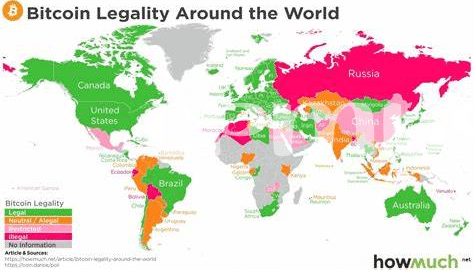

Understand the 📜 Existing Cryptocurrency Regulations in Libya.

In Libya, navigating the cryptocurrency landscape involves delving into a complex web of existing regulations. Understanding the legal framework surrounding digital currencies is crucial for individuals and businesses looking to participate in this emerging market. From licensing requirements to tax implications, staying informed about the rules governing cryptocurrency transactions is key to operating within the bounds of the law and avoiding potential pitfalls. As the regulatory environment continues to evolve, keeping abreast of updates and changes will be essential for anyone seeking to engage with cryptocurrencies in Libya.

Exploring the 💡 Potential Impact of Bitcoin on the Economy.

The rise of Bitcoin brings both excitement and uncertainties to Libya’s economy. As this digital currency gains traction, its potential impact on the country’s financial landscape becomes a subject of interest. From offering new investment opportunities to shaping financial regulations, Bitcoin’s presence in Libya could pave the way for innovative economic perspectives. However, challenges such as volatility and regulatory uncertainties must be considered as the nation navigates the evolving cryptocurrency terrain. Amidst these complexities, exploring the implications of Bitcoin on Libya’s economy reveals a blend of promise and caution.

Challenges in 💸 Complying with Cryptocurrency Laws in Libya.

Navigating the complex web of cryptocurrency laws in Libya can present significant hurdles for individuals and businesses alike. From ambiguous regulations to lack of clear guidance, staying compliant with the ever-evolving laws poses a major challenge. The scarcity of established frameworks and enforcement mechanisms further complicates the landscape, requiring careful navigation to avoid legal pitfalls. Additionally, the rapidly changing nature of the crypto space adds another layer of difficulty in ensuring adherence to regulatory requirements, making it crucial for entities to stay informed and adapt swiftly to changes.

Addressing 🔒 Security Concerns in Cryptocurrency Transactions.

In the realm of cryptocurrency transactions, security concerns loom large, demanding a proactive approach to safeguard digital assets against potential threats. Implementing robust encryption measures and multi-factor authentication protocols fortify the integrity of transactions, shielding them from malicious actors seeking to exploit vulnerabilities. Moreover, regular audits and compliance checks serve as critical tools in maintaining the security of cryptocurrency exchanges, ensuring transparency and accountability in handling sensitive financial information.

Within the dynamic landscape of digital currency, addressing security concerns in cryptocurrency transactions is paramount for fostering trust and confidence among users. By staying abreast of emerging cybersecurity threats and adopting best practices in data protection, stakeholders can bolster the resilience of the ecosystem, paving the way for enhanced security standards that underpin the future of decentralized finance.

Navigating 💡 the Future of Bitcoin and Blockchain Technology in Libya.

Understanding the regulatory landscape and technological advancements is crucial for individuals and businesses entering the cryptocurrency sphere in Libya. As the adoption of Bitcoin and blockchain technology gains traction, navigating the future of these innovations requires a blend of foresight and adaptability. Embracing the potential of these digital assets while being mindful of regulatory frameworks can pave the way for a transformative impact on the Libyan economy. By staying informed, engaging with stakeholders, and proactively addressing challenges, individuals can position themselves to harness the opportunities presented by the evolving crypto landscape in Libya.

Conclusion: 🚀 Opportunities and Risks in Libya’s Crypto Landscape.

In Libya’s evolving crypto landscape, both opportunities and risks abound for those engaging in digital currency transactions. The country’s regulatory framework presents challenges, yet also opens doors for innovative financial solutions. As the economy explores the potential impact of Bitcoin, individuals and businesses must navigate security concerns and compliance issues. Embracing the future of blockchain technology promises exciting developments, offering a glimpse into the transformative power of decentralized finance. Amidst the uncertainties, Libya stands at a crossroads of potential growth and regulatory hurdles, shaping the path for crypto enthusiasts and investors alike.

is bitcoin legal in ireland?