Understanding the Basics of Aml Regulations 🧐

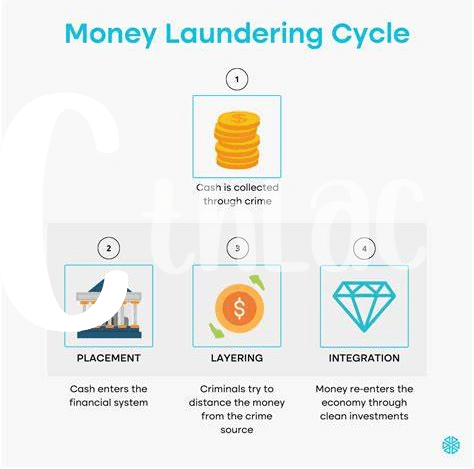

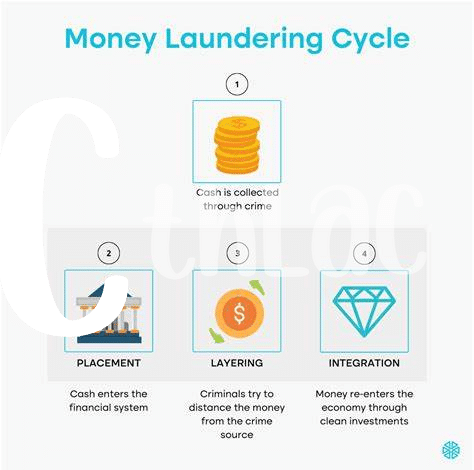

AML regulations are like a set of rules to make sure that people who deal with Bitcoin follow certain guidelines. It’s all about keeping an eye out for any suspicious activity, like when someone tries to use Bitcoin for things that might not be legal. These regulations are put in place to protect everyone involved and to make sure everything is done safely and securely. Think of it as a way to make sure that Bitcoin transactions are done in a responsible and trustworthy manner. Understanding these basic rules is important for anyone looking to get involved with Bitcoin, as it helps create a safer environment for everyone using it.

Key Aml Requirements for Bitcoin Transactions 🔒

When it comes to engaging in Bitcoin transactions, understanding and adhering to the Anti-Money Laundering (AML) requirements is essential. These regulations are put in place to safeguard against illicit activities and ensure transparency within the cryptocurrency space. One of the main AML requirements for Bitcoin transactions entails verifying the identities of the parties involved and monitoring transactions for suspicious activities. Additionally, implementing robust Know Your Customer (KYC) procedures and keeping detailed records of transactions are crucial aspects of complying with AML regulations in Dominica.

To stay in line with these requirements, individuals and businesses dealing with Bitcoin transactions in Dominica must stay informed about the evolving AML landscape and continuously update their compliance measures. By integrating effective AML tools and technologies, such as blockchain analytics and transaction monitoring systems, stakeholders can enhance their ability to detect and prevent money laundering activities. Taking a proactive approach to AML compliance not only mitigates risks but also fosters trust and credibility within the cryptocurrency ecosystem.

Challenges in Compliance with Aml Laws 🤔

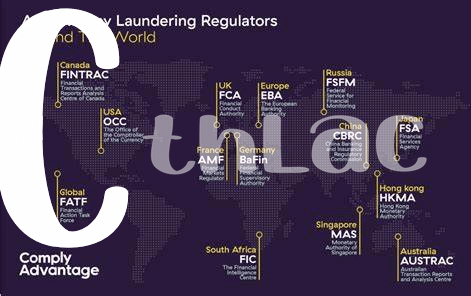

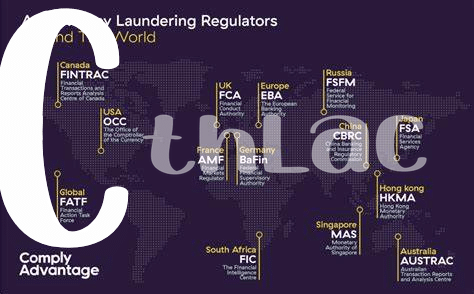

Navigating the landscape of AML laws poses a significant challenge for individuals engaging in Bitcoin transactions. The decentralized nature of cryptocurrencies adds a layer of complexity to compliance efforts, with the pseudonymous nature of Bitcoin transactions making it difficult to trace and monitor for illicit activities. Additionally, the global nature of the digital asset means that regulations can vary widely across jurisdictions, further complicating efforts to stay compliant. As regulatory bodies strive to keep pace with the rapid evolution of the cryptocurrency space, individuals and businesses must proactively adapt their AML practices to mitigate risks and ensure adherence to changing requirements.

Impact of Aml Regulations on Bitcoin Users 💸

Bitcoin users in Dominica are feeling the impact of AML regulations, as compliance requirements continue to shape their transactions. The stringent measures aimed at preventing money laundering and terrorist financing have added an extra layer of verification and reporting for individuals engaging in Bitcoin activities. This has led to increased scrutiny and sometimes delays in processing transactions, affecting the user experience and convenience of utilizing the cryptocurrency. As users navigate these challenges, maintaining compliance with AML laws becomes crucial to ensure the legitimacy and security of their Bitcoin transactions in Dominica. For more insights on AML compliance procedures for Bitcoin exchanges, check out this comprehensive guide on bitcoin anti-money laundering (AML) regulations in the Czech Republic.

Strategies for Ensuring Aml Compliance 🛡️

Strategies for Ensuring Aml Compliance involve implementing robust identification processes, monitoring transactions for suspicious activities, and conducting regular audits to uphold regulatory standards. Utilizing advanced blockchain analytics tools can enhance compliance efforts, while collaborating with industry peers and regulators can provide valuable insights for staying ahead of evolving AML requirements. Additionally, educating staff on AML best practices and fostering a culture of compliance within the organization are crucial components of a comprehensive strategy. By continuously adapting to regulatory changes and investing in technology, businesses can mitigate risks and maintain trust in their Bitcoin transactions.

Future Trends in Aml Oversight for Cryptocurrency 🚀

The landscape of AML oversight for cryptocurrency is constantly evolving, with regulatory bodies worldwide stepping up efforts to combat financial crimes within the digital asset space. As more countries recognize the need for robust AML regulations in the realm of Bitcoin and other cryptocurrencies, we can expect to see increased collaboration between authorities, exchanges, and other stakeholders to ensure compliance and mitigate risks. This trend towards greater scrutiny and enforcement signifies a maturing industry striving for transparency and security. For more information on Bitcoin AML regulations in Costa Rica, refer to the bitcoin anti-money laundering (aml) regulations in Costa Rica.