Impact of Cryptocurrency Fraud on Investors 💰

Cryptocurrency fraud can have devastating effects on unsuspecting investors, leading to financial losses and shattered trust in digital assets. Individuals who fall prey to fraudulent schemes may face not only monetary consequences but also emotional distress from being deceived. This impact highlights the importance of vigilance and due diligence when navigating the volatile world of cryptocurrency investments.

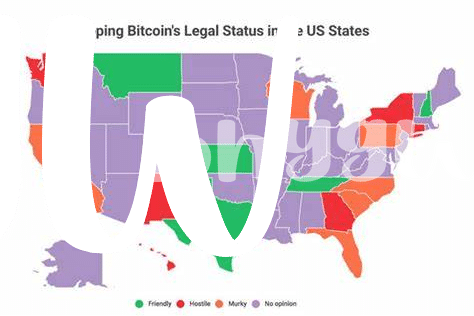

Regulatory Challenges Faced by Authorities 🚓

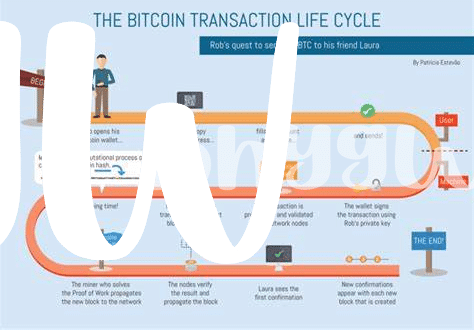

Regulatory challenges in the cryptocurrency space present a complex landscape for authorities worldwide. The rapid evolution of digital currencies often outpaces traditional regulatory frameworks 🚓. Policymakers struggle to keep up with the ever-changing nature of crypto transactions and the anonymity they can provide, making enforcement and monitoring a significant challenge. Additionally, the borderless nature of cryptocurrencies further complicates oversight and regulatory efforts, as coordination among different jurisdictions is essential to combat fraudulent activities effectively.

Common Types of Cryptocurrency Scams to Avoid 🛡️

When it comes to navigating the world of cryptocurrency, it’s crucial to be vigilant against various fraudulent schemes that can put your investments at risk. Some common types of cryptocurrency scams to avoid include phishing scams, Ponzi schemes, fake ICOs, and pump and dump schemes. These deceptive tactics often lure unsuspecting individuals with promises of high returns or new digital currencies, only to leave them with empty wallets. By staying informed and exercising caution, investors can better protect themselves from falling victim to these prevalent scams in the digital asset space.

Legal Consequences for Perpetrators ⚖️

When it comes to perpetrators of cryptocurrency fraud, they may face severe legal consequences. Authorities are increasingly cracking down on fraudulent activities, with penalties ranging from hefty fines to imprisonment. The legal system is actively working to hold accountable those who exploit cryptocurrency for illicit purposes, sending a clear message that fraudulent behavior will not be tolerated. To learn more about the legal consequences of Bitcoin transactions in Switzerland, you can explore the impact of Brexit on Bitcoin regulation in the United Kingdom at legal consequences of bitcoin transactions in Switzerland.

Strategies to Protect Yourself from Fraudulent Schemes 🔒

Protecting yourself from cryptocurrency fraud requires vigilance and caution. Safeguard your investments by conducting thorough research before parting with your funds. Always verify the legitimacy of the platform or service provider, and be wary of promises that seem too good to be true. Utilize secure wallets and strong passwords to protect your digital assets from potential theft. Stay informed about common scam tactics and be cautious of unsolicited offers or requests for personal information. Lastly, consider seeking advice from reputable sources or consulting with financial experts to mitigate risks and enhance your security measures in the ever-evolving landscape of cryptocurrency fraud.

Future Outlook for Combating Cryptocurrency Fraud 🔮

In looking ahead to combatting cryptocurrency fraud, advancements in technology and enhanced cybersecurity measures will play a crucial role. Industry experts and regulatory bodies are working together to develop more robust mechanisms for identifying and preventing fraudulent activities in the cryptocurrency space. Collaboration on an international scale is key to staying ahead of evolving scam techniques. By fostering transparency and education, the future outlook aims to create a safer environment for investors and users alike.

Legal consequences of bitcoin transactions in Uruguay link with anchor legal consequences of bitcoin transactions in United Kingdom: Legal consequences of bitcoin transactions in United Kingdom