Unveiling the World of Cryptocurrency and Sanctions 🌍

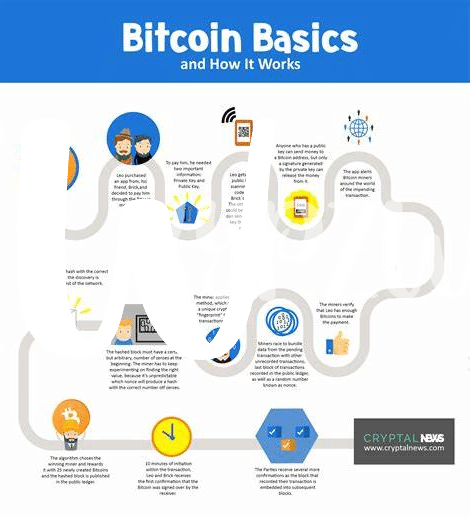

Imagine a world where digital money changes hands as easily as ideas flow across borders. That’s the essence of cryptocurrency – a type of money that exists only in the virtual realm, offering a new way to think about buying and selling. On the other side is the traditional power of nations to impose sanctions, a way to restrict or control what other countries can do by limiting their access to money, resources, or trade. These sanctions are like the rules of the road, designed to keep international behavior in check. Yet, as the digital wave of cryptocurrency swells, it challenges these old rules, creating a fascinating tug-of-war. It’s a battle between the established ways of holding countries accountable and the new paths that cryptocurrencies blaze, promising a journey filled with financial freedom but also unknowns. As cryptocurrencies grow in popularity, they present an enticing route for countries under sanctions to sidestep financial barriers, reshaping how international policies and economics intertwine.

| Concept | Description |

|---|---|

| Cryptocurrency | Digital or virtual money, using cryptography for security, making it difficult to counterfeit. |

| Sanctions | Restrictive measures taken by countries to control or penalize others, affecting trade, economy, and diplomacy. |

How Sanctions Drive Countries Towards Cryptocurrencies 💼

Sanctions from big players on the global stage can corner countries, pushing them into a tight spot. It’s like getting a time-out in the big, interconnected playground of international finance. But here’s where it gets interesting – cryptocurrencies offer a secret tunnel out of that corner. Imagine having a magic door that lets you escape the time-out chair unnoticed. That’s what countries under sanctions are finding in cryptocurrencies. They’re turning to digital currencies as a kind of invisible ink, making financial transactions without leaving the usual trace that dollars, euros, or yen would.

This shift towards cryptocurrencies isn’t just a clever dodge; it’s reshaping how money moves around the world. For these countries, it means they can keep buying what they need and selling what they make, all while flying under the radar of sanctions. Not only does this keep their economies afloat, but it also poses a big question mark on the effectiveness of traditional sanctions in the digital age. In a world where financial transactions can happen in the shadowy corners of the internet, the old rules of economic punishment start to blur. It is like playing a game of cat and mouse, but now the mouse has a jetpack. For more insights on the evolving landscape of cryptocurrency, check out how even Bitcoin is seeing changes with new versions called ‘forks’ https://wikicrypto.news/securing-your-bitcoin-wallet-quantum-computing-risks.

The Cryptocurrency Loophole: Evading Economic Barriers 🚪

Imagine a world where traditional money rules don’t apply, where countries facing tough restrictions from others find a new playground. This is where digital currencies, which many know as Bitcoin, Ethereum, and others, come into the picture. They offer a secret path for these countries to buy and sell globally without being caught by traditional barriers set by these sanctions. It’s like playing a game where some roads are blocked, but then you find a hidden path that allows you to keep going.

The impact of this move is big, not just for the countries using this trick, but for the whole money world. By stepping into the digital currency zone, they manage to keep their economies afloat and continue trading on a global scale. It raises a lot of eyebrows because it challenges the way traditional sanctions are supposed to work. It’s a bit like a game of cat and mouse, where the rules are constantly changing, and everyone is trying to stay one step ahead. 🕹️💸🌐

The Ripple Effect on Global Finance 🌊

Imagine a world where money moves like waves, freely crossing borders without the usual barriers. This vision is becoming a reality thanks to cryptocurrencies, which are shaking up global finance in surprising ways. As countries face economic sanctions, they often look for alternative routes to keep their finances flowing. Here, cryptocurrencies emerge as a handy tool, allowing them to bypass traditional financial systems that are heavily monitored and controlled. This shift is causing a stir among global financial leaders, who are used to calling the shots. The move towards digital currencies is not just about evading sanctions; it’s sparking a broader change, challenging the conventional norms of international trade and finance. As these digital coins gain popularity, they’re urging banks, businesses, and governments to rethink how money is transferred around the world. This transformation could lead to a more inclusive financial system, where access to funds is based on Internet connectivity rather than nationality or social status. For those intrigued by how cryptocurrencies can reshape our financial future, exploring bitcoin forks and their impact for beginners could provide valuable insights into the evolving landscape.

International Reactions and Policies on Crypto-usage 📜

As the world becomes more connected, countries have taken different paths in reacting to the growth of digital money. Some see it as a threat to traditional financial systems and have set up strict rules to control its use. Others view it as an opportunity to boost their economy, encouraging innovation with open arms. This global patchwork of policies highlights the struggle to balance national security concerns with the potential benefits of embracing technological progress. For instance, nations under economic sanctions see cryptocurrencies as a lifeline, offering a way to participate in global commerce outside the reach of traditional financial controls. Meanwhile, economic powerhouses aim to curb its usage, fearing the loss of control over monetary policies and potential illegal activities. This divergence in approaches underscores the complexity of governing a borderless digital currency in a world of sovereign borders.

| Country | Approach to Cryptocurrency | Key Policies |

|---|---|---|

| USA | Regulatory | License requirements for exchanges, SEC oversight on investments |

| China | Restrictive | Ban on crypto exchanges and ICOs |

| Japan | Encouraging | Legal framework for crypto, fostering innovation |

| Switzerland | Progressive | “Crypto Valley” initiative, supportive legal environment |

Shaping the Future: Cryptocurrency Vs. Sanctions 🔮

As we step into the future, the tug-of-war between digital currencies and international regulations could redefine global finance. Imagine a world where the boundaries imposed by sanctions start to blur, thanks to the innovative nature of cryptocurrencies. These digital assets could serve as a beacon of hope for countries under economic pressure, offering them a doorway to participate in global trade without the traditional barriers. This shift may not happen overnight, but the seeds are being sown today. With every leap in technology, the scales could tip slightly in favor of digital currency, promising a future where financial interactions are more inclusive and free from the grasp of sanctions.

However, this change also calls for a dance of diplomacy and strategy. Countries and international bodies are already reacting, crafting policies to either harness or control the tide of cryptocurrencies. As these discussions evolve, so does the landscape of global finance. For anyone curious about diving deeper into this evolving world, especially the intriguing interplay between cutting-edge technologies like bitcoin community projects for beginners offers a fascinating starting point. It’s a glimpse into how the future may unfold, where the balance between control and innovation will shape the paths countries can take in the global economy. As we move forward, the story of cryptocurrencies and sanctions will undoubtedly be one of transformation and adaptation, heralding a new era of economic engagement across the globe. 🌐🔍💡