Overview of Bitcoin Cross-border Money Transfer Laws 🌍

Bitcoin cross-border money transfer laws are crucial in shaping the landscape of international financial transactions. These regulations govern the movement of cryptocurrencies, such as Bitcoin, across borders, impacting individuals and businesses engaging in cross-border transactions. Understanding the legal framework surrounding Bitcoin transfers is essential for complying with the laws set forth by different jurisdictions, including Burkina Faso. It involves navigating through a complex web of regulations to ensure seamless and lawful transactions while also considering the implications on financial inclusion and global economic stability. The overview of Bitcoin cross-border money transfer laws sheds light on the evolving nature of digital currency regulations and the need for users to stay informed and compliant in today’s interconnected world.

Key Regulations Governing Bitcoin Usage 💼

Bitcoin usage is subject to a variety of regulations aimed at ensuring transparency and security in cross-border money transfers. These regulations typically focus on identifying and verifying users, monitoring transactions for suspicious activity, and complying with anti-money laundering (AML) and counter-terrorist financing (CTF) laws. In addition, regulations may also touch upon tax implications and reporting requirements related to Bitcoin transactions. It’s important for individuals and businesses engaged in Bitcoin transfers to thoroughly understand and adhere to these regulations to avoid legal consequences or sanctions. By staying informed and implementing robust compliance measures, users can navigate the regulatory landscape effectively and contribute to a more secure and trustworthy financial environment.

Compliance Challenges Faced by Users 🤔

Navigating the complex landscape of cross-border Bitcoin transfers poses various compliance challenges for users. From differing regulatory frameworks to evolving enforcement measures, staying abreast of the ever-changing requirements can be daunting. Additionally, the anonymity associated with Bitcoin transactions can raise red flags for regulators, leading to increased scrutiny and potential roadblocks for users seeking to transfer funds across borders. To add to the complexity, the lack of clarity in how existing laws apply to Bitcoin transactions further complicates compliance efforts. As a result, users often find themselves grappling with the challenge of ensuring adherence to regulations while still harnessing the benefits of decentralized digital currencies.

Impact of Regulations on Financial Inclusion 🌐

In considering the impact of regulations on financial inclusion, it is essential to recognize the dual nature of such measures. While regulations can serve to safeguard users and instill trust in the system, they can also inadvertently create barriers that exclude certain segments of the population. In the case of cross-border Bitcoin transfers in Burkina Faso, regulations must be crafted with a delicate balance, promoting compliance without stifling accessibility. By fostering an environment that encourages both innovation and adherence to standards, the regulatory framework can enhance financial inclusion, ensuring that individuals from all backgrounds have the opportunity to participate in the global economy. This approach is crucial in realizing the full potential of Bitcoin as a tool for expanding financial access and driving economic empowerment for individuals in Burkina Faso and beyond.

Strategies for Ensuring Compliance 🛡️

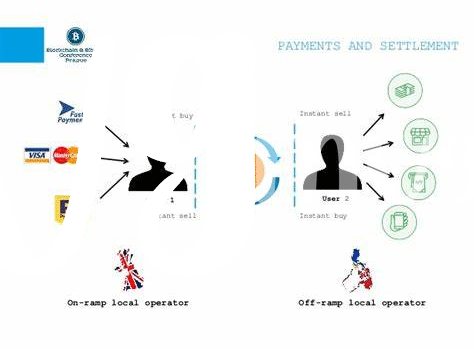

Understanding and abiding by the compliance regulations in cross-border Bitcoin transfers is crucial for users in Burkina Faso. One key strategy for ensuring compliance involves conducting thorough due diligence on counterparties and transactions, as well as implementing robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. Additionally, staying updated on the evolving regulatory landscape and seeking guidance from legal experts can help navigate the complexities of compliance requirements. Developing internal controls and regular audits can also play a vital role in ensuring adherence to regulations and mitigating potential risks. By proactively establishing and adhering to compliance strategies, users can enhance trust, transparency, and the overall sustainability of cross-border Bitcoin transfers in Burkina Faso.

Future Trends in Cross-border Bitcoin Transfers 🔮

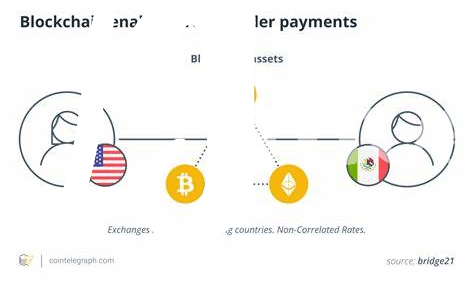

In the dynamic landscape of cross-border Bitcoin transfers, the future holds promising trends that are poised to reshape the global financial ecosystem. As advancements in blockchain technology continue to evolve, we anticipate increased efficiency and security in cross-border transactions, driving greater adoption and acceptance of Bitcoin as a legitimate form of value transfer across borders. Moreover, the growing recognition of the importance of financial inclusion is likely to propel initiatives that leverage Bitcoin to enhance access to financial services for underserved communities, fostering greater economic empowerment and participation on a global scale.

For more information on Bitcoin cross-border money transfer laws in Brazil, please visit Bitcoin cross-border money transfer laws in Botswana.