Understanding Aml and Its Impact on Bitcoin 💡

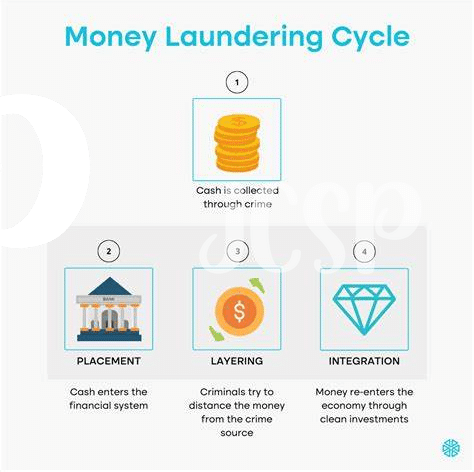

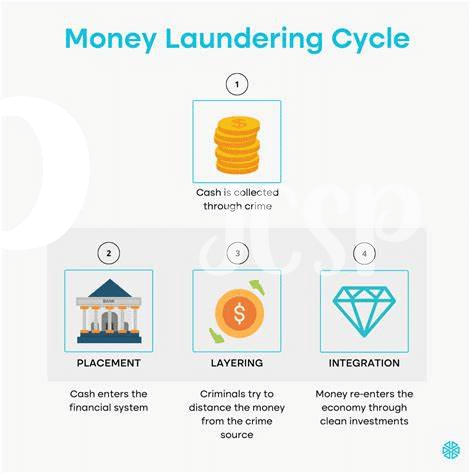

AML, or Anti-Money Laundering, regulations play a crucial role in the world of Bitcoin transactions. Understanding the implications of AML on Bitcoin is vital for users to navigate the regulatory landscape effectively. AML regulations are designed to prevent money laundering and illicit activities, ensuring transparency and compliance within the digital currency space. The impact of these regulations on Bitcoin transactions can affect the way individuals and businesses interact with cryptocurrencies. By comprehending AML requirements, users can better safeguard themselves and contribute to a more secure and trustworthy environment for conducting Bitcoin transactions.

Key Aml Regulations Affecting Bitcoin in Trinidad 📜

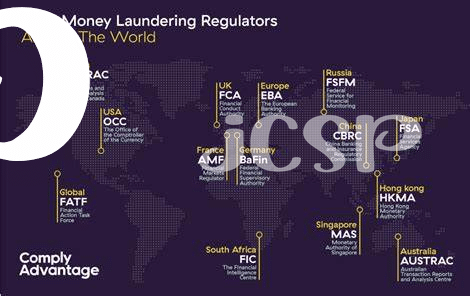

When it comes to the regulatory landscape affecting Bitcoin in Trinidad, there are several key AML (Anti-Money Laundering) regulations that play a crucial role in shaping the environment for cryptocurrency transactions. Understanding and complying with these regulations is essential for individuals and businesses engaging in Bitcoin-related activities in Trinidad. From customer due diligence requirements to transaction monitoring and reporting obligations, these regulations aim to prevent illicit activities and ensure transparency within the digital currency space. Being aware of and adhering to these AML regulations is not only a legal requirement but also a way to foster trust and credibility in the evolving landscape of Bitcoin transactions in Trinidad. 📜

Navigating the intricacies of AML regulations can be challenging, especially for those new to the cryptocurrency space. However, by staying informed about the regulatory developments and implementing best practices for compliance, Bitcoin users can mitigate risks and operate with confidence in the regulatory framework. Education, proactive risk management, and collaboration with regulatory bodies are key components to successfully navigating the AML landscape in the context of Bitcoin transactions in Trinidad. By building a strong compliance foundation, individuals and businesses can contribute to the legitimacy and sustainability of Bitcoin usage in the region. 🚀

Compliance Challenges Faced by Bitcoin Users 🤯

Bitcoin users in Trinidad encounter various hurdles when it comes to complying with regulations. Navigating the complex landscape of Anti-Money Laundering (AML) requirements poses a significant challenge, especially for individuals unfamiliar with the legal framework. Lack of clarity on reporting obligations and identifying suspicious activities adds to the confusion. Additionally, the evolving nature of AML regulations necessitates regular updates and adjustments, further complicating compliance efforts for Bitcoin users in Trinidad.

As these users strive to uphold AML standards, they also grapple with limited resources and expertise, making it difficult to ensure full compliance. Heightened scrutiny from regulatory authorities underscores the importance of maintaining detailed records and implementing robust monitoring mechanisms. The decentralized and pseudonymous nature of Bitcoin transactions amplifies the compliance burden, as users must navigate the fine line between privacy and regulatory requirements to avoid potential penalties and legal ramifications.

Impact of Aml Regulations on Bitcoin Transactions 💸

The aim of AML regulations on Bitcoin transactions is to enhance transparency and security within the digital currency realm. These regulations impose certain requirements and obligations on individuals and businesses engaging in Bitcoin activities to prevent money laundering and terrorist financing activities. By complying with these regulations, Bitcoin transactions can become more trustworthy and attract wider adoption among the public. However, it is essential for users to be aware of the potential challenges and impacts associated with AML regulations in order to navigate the evolving regulatory landscape effectively. Engaging in best practices and staying informed about the latest AML trends in the Bitcoin space can help users adapt and thrive in a compliant manner. For more insights on navigating the legal landscape of AML regulations for Bitcoin in Taiwan, you can visit [bitcoin anti-money laundering (AML) regulations in Taiwan](https://wikicrypto.news/navigating-the-legal-landscape-aml-regulations-for-bitcoin-in-switzerland).

Best Practices for Navigating Aml Regulations 🛡️

Navigating anti-money laundering regulations can be daunting for Bitcoin users in Trinidad. To ensure compliance without hindering transactions, it is essential to stay updated on the evolving AML landscape. Implementing robust Know Your Customer (KYC) processes, conducting thorough due diligence on counterparties, and employing industry-standard transaction monitoring tools are pivotal. Regularly reviewing and enhancing internal AML policies and procedures, along with fostering a culture of compliance within the organization, are also crucial. Collaboration with regulatory bodies and industry peers can provide insights into best practices and emerging trends, facilitating a proactive approach to AML compliance. By adopting these strategies, Bitcoin users can navigate the intricate regulatory environment effectively while safeguarding their transactions and reputation in the cryptocurrency space.

Future Outlook: Aml Trends in Bitcoin Space 🔮

In the ever-evolving landscape of Bitcoin transactions, staying abreast of the latest Anti-Money Laundering (AML) trends is crucial for both users and regulators. As we look to the future, increased global collaboration and technology advancements are expected to shape AML regulations in the Bitcoin space. This includes the development of more sophisticated monitoring tools and a stronger focus on compliance across borders. To learn more about how different countries are approaching Bitcoin AML regulations, explore the dynamic landscape of Bitcoin Anti-Money Laundering (AML) regulations in Tajikistan and Switzerland.