Overview of Money Transfer Laws in Luxembourg 🌐

Money transfer laws in Luxembourg seek to ensure the security and transparency of financial transactions. These regulations are designed to prevent money laundering, terrorist financing, and other illicit activities. Understanding and complying with these laws is essential for anyone involved in transferring funds within or through Luxembourg. It is crucial to stay updated on the latest developments and changes in legislation to ensure compliance and avoid potential legal issues. Familiarizing oneself with the requirements and procedures set forth by the authorities can help streamline the money transfer process and build trust with customers and partners.

Bitcoin Solutions for Compliance in Regulations 💰

Bitcoin, as a decentralized digital currency, offers innovative solutions for complying with regulations in the money transfer landscape. Its unique features enable seamless transactions while adhering to the stringent laws set forth by authorities. By leveraging blockchain technology, Bitcoin provides a transparent and efficient way to monitor and track financial transfers, ensuring that every transaction meets the necessary compliance standards. The use of cryptography in Bitcoin transactions adds an extra layer of security, safeguarding sensitive information and enhancing the overall compliance process.

Additionally, Bitcoin’s borderless nature eliminates the complexities often associated with traditional money transfers, offering a cost-effective and swift alternative for individuals and businesses looking to navigate the regulatory environment. Its decentralized structure means that transactions can be conducted peer-to-peer without the need for intermediaries, streamlining the compliance process and reducing potential bottlenecks. Overall, Bitcoin presents a forward-looking approach to compliance in money transfers, paving the way for more efficient and secure transactions in the digital age.

Key Benefits of Using Bitcoin in Money Transfers 💡

While exploring the realm of money transfers, embracing Bitcoin presents a myriad of advantages that can revolutionize the traditional landscape. The seamless, swift nature of Bitcoin transactions eliminates the need for intermediaries, leading to reduced costs and quicker processing times. Additionally, the decentralized nature of Bitcoin ensures greater accessibility to financial services, especially for those in underserved regions. Anonymity and transparency coexist within Bitcoin transactions, ensuring privacy for users while maintaining a public ledger for verification. Embracing Bitcoin in money transfers can unlock a new realm of possibilities, transcending borders and limitations inherent in traditional financial systems.

Ensuring Data Privacy and Security with Bitcoin 🔒

Bitcoin offers a robust solution for ensuring data privacy and security in money transfers. The use of cryptographic techniques in Bitcoin transactions adds an extra layer of protection, making it difficult for unauthorized parties to access sensitive information. The decentralized nature of the blockchain also helps in safeguarding data as transactions are recorded across a network of computers, reducing the risk of a single point of failure. This not only enhances security but also promotes transparency in financial transfers. To delve deeper into how Bitcoin improves data privacy and security in money transfers, you can refer to this informative article on bitcoin cross-border money transfer laws in Liechtenstein.

To learn more about this topic, you can visit https://wikicrypto.news/bitcoin-cross-border-transfers-lesothos-compliance-requirements-unveiled.

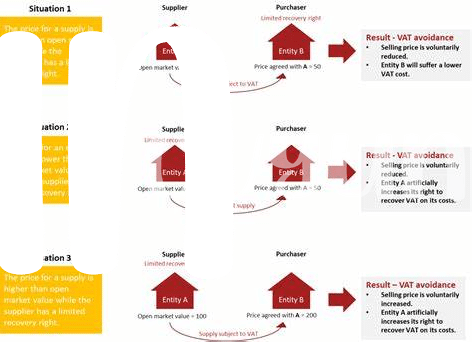

Challenges and Risks of Using Bitcoin for Transfers ⚠️

When using Bitcoin for money transfers, there are certain challenges and risks that need to be considered. One key challenge is the volatility of Bitcoin prices, which can affect the value of funds being transferred. Additionally, the regulatory environment surrounding Bitcoin is constantly evolving, leading to uncertainties in compliance requirements. Security concerns also arise due to the irreversible nature of Bitcoin transactions, making it crucial to safeguard against hacking and fraud. Despite these challenges, the transparency and efficiency of Bitcoin transactions offer opportunities for improving cross-border payments and reducing transaction costs in the long run.

When venturing into money transfers with Bitcoin, it is essential to stay informed about the ever-changing landscape of regulations and security measures. Embracing innovative solutions while mitigating risks through robust security protocols can unlock the full potential of Bitcoin as a viable option for compliant money transfers. The key lies in understanding the nuances of using Bitcoin in financial transactions and proactively addressing the challenges to harness its benefits effectively.

Future Outlook: Bitcoin’s Role in Money Transfer Compliance 🚀

In the rapidly evolving landscape of money transfer compliance, Bitcoin is poised to play a pivotal role in ensuring seamless and secure transactions across borders. With its decentralized nature and cryptographic principles, Bitcoin offers a transparent and efficient solution for navigating the complexities of regulatory requirements. As financial authorities and businesses adapt to the changing regulatory environment, Bitcoin’s versatility and potential to streamline compliance processes continue to garner attention and adoption. Embracing technological innovation, such as blockchain-based solutions, can pave the way for a more interconnected and compliant global financial system.

For a deeper understanding of how Bitcoin is revolutionizing cross-border money transfer laws, explore the regulations in Lithuania through the lens of Bitcoin cross-border money transfer laws in Lesotho. This comparison highlights the transformative impact of Bitcoin on regulatory frameworks worldwide, shedding light on the progressive outlook of leveraging cryptocurrency for enhanced compliance in the financial sector.