Regulations & Compliance 📜

Navigating the evolving landscape of cryptocurrency regulations can be a daunting task for exchanges operating in Ecuador. The regulatory framework governing these digital assets is rapidly changing, requiring exchanges to stay informed and compliant with the latest rules and guidelines. Compliance with these regulations is not just a legal obligation but also a crucial aspect of building trust and credibility within the industry.

Staying abreast of the regulatory environment, adapting operations to meet compliance standards, and proactively engaging with regulatory bodies are essential steps for cryptocurrency exchanges to ensure long-term sustainability and legitimacy in Ecuador. By prioritizing compliance, exchanges can safeguard their business from potential legal challenges and demonstrate their commitment to operating transparently and responsibly in the fast-paced world of cryptocurrencies.

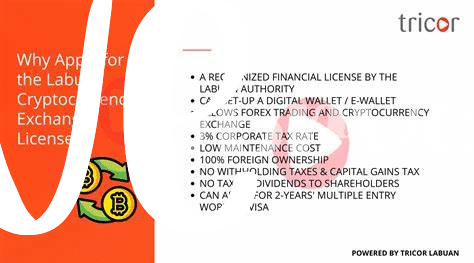

Licensing Process 🛡️

In navigating the licensing process for cryptocurrency exchanges, entities in Ecuador must adhere to a structured framework that ensures compliance with regulatory standards. This involves thorough documentation of business activities, financial stability checks, and adherence to anti-money laundering protocols. The process of obtaining a license is multifaceted and requires clear communication with regulatory bodies, showcasing a commitment to transparency and accountability. By meticulously following the licensing procedures, cryptocurrency exchanges can establish credibility within the industry and gain the trust of both users and stakeholders. It is essential to approach this process with diligence and precision to operate successfully within the regulatory landscape.

Reporting Requirements 📊

Cryptocurrency exchanges in Ecuador must adhere to specific reporting requirements to ensure compliance with regulations. These obligations typically involve regularly submitting detailed reports to the relevant authorities, outlining various operational aspects and financial transactions. By maintaining transparent and accurate records, exchanges can demonstrate their commitment to regulatory compliance and accountability. Additionally, thorough reporting practices help identify any potential issues or discrepancies promptly, allowing for corrective actions to be taken promptly. By integrating robust reporting mechanisms into their operational processes, cryptocurrency exchanges play a vital role in fostering trust and transparency within the digital asset ecosystem.

Customer Due Diligence 🕵️♂️

When it comes to ensuring compliance for cryptocurrency exchanges, customer due diligence plays a crucial role. By verifying the identities of customers and assessing the risks associated with their transactions, exchanges can enhance security and integrity within the digital asset space.

Effective customer due diligence involves thorough documentation verification, ongoing monitoring of transactions, and the implementation of robust KYC (Know Your Customer) procedures. By prioritizing these practices, exchanges in Ecuador can uphold regulatory requirements and foster trust among their user base. To learn more about best practices for operating a crypto exchange, you can refer to this informative guide on cryptocurrency exchange licensing requirements in Costa Rica.

Security Measures 🔒

Cryptocurrency exchanges in Ecuador implement robust security measures to protect users’ assets from potential threats. These measures include advanced encryption protocols, multi-factor authentication, and cold storage for storing a significant portion of funds offline. Additionally, regular security audits and penetration testing are conducted to identify and address any vulnerabilities promptly. By prioritizing security, exchanges aim to instill trust and confidence among users, fostering a safe environment for trading and transacting in the digital asset space.

Ongoing Compliance Monitoring 🔄

In the realm of operating a cryptocurrency exchange in Ecuador, a crucial aspect to uphold is consistent and diligent ongoing compliance monitoring. 🔄 This involves continuously assessing and ensuring that all regulatory requirements are being met, and that necessary updates or changes are promptly implemented. By conducting regular audits and checks, the exchange can mitigate potential risks, maintain adherence to licensing rules, and safeguard the interests of both the platform and its users. This proactive approach not only supports a culture of compliance but also fosters trust and credibility within the industry. To understand more about the licensing requirements for cryptocurrency exchanges in Ecuador, one can refer to the cryptocurrency exchange licensing requirements in the Dominican Republic for detailed insights and specifics.