Overview of Aml Requirements for Bitcoin Wallets 📋

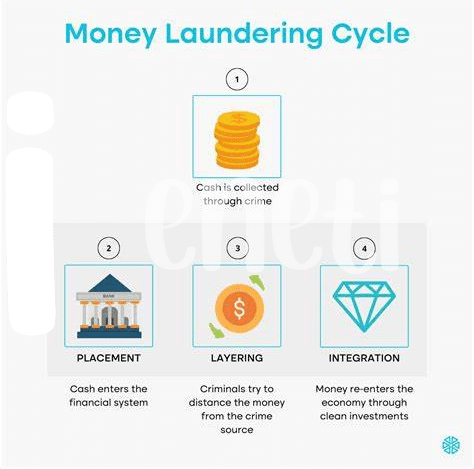

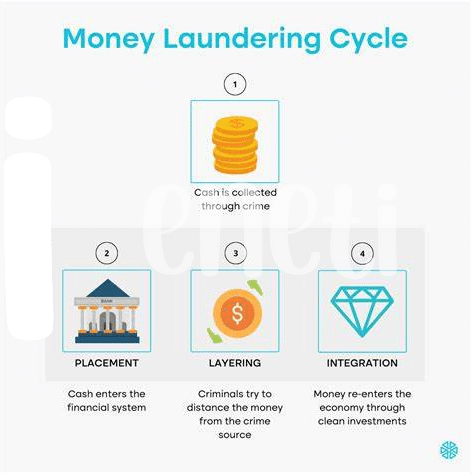

-AML requirements for Bitcoin wallets play a crucial role in maintaining the integrity and security of digital currency transactions. These requirements aim to prevent money laundering and terrorist financing by ensuring that providers adhere to strict guidelines and regulations. By understanding and complying with AML requirements, Bitcoin wallet providers contribute to a safer and more transparent financial ecosystem for users and regulators alike. Stay tuned to discover key regulations specific to Denmark and how they influence AML practices in the realm of digital currencies.

Key Regulations Specific to Denmark 🇩🇰

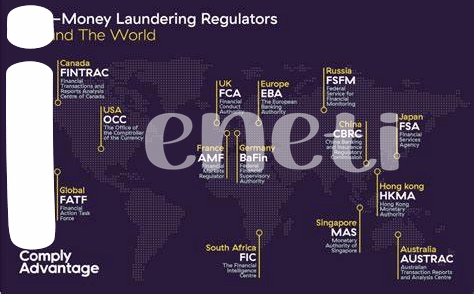

Danish authorities have established clear regulatory frameworks for Bitcoin wallet providers to adhere to. These regulations aim to promote transparency and combat financial crimes within the cryptocurrency space. For instance, Denmark requires virtual currency exchanges to register with the Danish Financial Supervisory Authority under the Anti-Money Laundering Act. Additionally, Bitcoin wallet providers must implement robust Know Your Customer (KYC) procedures to verify the identities of their users and monitor transactions for suspicious activities. These measures are crucial in safeguarding the integrity of the financial system and mitigating the risks associated with money laundering and terrorist financing. By complying with these key regulations, Bitcoin wallet providers can contribute to a more secure and trustworthy ecosystem for digital assets in Denmark.

It is essential for Bitcoin wallet providers operating in Denmark to stay informed about the evolving regulatory landscape and ensure full compliance with the country’s AML requirements. By prioritizing proactive measures such as customer due diligence, transaction monitoring, and timely reporting of suspicious activities, wallet providers can build trust with regulators and users alike. Embracing best practices in AML compliance not only helps in preventing illicit activities but also fosters a legitimate and sustainable environment for digital asset transactions in Denmark. As the cryptocurrency market continues to expand, adherence to these regulatory standards is paramount for the long-term success and credibility of Bitcoin wallet providers in the Danish market.

Understanding Customer Due Diligence Processes 🕵️♂️

Customer due diligence processes are essential for Bitcoin wallet providers in Denmark to combat money laundering and terrorist financing. By verifying the identity of their users and assessing the risk associated with each transaction, these processes help ensure compliance with regulatory requirements and protect the integrity of the financial system. Implementing thorough due diligence procedures not only strengthens the company’s defenses against illicit activities but also fosters trust and credibility among users.

Engaging in customer due diligence involves gathering and verifying information about users, monitoring transactions for suspicious activities, and assessing the overall risk level associated with each customer. This proactive approach enables Bitcoin wallet providers to detect, deter, and report any suspicious behavior, ultimately contributing to a more secure and compliant operating environment in Denmark.

Importance of Transaction Monitoring ⚙️

Have you ever wondered about the critical role that transaction monitoring plays in the world of Bitcoin wallet providers in Denmark? In the realm of compliance, ensuring that transactions are carefully monitored is paramount. It serves as a crucial mechanism to detect and prevent potential money laundering activities within the cryptocurrency sector, contributing to a safer and more secure financial environment for all users. By diligently implementing transaction monitoring processes, Bitcoin wallet providers can uphold regulatory standards and foster trust among their customers, reinforcing the integrity of the industry.

To delve deeper into the nuances of transaction monitoring and its significance in the context of Anti-Money Laundering (AML) regulations for Bitcoin, check out this insightful article on navigating compliance challenges in Djibouti: Bitcoin Anti-Money Laundering (AML) Regulations in El Salvador.

Reporting Obligations and Compliance Challenges 🚨

Navigating reporting obligations and compliance challenges can pose significant hurdles for Bitcoin wallet providers in Denmark. Ensuring adherence to regulatory requirements while managing the complexities of reporting can be intricate. Identifying and addressing potential compliance gaps, staying updated with evolving regulations, and establishing robust internal controls are essential aspects of meeting reporting obligations effectively. Moreover, understanding the nuances of compliance challenges such as determining thresholds for reporting, handling suspicious activities, and managing data privacy concerns are crucial for maintaining a compliant operation in the dynamic landscape of cryptocurrency regulations in Denmark.

Best Practices for Aml Compliance in Denmark 🏆

When it comes to navigating Anti-Money Laundering (AML) compliance in Denmark, it’s crucial for Bitcoin wallet providers to adopt best practices to uphold regulatory standards and maintain trust with customers. Implementing robust Know Your Customer (KYC) procedures tailored to Danish requirements is a cornerstone of compliance efforts. Conducting thorough due diligence on users, including verifying their identities and monitoring their transactions, helps mitigate risks and prevent illicit activities within the cryptocurrency space. Moreover, ensuring that all transactions are monitored continuously and suspicious activities are promptly flagged enhances the overall integrity of AML frameworks.

To further enhance AML compliance in Denmark, it’s essential for Bitcoin wallet providers to stay updated on regulatory changes and proactively adjust their processes to align with evolving standards. Collaborating with relevant authorities and industry peers can also provide valuable insights and support in navigating complex compliance landscapes. By fostering a culture of transparency and education within their organizations, Bitcoin wallet providers can not only meet regulatory requirements but also contribute to a more secure and trustworthy cryptocurrency ecosystem.