Introduction to Bitcoin and Tonga’s Regulations 🌐

Bitcoin, a digital currency that has been making waves in the financial world, has caught the attention of policymakers worldwide, including Tonga. With the rapid growth of Bitcoin transfers, Tonga has started to implement regulations to ensure transparency and security in these transactions. Understanding the ins and outs of Bitcoin and Tonga’s regulations is crucial for anyone looking to navigate this evolving landscape effectively.

As Tonga adapts its regulatory framework to accommodate the increasing use of Bitcoin, individuals and businesses must stay informed about the rules governing these transfers. By delving into the nuances of Bitcoin and Tonga’s regulations, one can gain a deeper appreciation of the opportunities and challenges presented by this innovative form of digital currency.

Importance of Compliance in Bitcoin Transfers 💼

Compliance in Bitcoin transfers is crucial for ensuring security and trust in the cryptocurrency ecosystem. By following regulations and guidelines, individuals and businesses can mitigate risks associated with illegal activities such as money laundering and fraud. Being compliant not only protects the integrity of transactions but also fosters a more stable environment for the widespread adoption of Bitcoin. It demonstrates a commitment to ethical practices and upholds the reputation of the cryptocurrency industry as a whole. With increasing scrutiny from regulatory bodies and law enforcement agencies, maintaining compliance is not just a best practice but a necessary step towards legitimizing and safeguarding the future of Bitcoin transfers. By proactively adhering to compliance requirements, stakeholders can contribute to a more transparent and sustainable digital financial landscape.

Key Regulations Governing Bitcoin Transfers 📜

Bitcoin transfers are subject to a set of regulations that aim to ensure transparency, security, and compliance with legal requirements. These regulations typically focus on aspects such as anti-money laundering (AML) and know your customer (KYC) procedures. Additionally, guidelines often cover the licensing and registration of cryptocurrency exchanges, as well as reporting requirements for suspicious activities. Understanding and adhering to these key regulations is essential for businesses and individuals engaging in Bitcoin transfers to minimize the risk of legal implications and ensure the legitimacy of their transactions. Compliance with these regulations not only fosters a more robust and trustworthy cryptocurrency ecosystem but also helps to protect against illicit activities and fraud within the digital asset space. Staying informed about the evolving regulatory landscape and implementing robust compliance measures is crucial for both the sustainable growth of Bitcoin as a transfer mechanism and the safeguarding of stakeholders’ interests.

Risks and Challenges in Compliance 🚨

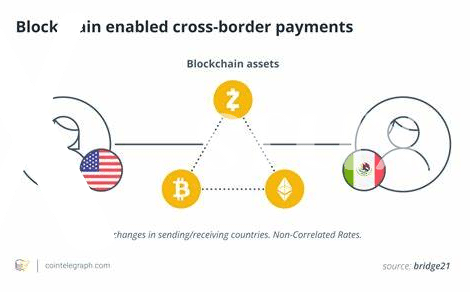

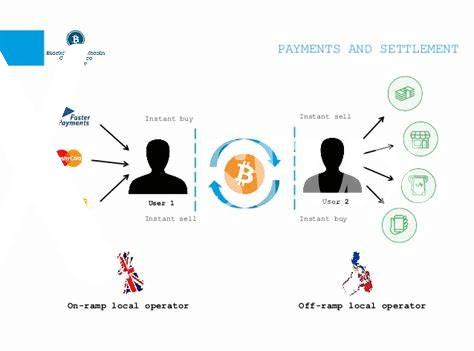

Navigating the landscape of regulatory compliance in the realm of Bitcoin transfers poses a multitude of risks and challenges. From the inherent volatility of cryptocurrencies to the evolving nature of laws and regulations, ensuring adherence to compliance standards can be a complex endeavor. The anonymity associated with Bitcoin transactions also raises concerns regarding the potential for illicit activities, emphasizing the need for robust monitoring mechanisms. Moreover, the global nature of Bitcoin transfers introduces jurisdictional issues and varying interpretations of compliance requirements across different regions. As the regulatory framework continues to mature, organizations must stay vigilant in adapting their compliance strategies to mitigate these risks effectively. To delve deeper into how Bitcoin is reshaping cross-border money transfers, exploring insights on the laws in Tunisia could provide valuable perspectives on the future landscape of digital currency. Discover more about the transformative potential of Bitcoin cross-border money transfer laws in Tunisia [here](https://wikicrypto.news/bitcoin-as-a-solution-for-safe-cross-border-transfers-in-togo).

Strategies for Ensuring Compliance 🛡️

Strategies for Ensuring Compliance: As businesses navigate the evolving landscape of Bitcoin transfers and Tonga’s regulations, robust compliance strategies are essential for mitigating risks and maintaining trust. Implementing thorough KYC (Know Your Customer) procedures is a fundamental step in ensuring compliance with regulatory requirements. By verifying the identities of individuals involved in Bitcoin transactions, businesses can foster transparency and accountability within their operations. Moreover, establishing robust internal controls and monitoring mechanisms can help detect and prevent potential fraudulent activities, enhancing overall compliance efforts. Embracing a proactive approach to compliance not only safeguards against legal implications but also builds credibility and fosters long-term sustainability in the rapidly advancing realm of Bitcoin transfers and regulations.

Future Trends and Implications for Bitcoin Transfers 💡

For the future trends and implications of Bitcoin transfers, we are witnessing a rapidly evolving landscape with increased adoption and regulatory scrutiny. As more countries explore the integration of cryptocurrencies into their financial systems, the need for clear guidelines and regulations becomes paramount. This shift towards formalized structures will likely lead to better consumer protection, reduced fraud and illicit activities, and increased trust in the digital asset space. Moreover, the advancements in technology, such as blockchain and smart contracts, are poised to revolutionize the way we conduct financial transactions, making them faster, more secure, and cost-effective. However, while the future looks promising, challenges such as scalability, interoperability, and regulatory divergence still need to be addressed to fully harness the potential of Bitcoin transfers bitcoin cross-border money transfer laws in Togo.