Understanding the Basics of Bitcoin 💡

The table format will be as follows:

| Topic | Details |

|---|---|

| Blockchain Technology | Decentralized, secure ledger system. |

| Cryptographic Hash Functions | Essential for ensuring transaction security. |

| Digital Wallets | Store and manage your bitcoins securely. |

Regulations & Compliance Requirements 📜

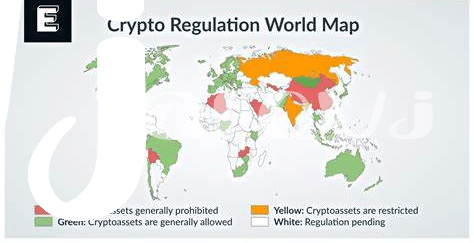

When delving into the realm of Bitcoin investments, navigating the intricate web of regulations and compliance requirements is paramount. Understanding the regulatory landscape and ensuring adherence to compliance standards is essential for a seamless investment journey. From anti-money laundering protocols to data protection regulations, staying compliant not only safeguards your investments but also fosters trust within the digital asset ecosystem. Compliance is not merely a box to check but a cornerstone of responsible and sustainable investing practices. By upholding regulatory standards, investors can mitigate potential risks, foster market integrity, and contribute to the legitimacy of the burgeoning Bitcoin market. Embracing compliance not only fortifies the investor’s position but also paves the way for a more resilient and transparent financial landscape.

Security Measures for Safeguarding Investments 🔒

Bitcoin security is a critical aspect of safeguarding your investments in the digital currency world. Ensuring the protection of your assets requires implementing robust security measures to prevent unauthorized access, fraud, and cyber attacks. By utilizing secure wallets, two-factor authentication, and keeping your private keys offline, you can significantly reduce the risk of potential breaches. Regularly updating your software, using reputable exchanges, and conducting thorough research before engaging in transactions are additional steps to enhance the security of your Bitcoin investments. Prioritizing security measures is essential to mitigate risks and protect your assets from unforeseen threats in the digital landscape.

Licensing and Registration Processes 🔑

When it comes to navigating the world of licensing and registration processes for investing in Bitcoins in Mali, it’s essential to understand the steps involved in getting the necessary approvals and permits. This part of the process can be crucial in ensuring compliance with the regulatory framework in place, providing investors with the legitimacy and protection needed to operate within the legal boundaries. By following the appropriate procedures and obtaining the required licenses, investors can establish a solid foundation for their Bitcoin investments in Mali, setting them on the right path towards financial growth and security.

For detailed regulatory guidance on Bitcoin investments in Marshall Islands, be sure to check out the valuable insights provided in this informative article: regulatory guidance on Bitcoin investments in Marshall Islands.

Tax Implications and Reporting Obligations 💰

Bitcoin investments in Mali entail various tax implications and reporting obligations that investors need to be mindful of. Understanding the tax landscape is crucial to ensure compliance with local laws and regulations. This includes reporting capital gains, income from mining activities, and potential VAT liabilities. Engaging with local tax authorities and seeking advice from financial experts can help navigate the complex tax environment surrounding digital assets in Mali. By staying informed and fulfilling reporting obligations promptly, investors can mitigate risks and optimize their returns in the evolving landscape of cryptocurrency taxation.

Benefits and Risks of Investing in Bitcoins 🚀

When considering investing in Bitcoins, it’s crucial to weigh both the potential benefits and risks that come with it. On the one hand, Bitcoin has the potential for significant growth and can serve as a diversification tool in an investment portfolio. Its decentralized nature also offers a level of independence from traditional financial systems. However, it’s important to note that the value of Bitcoin can be highly volatile, leading to potential losses as well. Additionally, the lack of regulatory oversight and security vulnerabilities in the digital currency space can pose risks to investors.

For regulatory guidance on bitcoin investments in Mali, you can refer to regulatory guidance on bitcoin investments in Maldives.