🌐 Exploring the World of Public Ledgers

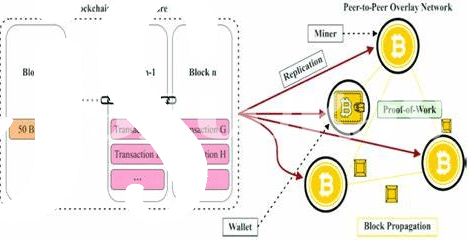

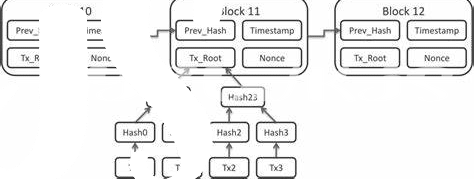

Imagine a giant, digital book where anyone in the world can write down who owns what, like making a mark that says, “I gave you a piece of my digital pie.” This book is out there for everyone to see, but no one can erase or change what’s been written without the nod of the whole group. That’s the essence of public ledgers. They are the heart of cryptocurrencies like Bitcoin, acting as the transparent and trustworthy backbone keeping track of every transaction. Picture sending a digital coin to a friend. That transaction gets recorded in this big book, timestamped, and secured by some really smart math, so it’s safe and sound for everyone to see but not tamper with. It’s kind of like posting on a social media wall that can’t be edited, only this wall is used for tracking who owns what digital coins. Here’s a simple breakdown of what makes up these ledgers:

| Component | Role |

|---|---|

| Transactions | Acts like a diary entry of who sent what to whom |

| Blocks | A collection of transactions bundled together |

| Blockchain | The chain of all blocks, creating the ledger |

With this foundation, public ledgers not only keep an eye on our digital transactions but also open the door to a world where our financial dealings are transparent, immediate, and more secure than ever before.

🔍 How Public Ledgers Fuel Bitcoin’s Transparency

Imagine a world where every transaction you make is recorded in a big open book that anyone can read, but still, your name stays secret. This is what happens with Bitcoin thanks to its public ledger, also called the blockchain. Each time someone buys, sells, or moves their Bitcoin, that action is added to this book. It’s like a never-ending list that ensures everyone can see what’s going on without revealing who’s behind each transaction. This openness is why we trust Bitcoin – it’s like having a transparent bank vault that everyone can check anytime to make sure nothing fishy is happening. To delve deeper into how Bitcoin continues to revolutionize transparency and privacy in financial transactions, you might find it enlightening to explore https://wikicrypto.news/mastering-compliance-a-guide-to-bitcoin-lending-regulations, which offers a comprehensive view on navigating this innovative landscape.

💸 the Transaction Journey on Bitcoin’s Ledger

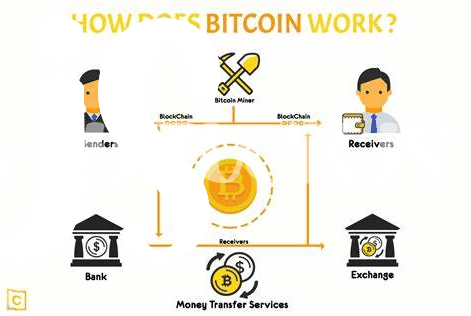

Imagine you want to send a friend some Bitcoin—a digital version of handing over cash, but instead of a physical exchange, it’s all done online. This transaction gets jotted down in a special book that everyone can see, called the public ledger. First, you tell the network, “Hey, I want to send some Bitcoin to my friend”. The network takes note, checking you really have the Bitcoin you want to send. Once it’s sure you’re not trying to spend money you don’t have, your transaction gets put in a line with others, waiting to be finalized.

Now, here’s where it gets interesting. Special users on the network, called miners, pick up your transaction and others. They use powerful computers to solve complex puzzles that seal your transaction into the ledger. This process ensures that once your transaction is recorded, it’s set in stone, proving the Bitcoin moved from you to your friend. Along the way, this open book shows everyone the journey of your transaction, making sure everything is clear and fair without revealing personal details, like your name or your friend’s. It’s a clever dance of transparency and privacy, powered by technology and trust.

🛡️ Protecting Privacy Within Open Financial Books

Imagine dipping your toes into a crystal-clear pool, but at the same time, you’re wearing a cloak that keeps you invisible. That’s a bit like how Bitcoin manages to keep your financial transactions open for everyone to see, without revealing who you are. Every time someone makes a move, like sending or receiving Bitcoin, it’s recorded on this big public book. Think of it as writing in a diary that anyone can read, but instead of signing your name, you use a secret code. Now, you might wonder, doesn’t this make it easy for others to peek into my business? Well, this is where the magic happens. While the transaction details are out there for the world to see, your secret code doesn’t directly tell anyone it’s you. It’s like everyone knows a spaceship landed, but no one knows who the astronaut is. For those who want to dive deeper into how Bitcoin stays transparent, yet keeps your secrets safe, and explore how this could shape our financial future, embarking on a journey of learning and even joining a Bitcoin developer community: how to contribute regulatory outlook could be your next great adventure. This blend of openness, intertwined with privacy, not only keeps our financial dealings honest but also ensures that our virtual wallets remain under our control, paving the way for a future where our financial freedom is protected.

🔄 the Role of Consensus in Ledger Integrity

Imagine a world where everyone agrees on what time it is, not because there’s only one clock, but because everyone’s clocks are synchronized. This is a bit like how Bitcoin works, but instead of time, it’s about agreeing on transactions. In this system, there’s a special kind of teamwork called consensus. It’s like a digital handshake, ensuring that everyone’s records match up. This process is crucial because it keeps the digital ledger accurate and trustworthy, without needing a central boss. It’s a bit like a group project where every participant has a say, and a decision is made only when everyone agrees. This table helps to break down the basics:

| Key Term | Definition |

|—————|—————————————————————————-|

| **Consensus** | A method used to achieve agreement on a single data value among distributed processes or systems. |

| **Ledger** | A record-keeping system that tracks transactions. |

| **Trust** | Confidence in the accuracy and integrity of the ledger. |

Thanks to this clever method, even though the ledger is open for everyone to see, it remains solid and reliable, keeping our digital coins safe and sound.

💡 Future Visions: Public Ledgers Beyond Bitcoin

Imagine a future where the concept of public ledgers stretches far beyond the confines of Bitcoin, painting a vivid picture of diverse applications across industries. Public ledgers, the digital equivalent of open financial books, could transform not just financial transactions but also how we verify the authenticity of goods, manage supply chains, and even vote in democratic elections. The magic lies in their ability to provide a transparent, tamper-proof record of transactions and events, accessible to anyone. This opens up endless possibilities for creating systems where trust is built-in, from ensuring the origin of your morning coffee to securing your digital identity.

In parallel, as we venture into new territories with public ledgers, it’s crucial to navigate the shifting regulatory landscapes. For those keen on exploring the financial opportunities these technologies offer, such as Bitcoin lending platforms and interest accounts, staying informed is key. The regulatory outlook can significantly impact the profitability and legality of trading and lending activities. By mastering bitcoin technical analysis for profitable trading regulatory outlook, investors can make informed decisions, adapting to new rules whilst optimizing their strategies. As we stand on the brink of a new era, the journey of public ledgers beyond Bitcoin promises a fusion of innovation, security, and greater societal trust.