Introduction to Bitcoin in Congo-brazzaville 🌍

Bitcoin has been steadily gaining popularity in Congo-brazzaville, offering a decentralized alternative to traditional currency systems. This digital currency provides opportunities for financial inclusion and innovation, allowing individuals to engage in borderless transactions. As more people in Congo-brazzaville become aware of Bitcoin’s potential, the cryptocurrency is shaping a new narrative in the country’s financial landscape. Its decentralized nature and potential for growth are attracting interest and curiosity among both enthusiasts and policymakers.

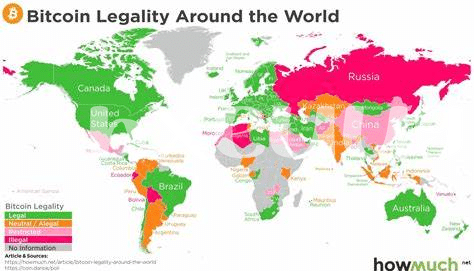

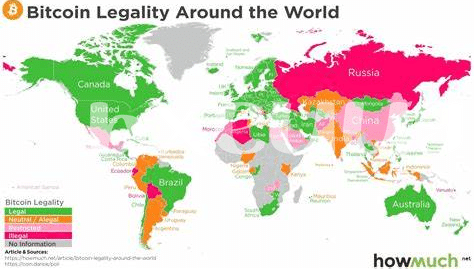

Legal Status of Bitcoin in the Country 📜

Bitcoin operates in a legal gray area within Congo-Brazzaville, with no specific regulations in place to address its status. This lack of clarity poses challenges for users and businesses looking to engage in Bitcoin-related activities. While the government has not explicitly banned or endorsed Bitcoin, the absence of clear guidelines creates uncertainty for investors and consumers alike.

The ambiguous regulatory environment surrounding Bitcoin in Congo-Brazzaville underscores the need for comprehensive legislation to provide clarity and protection for stakeholders. Without a clear legal framework, the potential risks associated with using Bitcoin in the country remain significant, highlighting the importance of regulatory oversight to safeguard the interests of users and ensure the stable development of the cryptocurrency market.

Impact on Economy and Financial Landscape 💰

Since the arrival of Bitcoin in Congo-brazzaville, there has been a noticeable shift in the financial landscape and economy. The decentralized nature of this digital currency has opened up new opportunities for the unbanked population to participate in financial transactions. Small businesses, in particular, have embraced Bitcoin as a means for cross-border trade and remittances, leading to increased economic activity. Additionally, the transparency and security features of Bitcoin have instilled confidence among users, fostering a more robust financial ecosystem in the country.

Potential Risks and Challenges for Users ⚠️

Bitcoin adoption in Congo-brazzaville brings exciting opportunities for users, but it also comes with potential risks and challenges to navigate. Security concerns, such as hacking and theft, loom large in the cryptocurrency space, emphasizing the importance of robust safeguards and protective measures for users. Moreover, the volatile nature of Bitcoin prices poses a risk for investors, warranting careful consideration and strategic decision-making to mitigate financial uncertainties. As users navigate these challenges, staying informed and adopting best practices can help safeguard their investments and ensure a positive experience in the evolving crypto landscape.

Is Bitcoin recognized as legal tender in Cabo Verde?

Government Regulations and Future Outlook 🏛️

In the context of Congo-brazzaville, the future outlook for Bitcoin remains dynamic. As the government adapts to the evolving digital landscape, potential regulations may offer both clarity and challenges for users navigating the cryptocurrency sphere. The balance between promoting innovation and ensuring financial security will be crucial in shaping the regulatory framework. The collaborative efforts of policymakers, financial institutions, and the tech community will play a key role in determining the feasibility and acceptance of Bitcoin within the country. Looking ahead, a proactive approach that integrates technological advancements with regulatory oversight could pave the way for a sustainable and secure environment for Bitcoin enthusiasts in Congo-brazzaville.

Conclusion and Recommendations for Bitcoin Enthusiasts ✨

In the realm of Bitcoin in Congo-brazzaville, enthusiasts are urged to stay informed of the evolving landscape and regulatory developments. Embracing technological advancements while also being cautious of potential risks is key for all users. It is recommended for enthusiasts to engage in dialogues with regulators to ensure compliance and to advocate for a balanced approach toward cryptocurrency integration within the economy. Additionally, fostering education and awareness initiatives can help cultivate a supportive environment for Bitcoin adoption in the country.