Introduction to Bitcoin Atms in Colombia 🌎

In Colombia, Bitcoin ATMs are revolutionizing access to digital currency. These machines provide a gateway for individuals to engage in secure and convenient transactions, bridging the gap between traditional financial services and the growing digital economy. With the rise of Bitcoin ATMs across Colombia, more people are gaining familiarity with cryptocurrency, ultimately expanding opportunities for financial inclusion and empowerment. This introduction sets the stage for exploring the transformative impact of Bitcoin ATMs on the Colombian financial landscape.

Benefits of Financial Inclusion through Bitcoin 💸

Financial inclusion through Bitcoin opens up new possibilities for individuals in Colombia, fostering access to financial services and empowering them economically. With the growth of Bitcoin ATMs, traditional barriers like lack of banking infrastructure are being overcome. By providing a gateway to the digital economy, users can experience lower transaction fees, quicker cross-border transfers, and heightened financial privacy. This innovative approach not only expands opportunities for the financially underserved but also promotes a more inclusive and efficient financial system for all.

Impact on Underserved Communities 🌍

Bitcoin ATMs have the potential to significantly impact underserved communities in Colombia. By providing access to financial services and the ability to securely store and transfer funds, these ATMs can empower individuals who have been marginalized by traditional banking systems. This newfound access to financial resources can bridge the gap and promote economic stability within these communities, fostering a more inclusive and prosperous society.

Overcoming Barriers to Access ✨

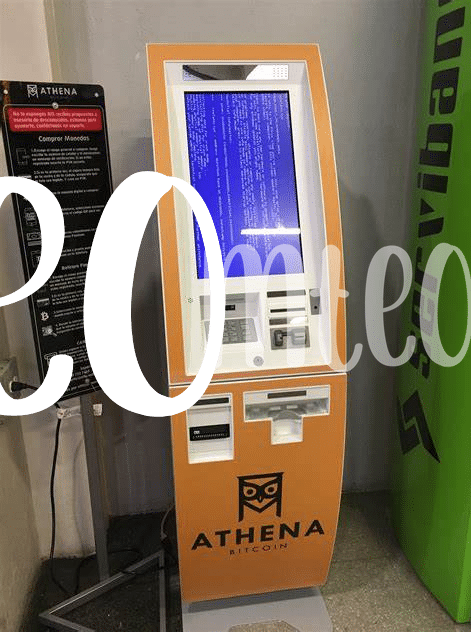

Bitcoin ATMs in Colombia present a promising avenue for overcoming barriers to financial access. By providing a familiar interface for individuals to buy, sell, and store Bitcoin, these ATMs offer a user-friendly solution. The convenience and accessibility of these machines have the potential to bridge the gap between traditional financial services and the unbanked or underbanked populations in Colombia.

For a deeper look into the legal ramifications of Bitcoin transactions in Guinea, check out this insightful article on legal consequences of bitcoin transactions in Guinea.

Future Outlook for Bitcoin Atms in Colombia 🚀

In the evolving landscape of Colombia’s financial ecosystem, the integration of Bitcoin ATMs heralds a new era of accessibility and convenience for both urban centers and rural areas. Embracing digital assets through these ATMs not only empowers individuals with financial autonomy but also fosters a more inclusive financial environment for all. As these Bitcoin ATMs become more widespread across Colombia, they hold the promise of revolutionizing traditional banking systems, bridging gaps, and providing a gateway to economic participation for previously underserved populations. The future outlook for Bitcoin ATMs in Colombia envisions a dynamic shift towards a more democratized and efficient financial infrastructure, opening avenues for broader economic prosperity and empowerment.

Conclusion: the Path to Economic Empowerment 🌟

The path to economic empowerment for underserved communities in Colombia is illuminated by the accessibility and innovation brought forth by Bitcoin ATMs. By enabling individuals to easily buy and sell Bitcoin, these ATMs break down traditional barriers to financial inclusion. Through this technology, Colombians can navigate around the limitations of traditional banking systems and take control of their financial futures. As these ATMs continue to expand their reach across the country, the potential for economic empowerment becomes increasingly tangible.

For further insights into the legal aspects of Bitcoin ATMs in different countries, including Chile and Burkina Faso, explore the question “Are Bitcoin ATMs legal in Chile?” and delve into the regulations and implications surrounding these virtual currency exchange machines.