Legal Landscape 🏛️

In Chad, navigating the legal landscape surrounding Bitcoin can be akin to exploring uncharted territory. The evolving nature of cryptocurrency regulation in the country requires a nuanced understanding of both existing laws and potential updates. Amidst a backdrop of shifting policies and directives, staying compliant with Bitcoin transactions necessitates a keen awareness of the legal framework at play. Navigating this terrain can be both challenging and rewarding, as clarity in regulatory compliance is essential for cross-border interactions involving Bitcoin. Embracing transparency and adherence to legal guidelines forms the cornerstone of operating within the dynamic legal landscape of Chad.

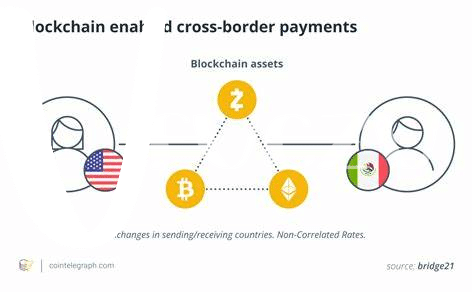

Cross-border Transactions 🌍

Cross-border transactions involving Bitcoin in Chad present a dynamic landscape influenced by regulatory frameworks and evolving global trends. As individuals and businesses engage in international transactions using Bitcoin, they navigate a complex terrain that requires a keen understanding of the legalities and compliance measures. Factors such as currency exchange regulations, anti-money laundering laws, and international sanctions play a crucial role in shaping cross-border Bitcoin transactions. Understanding how these elements interact is vital for complying with the regulatory environment and ensuring seamless cross-border payments. With the rise of digital currencies as a means of international exchange, the need to address regulatory challenges and implement effective compliance strategies becomes increasingly important. As Chad moves towards integrating Bitcoin into cross-border transactions, staying informed about regulatory requirements and adopting proactive measures will be key to navigating this evolving landscape.

Regulatory Challenges 🚫

Navigating the intricate world of Bitcoin cross-border transactions in Chad poses a myriad of regulatory challenges for individuals and entities alike. The evolving legal landscape surrounding cryptocurrency adds a layer of complexity to compliance efforts. One of the primary hurdles is the lack of clear guidelines and uniform regulations governing the use of Bitcoin in cross-border transactions. This ambiguity can lead to uncertainty and potential noncompliance issues. Additionally, variations in regulatory frameworks between countries further complicate the process, requiring a nuanced approach to ensure adherence to all relevant laws and guidelines. Finding the delicate balance between innovation and regulatory compliance is a central challenge facing stakeholders in the Bitcoin cross-border realm.

Compliance Strategies 💡

Navigating compliance in cross-border Bitcoin transactions in Chad requires a strategic approach. To ensure adherence to regulatory guidelines, businesses must implement robust frameworks that align with local laws and international standards. A key aspect of compliance strategies involves conducting thorough due diligence on counterparties and transactions to mitigate risks associated with cross-border transfers. This proactive approach not only fosters trust among stakeholders but also demonstrates a commitment to upholding regulatory requirements. By integrating compliance into operational procedures, companies can safeguard against potential violations and maintain a secure environment for cross-border transactions in the evolving landscape of digital currencies.

For further insights on the impact of regulatory environments on Bitcoin cross-border money transfer laws in Central African Republic, refer to this informative article: bitcoin cross-border money transfer laws in Central African Republic. Stay updated on the latest developments and best practices to enhance compliance strategies for seamless cross-border Bitcoin transactions.

Reporting Requirements 📊

Reporting requirements in Chad pertaining to Bitcoin transactions are crucial for ensuring compliance with the country’s regulations. Transparency and accurate record-keeping play a significant role in demonstrating adherence to financial laws. Individuals and entities engaging in cross-border Bitcoin transactions must be diligent in fulfilling these obligations. Failure to meet reporting requirements can result in penalties and legal implications. Implementing robust reporting practices not only fosters regulatory compliance but also enhances trust and credibility within the financial ecosystem.

Future Outlook 🔮

In today’s rapidly evolving landscape of bitcoin cross-border transactions, staying ahead of regulatory changes is crucial for compliant operations. As the global financial environment continues to adapt, it’s essential for businesses and individuals in Chad to anticipate upcoming shifts in regulatory frameworks. Understanding the potential impacts on cross-border transactions and compliance strategies will be key to navigating these changes effectively. Looking towards the future, proactive engagement with regulatory authorities and a commitment to upholding compliance standards will be vital for the sustainable growth of bitcoin transactions in Chad.

For more detailed insights on bitcoin cross-border money transfer laws in Canada, and how they compare with regulations in Cambodia, click here: bitcoin cross-border money transfer laws in Cambodia.