El Salvador’s Big Bet on Bitcoin 🎰

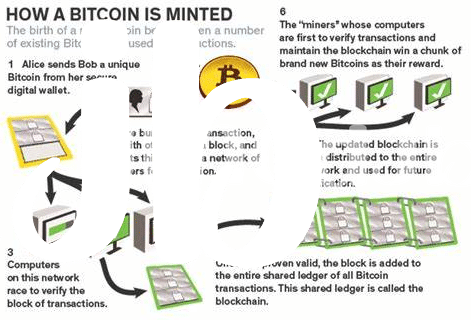

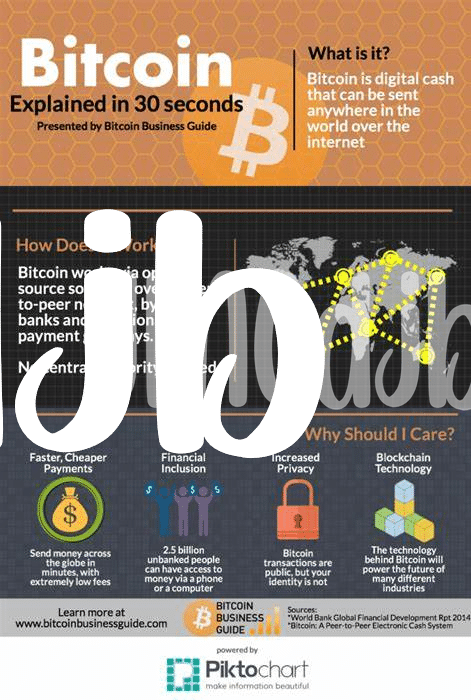

In a bold move that caught the world’s attention, El Salvador decided to embrace Bitcoin, marking a significant turn in their economic strategy. This small country stepped into the spotlight by becoming the first to officially adopt the digital currency as legal tender. The decision was surrounded by excitement and curiosity, as it promised to reshape how money moves and grows within the nation. From buying a coffee to receiving a paycheck, Bitcoin was expected to streamline transactions, making them faster and more accessible to all, especially for those without traditional bank accounts. Skeptics and enthusiasts alike watched closely, wondering how this experiment would unfold. The government, led by President Nayib Bukele, also launched a national digital wallet, “Chivo,” offering a $30 Bitcoin incentive to users, aiming to encourage its adoption. This leap into the crypto universe was not just about embracing modernity but also about seeking financial inclusion and innovation.

| Date | Event |

|---|---|

| June 2021 | El Salvador passes law to adopt Bitcoin as legal tender. |

| September 2021 | “Chivo” digital wallet launched to the public. |

The Reaction: from Skepticism to Acceptance 🔄

When El Salvador decided to dive into the world of Bitcoin, it wasn’t just a small splash; it was a huge wave. Many people, both inside the country and around the world, watched with raised eyebrows. Doubt and worry were in the air. Could this really work? Is it safe? Questions buzzed like bees in a garden. However, as time passed, some of this skepticism began to melt away. People started to see the potential benefits: faster transactions, no need for traditional banks, and a new way to attract tourists and tech-savvy businesses.

For more insights into the complexities and the economic impact of adopting Bitcoin on a national level, check https://wikicrypto.news/the-economics-of-bitcoin-mining-is-it-profitable. This transition wasn’t just about changing the way money looks or feels but about transforming the entire financial ecosystem. Slowly but surely, the air filled with stories of successful transactions, businesses flourishing with new customers, and a growing sense of national pride. El Salvador was on its way to turning a bold gamble into a path of economic innovation and inclusion, showing the world that change, although scary, can lead to acceptance and growth.

Everyday Life with Bitcoin: Shopping to Paychecks 🛒

Imagining a day in El Salvador now includes a twist straight out of the future, where the clinking coins and rustling notes of traditional money find a digital counterpart – Bitcoin. From the moment the morning cup of coffee is paid for with a quick scan of a phone, the integration of this digital currency into daily transactions becomes clear. Across the country, market stalls, large stores, and even the local pupuserias have adapted to this change, displaying QR codes alongside usual prices. For many, the payday ritual has transformed; salaries once handed over in envelopes or deposited into bank accounts now seamlessly flow into digital wallets. This shift to Bitcoin transactions speaks of a broader trend where convenience, speed, and the promise of lower transaction fees entice both businesses and individuals. Yet, this blend of traditional and digital is more than a quirky trait of the Salvadoran economy; it’s a living experiment in financial technology. The humming servers and smartphones in hands are symbols of a nation stepping boldly into a realm where each swipe and tap on the screen echo its pioneering spirit in weaving Bitcoin into the very fabric of daily life.

The Bumps Along the Crypto Road 🚧

Not every step of embracing Bitcoin in El Salvador was smooth. Just like a road trip with unexpected potholes, the journey had its share of challenges. Some days, the value of Bitcoin saw big swings up and down, making some people a little dizzy with the rapid changes. Imagine buying a coffee and finding out it cost you more (or less!) by the time you finished drinking it! Plus, not everyone was ready to jump on the digital money train. Some folks preferred their familiar paper money, leading to a mix of high-tech excitement and a bit of head-scratching confusion. Then there’s the tech part – not everyone had the right phone or enough internet juice to make smooth transactions. And for those wanting to dig even deeper into how this all fits together, especially compared to what they’re used to, finding clear information was key. An excellent place to start is by understanding bitcoin versus fiat currency explained, offering a window into the intricacies of a crypto economy versus traditional money systems, shining a light on paths through the digital forest.

Global Eyes on El Salvador: Critique & Praise 👀

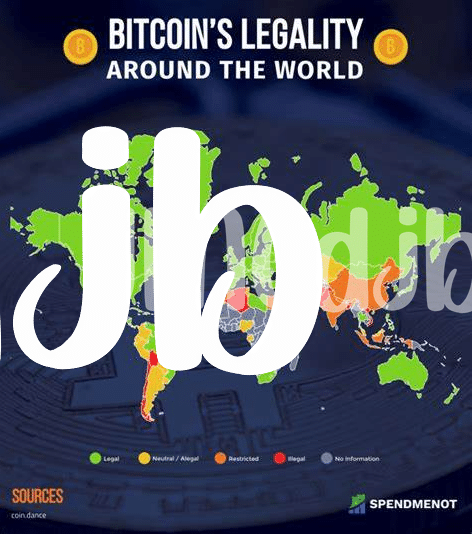

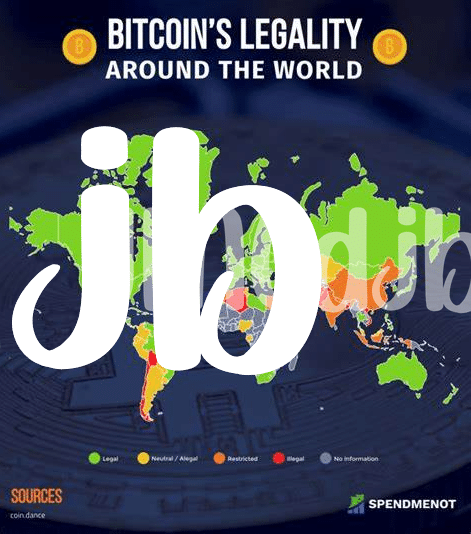

When El Salvador took the plunge into the world of digital currency, it wasn’t just a local news story—it captured attention worldwide. 🌍 Critics and supporters alike tuned in, keen to see how this bold move would play out on the global stage. On one side, skeptics pointed out the risks of volatility and regulatory challenges, worried about potential economic pitfalls. They argued that such a small economy betting big on Bitcoin could face tough times if digital currency values took a nosedive. On the other side, there were those who applauded the country for its pioneering spirit. 🚀 They saw El Salvador as a trailblazer, potentially setting a precedent for how national economies could integrate digital currencies. Praising the initiative, they highlighted the possibilities for greater financial inclusion and streamlined remittances—a significant factor for a country where many rely on money sent home from abroad. Amidst this buzz, international regulators, financial experts, and crypto enthusiasts have been closely watching, ready to learn from El Salvador’s experience. The country has become a live case study in adopting digital currency on a national scale, providing valuable lessons for the rest of the world as we all navigate the ever-evolving digital economy landscape.

| Opinion | Description |

|---|---|

| Critique | Concerns over volatility, regulatory challenges, and economic impact. |

| Praise | Recognition for pioneering spirit, financial inclusion, and potential for streamlined remittances. |

Future Prospects: Digital Waves in the Economy 🚀

As El Salvador continues to navigate the waters of cryptocurrency, its economic landscape could see remarkable transformation. Imagine a future where digital currency not only simplifies daily transactions but also opens up global markets to local businesses, fostering growth and innovation. This bold move towards a crypto economy might inspire other nations to explore similar paths, possibly leading to a more interconnected and digitally savvy global market. But challenges remain, such as ensuring fair access to technology and addressing environmental concerns linked to bitcoin mining process explained. Nonetheless, this small country’s journey could set a precedent, proving the viability of digital currencies in strengthening economies. With El Salvador’s example, the world watches and learns, contemplating how digital waves could reshape the economic shores of nations worldwide. As the country strides ahead, embracing both the risks and rewards, it lights a path for others to follow, potentially leading to a financial revolution where digital currency becomes a cornerstone of global economies.