What Is Decentralization Anyway? 🌐

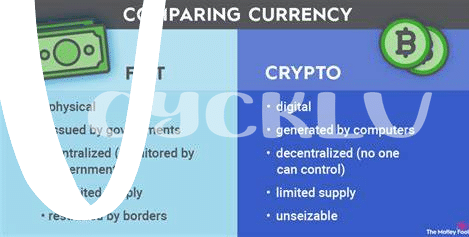

Imagine you live in a town where decisions are made not just by one person in charge, but rather, everyone has a say. This idea, simplified to its core, is what decentralization is all about 🌐. It’s like a network of computers, each independent yet working together, rather than a single computer making all the decisions 🖥️➡️🌍. In the context of currencies and transactions, decentralization means that instead of having one central authority, like a bank or government, control money, everyone who participates in the network has a piece of control. Through clever technology, this approach ensures that no single entity can dictate the rules unfairly, making the system more democratic. Bitcoin, a digital currency, embodies this principle by allowing money to flow between people without the need for a middleman 🔄💸. Think of it as a group project where everyone contributes equally, rather than having the project leader take all the credit. This decentralized approach challenges traditional money systems and introduces a new way of thinking about value, power, and control in our increasingly digital world.

| Feature | Decentralization | Centralization |

|---|---|---|

| Control | Distributed among users | Held by a single authority |

| Decision Making | Collective | Top-down |

| Efficiency in Changes | Can be slower due to consensus needs | Quick, as decided by the authority |

| Risk of Single Point of Failure | Lower | Higher |

Unpacking How Bitcoin Works 🔍

Imagine a world where every person can be their own bank. That’s the revolutionary idea behind Bitcoin. At its core, Bitcoin is a type of digital money that operates without the need for a central point of control. Instead of banks or governments calling the shots, Bitcoin runs on a network of computers around the globe. These computers work together to keep track of all Bitcoin transactions on a public list called the blockchain. It’s like a giant, secure ledger that everyone can see, but no single person or group can control. This setup means that anyone, anywhere, can send and receive Bitcoin without needing permission from a bank or government.

One of the coolest features of Bitcoin is how it’s created. Through a process called mining, computers solve complex puzzles. As a reward for their hard work, miners receive new Bitcoins. This not only helps secure the network and process transactions but also controls the creation of new Bitcoins, ensuring they’re introduced at a predictable rate. It’s a stark contrast to how traditional money is managed, where central banks can print new money, potentially leading to inflation. For those curious about keeping their digital currency secure, diving into options like cold storage or hot wallets is crucial. Discover more about it at https://wikicrypto.news/decoding-bitcoins-latest-trends-what-investors-should-know.

Fiat Currency: a Centralized Approach 💵

Imagine opening your wallet and seeing a bunch of colorful bills 🎨. This is what most of us understand by money, also known as fiat currency. It’s a system where the value of money isn’t based on physical commodities like gold or silver, but rather, it’s given value by the government that issues it. This setup means a central authority, like a bank or government, controls and regulates how much money is in circulation, how it’s distributed, and its overall value. This might sound like a neat and tidy way to manage money, but it comes with its downsides. For instance, when more money is printed, each bill in your wallet could end up buying you less than before – a process you might know as inflation 📉. Plus, having all our financial eggs in one central basket means our money’s fate is tied to the decisions and stability of these central powers.

Bitcoin’s Shield Against Inflation 🛡️

When we talk about protecting our money from losing its value, digital money like Bitcoin is like having a magic shield. 🛡️ Imagine every year, the money you saved buys less and less of what you love – that’s inflation, and it’s a problem with traditional money controlled by governments. But, here comes our hero, Bitcoin! It’s built differently; it has a rule that there can only ever be 21 million Bitcoins. This scarcity is like having a limited edition, making it more likely to hold its value over time, just like your favorite vintage comic book might.

Now, if you’re diving into the world of Bitcoin, you’d want your digital wallet to be as secure and suited to your needs as possible. Finding the right fit can feel like picking the best superhero gadget. That’s why options explored in bitcoin wallet types suggestions could be your guide in choosing your digital sidekick. With Bitcoin safeguarding your money from inflation and giving you control, it’s like having financial superpowers. 🚀🕵️♂️

Privacy and Freedom in Transactions 🕵️♂️

Imagine you’re sending a letter but don’t want anyone else to peek inside. That’s what it’s like when you’re using Bitcoin for your purchases or savings. Unlike traditional money systems controlled by big banks and government rules, Bitcoin operates on a cool digital network that spreads the power across many computers around the world. This setup ensures that your transactions—like sending or receiving money—are secure and only you and the person on the other end know about it. It’s a bit like having your own secret club where you set the rules. Plus, you can say goodbye to those annoying extra charges that banks love to surprise you with, giving you more control over your own money. Here’s how the two compare:

| Feature | Bitcoin | Fiat Currency |

|---|---|---|

| Privacy | High | Low to Medium |

| Freedom | High | Varies |

| Extra Charges | Low | High |

So, whether you’re buying something special or just keeping your savings in check, Bitcoin gives you a cloak of invisibility and the keys to your financial castle, making it a smooth and private experience. 🕵️♂️💼

Decentralization’s Role in Financial Freedom 🚀

Imagine living in a world where your financial health and growth aren’t strictly overseen by big banks or government bodies. This is not just a daydream but a reality made possible by decentralization. Through this lens, we see how Bitcoin is not just a digital currency but a gateway to financial freedom. Without a central power calling the shots, you’re in control of your own money. This independence means you have the liberty to send, receive, or invest your funds as you see fit, without unnecessary fees or waiting periods. It’s a fresh breeze in a world where traditional financial systems often feel stifling. Moreover, in an era where online privacy is precious, Bitcoin offers anonymity, ensuring your financial activities remain your own business. With Bitcoin, the power shifts from institutions to individuals, paving the way for a new kind of financial ecosystem that’s inclusive, fair, and free from the grip of central authorities. For a deeper dive into how Bitcoin stands in the current market and explores its capabilities for small-scale transactions, check out this insightful piece on bitcoin market analysis suggestions. 🚀 🌍 💡