What Makes Bitcoin Tick? Understanding Basics 🚀

Bitcoin is like a digital form of money, but it’s special because it doesn’t rely on banks or governments to make it work. Imagine you have a unique, digital coin in your virtual wallet that you can send to anyone, anywhere, without needing a middleman. This is made possible by technology called blockchain, which is like a ledger that records all transactions securely and transparently. Each time someone sends or receives Bitcoin, the details are added to this ledger, ensuring that every coin can be traced back to its origins.

The magic behind Bitcoin relies on a network of computers solving complex puzzles. This process, known as mining, not only helps to add new transactions to the blockchain but also creates new Bitcoins as a reward for the miners. The combination of these innovative ideas means Bitcoin operates on a peer-to-peer network, free from central control, making it incredibly appealing to those who value privacy and freedom in their financial transactions.

| Feature | Description |

|---|---|

| Blockchain | A digital ledger that records all Bitcoin transactions. |

| Mining | The process of validating transactions and securing the network, which also generates new Bitcoins. |

| Peer-to-Peer Network | A decentralized network that allows users to interact directly without the need for intermediaries. |

Why Do Transaction Fees Fluctuate So Much? ⚖️

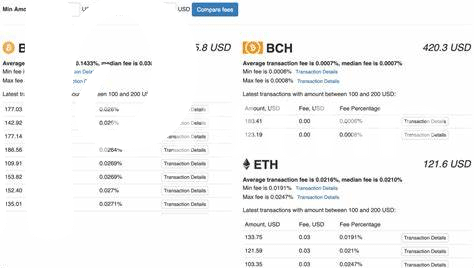

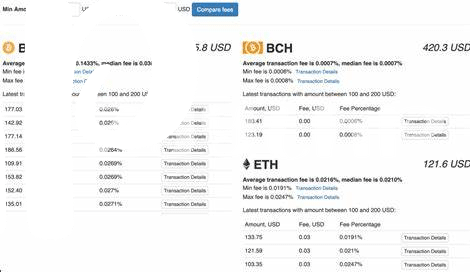

Ever wonder why sometimes sending Bitcoin feels like a bargain and other times, it feels like you’re giving away a tiny treasure? It’s all about demand and space. Imagine Bitcoin transactions as a bunch of letters that need to go on a trip via a single train that runs at intervals. When there are lots of letters (a.k.a. transactions) waiting to board, the train (or miners, in Bitcoin language) can only take so many. This is where bidding wars begin. People start offering more to ensure their letter gets on the next train, driving up the transaction fees. It’s like bidding for limited seats on a flight during peak season. But it’s not all doom and gloom; understanding this ebb and flow can offer insights on when to send transactions more economically. For more in-depth exploration on navigating these dynamics, especially with emerging solutions like the Lightning Network, head to https://wikicrypto.news/navigating-risks-investing-in-bitcoin-through-defi-in-2024. This dance of supply and demand, coupled with the choices miners make on which transactions to confirm first, paints the ever-changing landscape of Bitcoin transaction fees.

The Role of Network Traffic in Fees 🚦

Imagine a busy highway, where cars represent Bitcoin transactions waiting to get to their destinations. Now, the more cars on this highway, the busier it gets, right? This is pretty much what happens with Bitcoin transactions. When there’s a lot of traffic, or many people trying to make transactions at the same time, it gets crowded. Miners, who verify these transactions, can only add so many to a block (think of it as a bus that can only carry so many passengers). So, when traffic is high, these miners prioritize transactions with higher fees because they get a reward for their hard work. It’s a bit like tipping for faster service. Therefore, when there’s a digital traffic jam, those who pay more, move faster. This situation creates a dynamic where the fees can go up or down, much like the price of a plane ticket during holiday seasons versus a regular day. Understanding this can help us navigate the network more smoothly, ensuring our transactions don’t get stuck in the backlog. 🚦🔄💸

Mining: Not Just for Gold, but for Bitcoins Too ⛏️

Mining in the Bitcoin world is quite the adventure, not involving pickaxes or canaries in coal mines, but computers solving complex puzzles. Picture this: a global race where miners compete not just for the thrill, but for a reward – Bitcoin. This digital form of mining plays a crucial role in processing transactions and adding them to the blockchain, akin to a ledger in the digital age. However, it’s not just about maintaining the network; it also influences transaction fees. When miners prioritize transactions offering higher fees, it creates a competitive environment, especially during peak times. Understanding this dynamic is essential, especially when considering the future of digital transactions and their costs. For a deeper dive into how Bitcoin, and crucially, its transaction fees, are set to evolve, especially in the light of global events, check out bitcoin and payment channels in 2024. It’s a fascinating insight into how technology and economics entwine in the ever-evolving world of cryptocurrency.

How Your Wallet Choice Influences Fees 💼

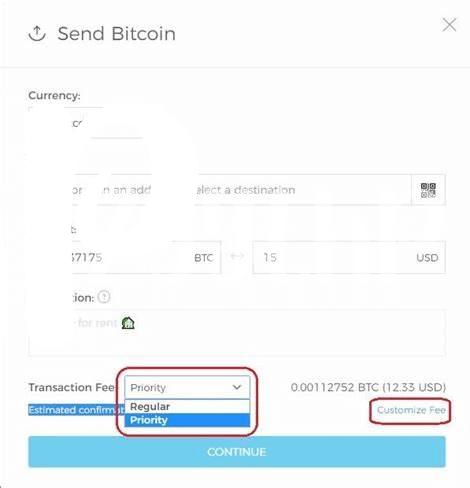

When you think about sending money to a friend using Bitcoin, the digital wallet you pick plays a surprisingly big role in how much you pay to make that transaction. Imagine your wallet as a sort of digital gatekeeper. Some of these gatekeepers are super efficient, finding you the cheapest way to send your Bitcoin, kind of like a smart travel agent finding you the best flight deals. Others might not be as savvy, or they might prioritize speed over savings, potentially leading to higher fees. The secret sauce? Some wallets give you the power to adjust the fee you’re willing to pay, a bit like bidding at an auction, where you decide how fast you want your transaction to be processed based on how much you’re willing to pay. Wallets can also differ in how they estimate the required fee, with some using more sophisticated methods to ensure your transaction doesn’t cost you an arm and a leg. Here’s a quick glance at how choosing the right wallet can impact your fees:

| Wallet Feature | Impact on Fees |

|---|---|

| Fee Adjustment Capability | Lets you choose lower fees but slower transactions, or vice versa for urgency. |

| Fee Estimation Technology | Smarter wallets can find optimal fees for a balance of speed and cost. |

| Type of Wallet (Custodial vs. Non-Custodial) | Non-custodial wallets often offer more control over fees compared to custodial ones. |

Choosing wisely can mean the difference between paying more than you should and saving those extra bits for your next transaction. So, diving a little into the tech and preferences behind your digital wallet’s curtain is definitely worth the savvy spender’s time.

Smart Tips to Minimize Your Transaction Costs 💡

Navigating the world of Bitcoin transactions doesn’t have to leave your digital wallet feeling light. Did you know that with a bit of savvy, you can actually reduce the fees you pay on each transaction? 🧐 It’s like finding a secret shortcut in a maze. First off, being patient can pay off. If you’re not in a rush, choosing a lower fee and waiting a bit longer for your transaction to be processed can save you money. It’s a bit like avoiding the express shipping option when buying online. Additionally, keeping an eye on the network traffic can help you time your transactions when it’s less busy, potentially lowering fees. 🕓

Another clever trick involves using a wallet that lets you customize transaction fees. Think of it as being able to choose a less expensive route for your journey. Some wallets give you the power to adjust fees based on how quickly you need your transaction to be completed. Also, exploring the vibrant world of bitcoin and international sanctions in 2024 can provide deeper insights into optimizing your transactions, ensuring you get the most bang for your Bitcoin buck. By arming yourself with these strategies, you can keep more of your money where it belongs – in your wallet! 🚀💸