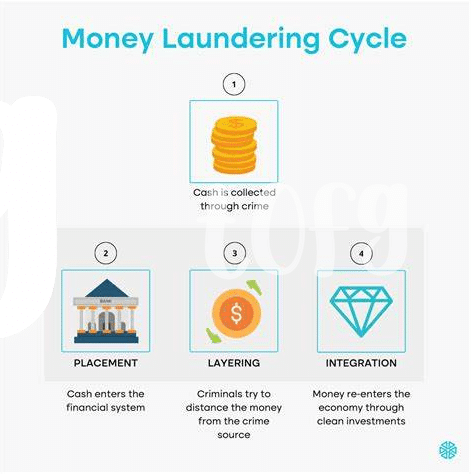

Amidst the evolving landscape of Malaysia’s Bitcoin ecosystem, the realm of Anti-Money Laundering (AML) regulations stands as a pivotal shield against illicit activities. These regulations serve as the cornerstone for ensuring transparency and accountability within the digital currency sphere. By requiring entities to adhere to stringent AML protocols, authorities aim to safeguard the integrity of financial transactions and prevent the misuse of cryptocurrencies for unlawful purposes. Striking a balance between innovation and security, AML regulations in Malaysia play a crucial role in fostering trust and credibility in the burgeoning Bitcoin market.

Impact on Bitcoin Exchanges 🔍

Navigating the evolving Bitcoin landscape in Malaysia poses both opportunities and challenges for cryptocurrency exchanges. The increased focus on Anti-Money Laundering (AML) regulations has significantly impacted how these exchanges operate. Stricter AML measures have been put in place to combat illicit activities and ensure transparency within the Bitcoin ecosystem. With heightened scrutiny, exchanges must now implement robust compliance procedures to meet regulatory requirements and protect against financial crimes. Additionally, enhancing customer due diligence processes has become a key priority for exchanges to maintain trust and credibility in the market. The impact of AML regulations on Bitcoin exchanges underscores the need for continuous adaptation and vigilance in an ever-changing regulatory environment.

Challenges Faced by Businesses 💼

Businesses operating in Malaysia’s evolving Bitcoin ecosystem encounter a multitude of hurdles in adhering to Anti-Money Laundering (AML) compliance. Navigating the complex regulatory landscape while staying innovative poses a significant challenge for these entities. Ensuring robust monitoring mechanisms for detecting suspicious activities amidst the fast-paced nature of cryptocurrency transactions adds another layer of complexity. Moreover, the need to strike a balance between customer privacy and regulatory requirements further complicates the compliance journey for businesses. Embracing technological advancements to enhance AML measures while also catering to the evolving regulatory expectations proves to be a daunting task for organizations in this dynamic landscape.

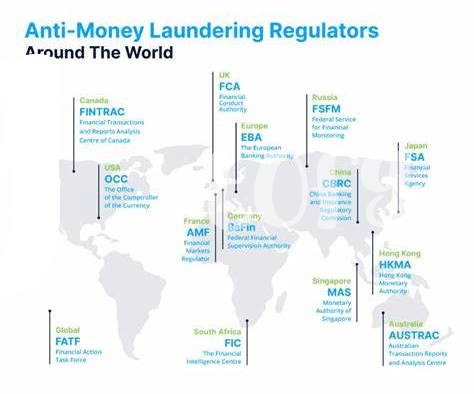

Role of Regulatory Authorities 🕵️♂️

In the evolving Bitcoin ecosystem of Malaysia, regulatory authorities play a pivotal role in shaping the landscape and ensuring compliance within the sector. With the dynamic nature of cryptocurrency markets, these authorities are tasked with staying ahead of emerging trends, technology advancements, and potential risks to safeguard the integrity of financial systems. Through robust regulations and oversight, regulatory bodies not only aim to protect consumers and investors but also foster innovation and sustainable growth in the digital currency space.

As businesses navigate the complexities of AML compliance in the Bitcoin realm, understanding and adhering to the guidelines set forth by regulatory authorities is paramount. By actively engaging with these entities, businesses can contribute to a more transparent and secure environment, building trust with stakeholders and fostering long-term success. Furthermore, collaboration between industry players and regulatory authorities is key to bridging gaps, addressing challenges, and promoting the responsible adoption of cryptocurrencies in Malaysia.

Importance of Compliance Training 📚

Compliance training plays a vital role in ensuring that businesses in Malaysia’s evolving Bitcoin ecosystem are equipped with the necessary knowledge and skills to adhere to AML regulations effectively. Through comprehensive training programs, employees can better understand their obligations, recognize red flags, and implement proper procedures to mitigate money laundering risks. Continuous education on compliance not only enhances the overall security of the ecosystem but also fosters a culture of integrity and responsibility within organizations.

It is essential for businesses to invest in ongoing compliance training as the regulatory landscape continues to evolve alongside the crypto industry. By staying abreast of the latest developments and best practices in AML compliance, companies can proactively address emerging challenges and maintain a strong reputation in the market. Additionally, well-informed staff members serve as frontline defense against illicit activities, thereby safeguarding the integrity and sustainability of the Bitcoin ecosystem in Malaysia.

Future of Aml in the Bitcoin Ecosystem 🚀

In the ever-evolving landscape of the Bitcoin ecosystem, the future of AML initiatives holds crucial significance. With technological advancements and regulatory developments shaping the financial sector, AML measures are expected to witness continuous refinement and adaptation. As cryptocurrencies gain further mainstream acceptance, regulatory authorities will likely enforce stricter compliance standards to curb illicit activities. Embracing innovative technologies such as blockchain analytics will become integral for detecting and preventing money laundering risks within the Bitcoin sphere. The collaborative efforts between businesses, regulatory bodies, and AML professionals will be instrumental in establishing a secure and transparent environment for digital asset transactions.

Insert link to legal consequences of bitcoin transactions in Serbia: legal consequences of bitcoin transactions in Serbia.