Ecuador’s Regulatory Approach to Bitcoin 🌎

Ecuador’s stance on Bitcoin encompasses a regulatory approach that seeks to balance innovation with financial oversight. Through clear guidelines and frameworks, the country aims to provide a supportive environment for Bitcoin while safeguarding against potential risks. This approach reflects Ecuador’s commitment to exploring the potential of digital currencies within a structured regulatory framework, promoting transparency and accountability in the evolving landscape of cryptocurrency. By outlining clear regulatory boundaries and embracing opportunities for growth, Ecuador sets a foundation for both investors and enthusiasts to participate in the Bitcoin ecosystem with confidence.

Impact of Aml Regulations on Bitcoin 🕵️♂️

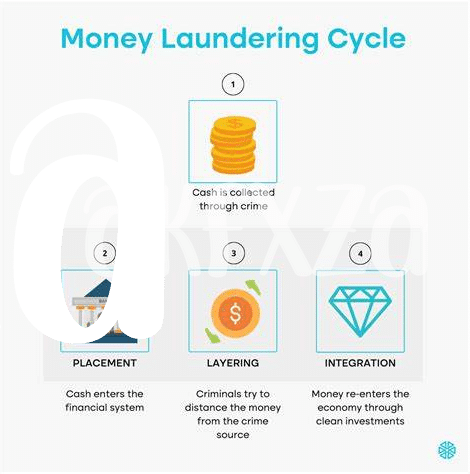

Bitcoin has experienced a notable influence due to the introduction of AML regulations in Ecuador. These regulations have mandated stricter monitoring and reporting requirements for transactions involving digital currencies, including Bitcoin. The impact of AML measures on Bitcoin users has been twofold, with increased transparency and security measures aiming to deter illicit activities. However, compliance with these regulations has also posed challenges for businesses and individuals operating in the cryptocurrency space. The need for enhanced identity verification and transaction monitoring has led to additional complexities in conducting Bitcoin transactions within Ecuador’s regulatory framework.

As Ecuador continues to navigate the landscape of AML regulations, initiatives aimed at combating money laundering are being actively pursued. By enhancing regulatory oversight and enforcement measures, Ecuador aims to bolster its anti-money laundering efforts and protect against financial crimes in the digital realm. The future outlook for Bitcoin compliance in Ecuador remains optimistic, with ongoing efforts to strike a balance between regulatory compliance and innovation within the cryptocurrency sector. Recommendations for enhancing AML practices are crucial in ensuring that the digital currency ecosystem evolves sustainably while mitigating the risks associated with illicit financial activities.

Challenges in Implementing Aml Measures 🤔

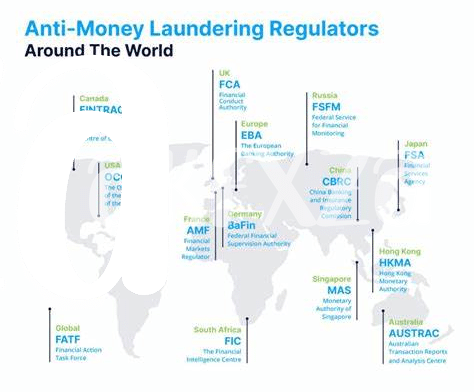

Ecuador faces several hurdles in implementing effective Anti-Money Laundering (AML) measures. One of the key challenges is the complexity of tracking and identifying illicit financial activities within the decentralized and pseudonymous nature of Bitcoin transactions. Additionally, the lack of standardized global AML regulations specific to cryptocurrencies further complicates enforcement efforts.

Despite the efforts to strengthen AML frameworks, the evolving nature of digital currencies presents ongoing challenges for authorities in detecting and preventing money laundering activities. The rapid pace of technological advancements in the crypto space also requires continuous monitoring and adaptation of AML measures to effectively combat illicit financial activities.

Initiatives Taken by Ecuador to Curb Money Laundering 💼

Ecuador has implemented various measures to combat money laundering, including enhancing oversight of financial institutions and promoting international cooperation. These initiatives involve increasing transparency in financial transactions, conducting thorough investigations into suspicious activities, and strengthening regulatory frameworks. By actively engaging in these actions, Ecuador aims to prevent the illicit flow of funds and safeguard its financial system from being exploited for criminal purposes. Through continuous efforts and collaboration with international partners, Ecuador is striving to uphold AML standards and ensure a more secure environment for financial transactions within the country. For more insights on global AML requirements for Bitcoin transactions, refer to the article on `bitcoin anti-money laundering (AML) regulations in Democratic Republic of the Congo`.

Future Outlook for Bitcoin Compliance in Ecuador 🚀

Ecuador’s vibrant cryptocurrency landscape hints at a promising future of increased Bitcoin compliance. With regulatory frameworks gradually evolving, the country is poised to embrace AML measures that enhance transparency and security within the crypto sphere. As Ecuador continues to navigate the complexities of cryptocurrency regulation, a proactive approach to compliance showcases a commitment to fostering a trustworthy environment for digital assets. The future outlook for Bitcoin compliance in Ecuador is one of potential growth and resilience, offering a beacon of hope for sustainable innovation and financial integrity.

Recommendations for Enhancing Aml Practices 🌟

To enhance AML practices in Ecuador, it is crucial to focus on continually updating regulatory frameworks to align with evolving financial technologies and money laundering techniques. Implementing robust KYC (Know Your Customer) procedures, transaction monitoring tools, and ongoing employee training programs are vital components in combating illicit activities within the Bitcoin ecosystem. Additionally, fostering greater collaboration between regulatory bodies, financial institutions, and cryptocurrency exchanges can facilitate the sharing of best practices and intelligence to strengthen AML compliance efforts.Embracing emerging technologies such as blockchain analytics and artificial intelligence tools can also provide valuable insights into suspicious transaction patterns and enhance the efficiency of AML monitoring and reporting processes. Stay updated on the latest Bitcoin anti-money laundering (AML) regulations in the Dominican Republic for further insights into regional AML compliance practices.