Overview 🌐

Bitcoin, a decentralized digital currency, has been gaining traction worldwide, offering a new way to transfer funds securely and efficiently. In this overview, we delve into how Bitcoin is revolutionizing money transfers and compliance with Armenian laws. By leveraging blockchain technology, Bitcoin enables seamless peer-to-peer transactions across borders, circumventing traditional banking systems’ limitations. This transformative approach to money transfer aligns with the evolving financial landscape, providing individuals and businesses with a transparent and cost-effective alternative. As we explore the intersection of Bitcoin and compliance with Armenian regulations, we uncover the potential for streamlined processes and enhanced financial inclusivity.

Armenian Money Transfer Laws 🇦🇲

Armenia has specific laws pertaining to money transfers, aimed at ensuring transparency and security in financial transactions. These regulations provide a framework for overseeing the transfer of funds within the country, helping to prevent illicit activities such as money laundering and terrorist financing. Understanding and adhering to the Armenian Money Transfer Laws is crucial for individuals and businesses engaging in financial transactions to ensure compliance with the legal requirements.

By familiarizing themselves with these regulations, individuals and businesses can navigate the nuances of money transfers in Armenia with ease and confidence. This knowledge not only helps in avoiding potential legal penalties but also fosters trust and credibility in financial dealings. Compliance with the Armenian Money Transfer Laws fosters a secure and regulated financial environment, ultimately contributing to the stability and integrity of the country’s monetary system.

Bitcoin Compliance Benefits 💰

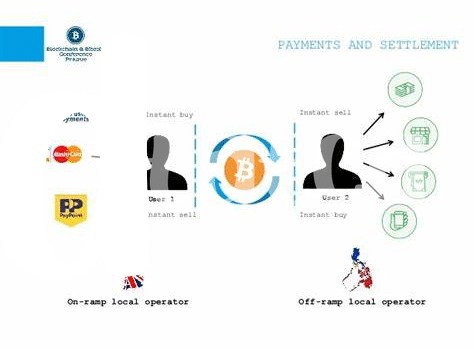

Bitcoin compliance benefits extend beyond traditional financial systems, offering a streamlined and cost-effective solution for businesses navigating Armenian money transfer laws. By harnessing the decentralized nature of Bitcoin, companies can facilitate cross-border transactions with greater efficiency and lower fees. The transparency and security provided by blockchain technology also enhance compliance efforts by ensuring a tamper-proof record of every transaction. This not only simplifies regulatory reporting but also reduces the risk of fraud and money laundering. Additionally, Bitcoin’s borderless nature allows businesses to reach a global market without the typical constraints of traditional banking systems. Overall, embracing Bitcoin for compliance not only meets regulatory requirements but also unlocks new opportunities for growth and innovation.

Understanding Regulatory Challenges 📜

When navigating the realm of financial regulations, particularly in the context of Bitcoin transactions, one must remain vigilant about the ever-evolving landscape of compliance requirements. These challenges can vary from country to country, with each jurisdiction imposing its own set of rules and guidelines. Staying abreast of these regulatory changes is crucial for businesses and individuals looking to engage in compliant Bitcoin transactions. To delve deeper into these regulatory challenges and how they impact Bitcoin money transfers, you can explore the detailed analysis provided by WikiCrypto.News on the compliance-check of bitcoin cross-border money transfer laws in Antigua and Barbuda. This comprehensive resource offers valuable insights into the intricacies of navigating regulatory landscapes, ensuring that compliance remains at the forefront of any Bitcoin transaction strategy.

Tips for Successful Compliance 🌟

Navigating compliance with Armenian money transfer laws using Bitcoin can feel like a complex puzzle. To succeed, it’s essential to stay informed about the evolving regulations, ensuring your operations align with the current legal framework. Conducting regular audits and reviews of your compliance processes can help identify any gaps or areas for improvement. Additionally, fostering open communication with regulators can build trust and demonstrate your commitment to operating within the law. Embracing a proactive approach to compliance, rather than reactive, can help your business stay ahead of regulatory changes and avoid potential pitfalls. Stay vigilant and adaptable in your compliance strategy to mitigate risks and build a solid foundation for sustainable growth in the evolving landscape of money transfers in Armenia.

Future Compliance Trends 🚀

In the rapidly evolving landscape of financial regulations, it is crucial for businesses to stay ahead of future compliance trends. As technology continues to shape the way we conduct transactions, authorities are increasingly focusing on ensuring transparency and security in cross-border money transfers. Companies that proactively adapt their operations to meet these upcoming compliance requirements will not only avoid potential penalties but also gain a competitive edge in the market. Keeping abreast of the latest developments and leveraging innovative solutions like Bitcoin can simplify compliance processes and enhance overall regulatory adherence. By being proactive and forward-thinking, businesses can navigate the complex regulatory environment with confidence and pave the way for sustainable growth and success in the future.

insert link to Bitcoin cross-border money transfer laws in Albania with anchor bitcoin cross-border money transfer laws in Antigua and Barbuda using the