Current State: 📊

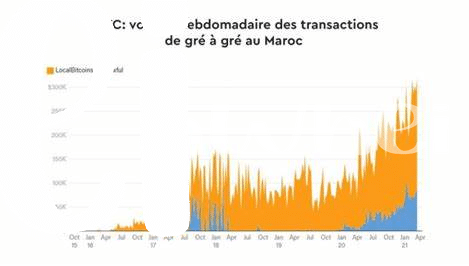

Cryptocurrency adoption in Morocco reflects a growing trend as more individuals explore this digital financial realm. A surge in interest is evident, mirroring global enthusiasm for decentralized currencies. Despite facing regulatory uncertainties, the current landscape in Morocco suggests a potential shift towards embracing cryptocurrencies. The evolving market dynamics and increasing public awareness signal a budding potential for integration within the nation’s financial ecosystem. As Morocco navigates this digital frontier, understanding the existing cryptocurrency ecosystem is crucial for both investors and regulators.

Regulatory Challenges: 🚫

Navigating the cryptocurrency realm in Morocco is not without its challenges, as regulatory hurdles often loom large for investors and traders alike. The lack of clear guidelines and restrictions can pose significant roadblocks, leading to uncertainty and apprehension within the market. Market participants must stay vigilant and informed, as evolving regulations can impact their strategies and operations. Overcoming these regulatory challenges demands a proactive approach and a thorough understanding of the legal landscape governing cryptocurrency activities within the country.

Looking ahead, the regulatory environment in Morocco is expected to witness shifts and updates as authorities strive to adapt to the evolving cryptocurrency landscape. Navigating these changes will require agility and a keen awareness of regulatory updates, ensuring compliance and mitigating risks for investors and traders. By staying abreast of regulatory developments and actively engaging with the evolving landscape, market participants can position themselves effectively amidst the regulatory challenges that lie ahead.

Investor Guidelines: 💡

In navigating the cryptocurrency landscape in Morocco as an investor, it’s crucial to prioritize due diligence and staying abreast of the latest regulatory developments. Understanding the legal framework and compliance requirements can help mitigate risks and ensure a smooth investment experience. Additionally, engaging with reputable local experts and seeking guidance from industry professionals can offer valuable insights into the market dynamics and investment opportunities within the country. Taking a prudent approach to investing in cryptocurrencies in Morocco can not only safeguard your assets but also position you to capitalize on potential growth opportunities in this evolving market.

Key Regulations: 🔐

Cryptocurrency regulations in Morocco involve a mix of existing financial laws and evolving frameworks specific to digital assets. One key regulation to note is the requirement for cryptocurrency exchanges to be licensed by the relevant authorities, ensuring a level of oversight and security for investors. Additionally, Morocco has taken steps to combat money laundering and terrorism financing through regulations that mandate the verification of customer identities for cryptocurrency transactions.

To gain a comprehensive understanding of the legal landscape surrounding cryptocurrencies, investors and traders should stay informed about key regulations and compliance requirements. By following the guidelines set forth by regulatory bodies in Morocco, individuals can navigate the cryptocurrency market with greater confidence and adherence to the law. For more insights on the legal consequences of bitcoin transactions in another country, check out this article on the legal implications of bitcoin transactions in Myanmar.

Trading Implications: 💸

Trading in the cryptocurrency market brings about various implications for investors and traders alike. The rapid price fluctuations characteristic of this space require a dynamic approach to decision-making, where quick reactions to market movements can yield substantial gains or losses. Risk management becomes paramount, emphasizing the need for diversification and strategic planning to navigate the volatile nature of cryptocurrency trading effectively. Additionally, staying informed about market trends, regulatory developments, and technological advancements is key to making informed investment decisions in this ever-evolving landscape.

As traders engage with the cryptocurrency market, they must also consider the impact of trading activities on their tax obligations. Different jurisdictions may have varying regulations regarding the taxation of cryptocurrency earnings, capital gains, and trading profits. Ensuring compliance with relevant tax laws is essential to avoid legal repercussions and financial penalties. Moreover, the decentralized nature of cryptocurrencies challenges traditional financial systems, prompting a reevaluation of established trading practices and risk management strategies to adapt to the unique characteristics of this digital asset class.

Future Outlook: 🔮

As the regulatory landscape continues to evolve in Morocco, the future outlook for cryptocurrency investors and traders is filled with both challenges and opportunities. With a growing interest in digital assets, stakeholders are closely monitoring potential developments that could shape the industry. Incorporating a proactive approach and staying informed about regulatory updates will be crucial for navigating the uncertainties ahead.

Legal Consequences of Bitcoin Transactions in Micronesia