Legal Status of Bitcoin Banking Services 📜

Bitcoin banking services in Australia are currently navigating a complex legal landscape that continues to evolve. As regulators grapple with defining the status of cryptocurrencies within existing laws, uncertainty surrounds the future of these financial services. Despite challenges, innovative approaches are emerging to address regulatory ambiguities and enhance the legitimacy of Bitcoin banking operations in the country. The legal framework plays a pivotal role in shaping the trajectory of digital currency adoption within the traditional banking sector in Australia.

Regulatory Challenges and Compliance Requirements 🚧

In navigating the realm of Bitcoin banking services in Australia, businesses face a landscape dotted with regulatory hurdles and compliance demands. The ever-evolving nature of regulations requires a keen understanding and proactive approach to ensure adherence to established frameworks. From anti-money laundering protocols to data privacy laws, staying compliant presents a continuous challenge that necessitates vigilance and adaptability in the face of evolving standards. Failure to meet these requirements not only poses operational risks but also threatens the credibility and sustainability of Bitcoin banking ventures in Australia and beyond.

Efforts to address regulatory challenges and compliance requirements are paramount for the long-term viability and growth of Bitcoin banking services. Embracing a proactive stance towards compliance not only shields businesses from legal repercussions but also fosters trust among stakeholders, paving the way for sustainable expansion and innovation within the sector. As the regulatory landscape continues to evolve, maintaining a robust compliance framework remains a cornerstone for establishing credibility and operational resilience within the burgeoning realm of Bitcoin banking services in Australia.

Consumer Protection and Security Measures 🔒

Consumer protection in the realm of Bitcoin banking is paramount, ensuring that users are shielded from potential risks and fraudulent activities. Security measures play a crucial role in safeguarding assets and personal information, mitigating the vulnerability to cyber threats. It is essential for Bitcoin banking services to prioritize robust encryption techniques, multi-factor authentication, and real-time monitoring to uphold trust and confidence among consumers. A proactive approach towards security not only fortifies the platform but also fosters a safe and resilient ecosystem for users to engage with cryptocurrencies securely.

Impact of Tax Laws on Cryptocurrency Transactions 💸

Tax laws have a significant impact on cryptocurrency transactions, influencing aspects like capital gains and losses, reporting requirements, and classification of digital assets. Understanding and adhering to these laws is crucial for individuals and businesses engaged in Bitcoin banking services to stay compliant and avoid legal consequences. The evolving nature of tax regulations in the cryptocurrency space adds complexity to financial planning and transaction structuring, requiring ongoing vigilance and adaptation to ensure smooth operations within the legal framework.

bitcoin banking services regulations in BangladeshInnovation and Future Prospects for Bitcoin Banking 🌟

Bitcoin banking services are continually evolving, with a strong focus on innovation and future growth opportunities. The integration of new technologies and financial instruments is expected to enhance user experience and accessibility. Exciting developments such as decentralized finance (DeFi) and blockchain interoperability are set to reshape the landscape of Bitcoin banking, offering greater efficiency and transparency for users. These advancements signal a promising future for the industry, driving increased adoption and mainstream acceptance.

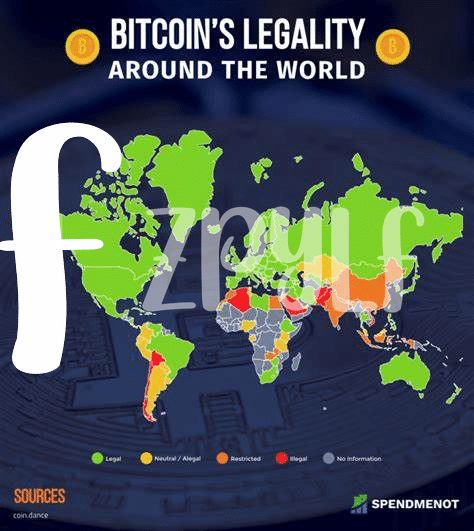

Comparison with Global Trends in Crypto Banking 🌏

Global trends in crypto banking are evolving rapidly, with various countries implementing diverse regulatory frameworks and approaches. In some regions, like Asia and Europe, cryptocurrency-friendly policies are being adopted to encourage innovation and investment in digital assets. For instance, nations like Singapore and Switzerland have become hubs for crypto banking, offering a conducive environment for startups and established companies alike to flourish. On the other hand, some countries are still grappling with the regulatory challenges and uncertainties surrounding cryptocurrencies, leading to a fragmented landscape in the global crypto banking sector.

To learn more about bitcoin banking services regulations in Bahrain, visit bitcoin banking services regulations in Andorra.