Understanding Uk’s Current Bitcoin Regulations 🌐

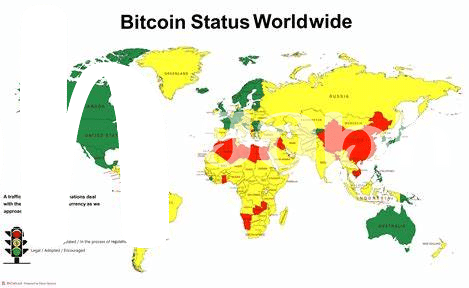

Understanding the current regulations surrounding Bitcoin in the UK involves navigating a complex landscape of guidelines set forth by financial authorities. The regulatory framework aims to balance consumer protection with promoting innovation in the digital currency space. While the UK does not consider Bitcoin as a legal form of tender, it does fall under the oversight of regulatory bodies. Individuals engaging in Bitcoin transactions must adhere to anti-money laundering regulations and report their activities as required by law. The evolving nature of cryptocurrency presents ongoing challenges for regulators in keeping pace with technological advancements and emerging trends in the market. Stay tuned to learn more about the intricacies of UK’s approach to Bitcoin regulation.

Impact of Recent Exchange Restrictions 🚫

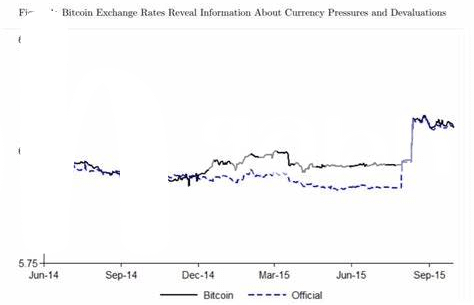

The recent exchange restrictions have caused a ripple effect in the UK’s Bitcoin community, prompting both concerns and adjustments. Users are facing challenges with limited options for trading and investing in cryptocurrencies, leading to a shift in their strategies. The impact of these restrictions extends beyond individual users to the broader cryptocurrency market, influencing trends and perceptions. As the landscape continues to evolve, navigating these changes requires a proactive approach and a keen understanding of the shifting regulatory environment.

Looking ahead, the resilience of the Bitcoin community in the UK will be tested as they adapt to the new normal. Innovations and alternatives may emerge as users explore diverse avenues for engaging with cryptocurrencies. Despite the challenges posed by the restrictions, there remains optimism and a sense of determination among users to overcome obstacles and thrive in the evolving digital economy.

Role of Government in Regulating Cryptocurrency 💼

The government plays a crucial role in shaping the regulatory landscape for cryptocurrencies in the UK. As the popularity of Bitcoin and other digital assets continues to grow, policymakers are faced with the challenge of balancing innovation and consumer protection. By establishing clear guidelines and frameworks, the government aims to create a safe and transparent environment for cryptocurrency users and businesses. Through collaboration with industry stakeholders and regulatory bodies, policymakers strive to address emerging risks and ensure the stability of the financial system in the face of digital disruptions.

Moreover, the government’s approach to regulating cryptocurrency reflects its commitment to fostering technological advancements while safeguarding against potential threats such as money laundering and fraud. By engaging with experts and monitoring market trends, regulatory authorities seek to adapt quickly to the evolving landscape of digital finance. Ultimately, the government’s involvement in regulating cryptocurrency underscores its role in promoting responsible innovation and maintaining trust in the financial sector.

Challenges Faced by Bitcoin Users in the Uk 🤔

Bitcoin users in the UK face a variety of challenges, ranging from security concerns to regulatory uncertainties. The lack of clear guidelines from authorities can make it difficult for users to navigate the landscape safely. Additionally, the volatility of the cryptocurrency market poses a risk to those investing in Bitcoin. Furthermore, issues such as hacking attacks on exchanges and the potential for fraud or scams add to the challenges faced by users. Despite these obstacles, many UK residents continue to show interest in and engage with Bitcoin, highlighting the need for improved education and protection within the industry. With the evolving nature of cryptocurrency regulations, users must stay informed and cautious when participating in the Bitcoin market. For more insights on how foreign exchange controls impacting Bitcoin are playing out globally, particularly in Tonga, check out this detailed analysis on foreign exchange controls affecting bitcoin in Tonga.

Future Outlook for Bitcoin in the Uk 💡

Bitcoin in the UK is poised for continued growth and evolution in the coming years. As the regulatory landscape becomes clearer and more defined, investors and users can expect increased stability and legitimacy in the market. With growing interest from institutional investors and the general public alike, the future outlook for Bitcoin in the UK is promising. The potential for mainstream adoption and acceptance of cryptocurrencies as a viable form of investment and payment method is on the horizon. As technology advances and awareness of the benefits of blockchain technology expands, Bitcoin is likely to become more integrated into the traditional financial system. Overall, the UK’s stance on Bitcoin is increasingly positive, signaling a shift towards embracing and regulating digital assets for the benefit of all stakeholders involved.

Tips for Navigating the Uk’s Bitcoin Landscape 💰

Navigating the UK’s Bitcoin landscape can be a maze of regulations and uncertainties, but there are actionable tips to help you steer through smoothly. Understanding the legal framework, staying updated on regulatory changes, and using reputable exchanges can safeguard your investments. Additionally, employing secure wallets, practicing proper risk management, and being wary of potential scams are crucial for a safe experience. Furthermore, seeking advice from financial professionals and joining supportive communities can provide valuable insights and help in making informed decisions. By staying informed, cautious, and proactive, you can navigate the evolving UK Bitcoin landscape with confidence and resilience.

Insert the hyperlink: foreign exchange controls affecting bitcoin in Trinidad and Tobago