Overview 🌍

Bitcoin investment funds have garnered increasing attention in recent years, with their potential for high returns attracting investors worldwide. Understanding the regulatory framework surrounding these funds is crucial for market participants seeking to navigate the complex landscape of digital asset investments. This overview provides a comprehensive insight into the key considerations and challenges associated with investing in Bitcoin funds, shedding light on the evolving dynamics of the cryptocurrency market and its implications for investors.

Regulatory Landscape 📜

The regulatory landscape for Bitcoin investment funds in Iceland is a critical aspect that investors need to navigate. Understanding the rules and regulations set forth by the authorities is key to ensuring compliance and smooth operations. From licensing requirements to reporting obligations, it is essential to stay updated on the evolving regulatory framework. Keeping abreast of the latest developments and proactively addressing compliance issues can help protect investors and maintain the integrity of the investment funds in the dynamic cryptocurrency market.

Compliance Requirements 🛡️

Compliance requirements serve as the cornerstone for ensuring the integrity and legality of Bitcoin investment funds operation in Iceland. These essential guidelines encompass adherence to strict reporting standards, risk assessment protocols, and transparency measures. By meticulously following these compliance mandates, investment funds can uphold regulatory expectations, safeguard investor interests, and foster trust within the financial ecosystem.

Investor Protection Measures 🔒

Investor protection measures are essential components in ensuring the security and safeguarding of investors’ interests within Bitcoin investment funds. By implementing stringent protocols, such as secure custody solutions and transparency requirements, investors can feel more confident in engaging with these funds. These measures aim to mitigate potential risks and provide a level of assurance for individuals seeking to participate in the cryptocurrency investment landscape. Discover more about the future outlook of Bitcoin investment funds regulation in India [here](https://wikicrypto.news/exploring-the-future-outlook-of-bitcoin-investment-funds-regulation).

Potential Risks ⚠️

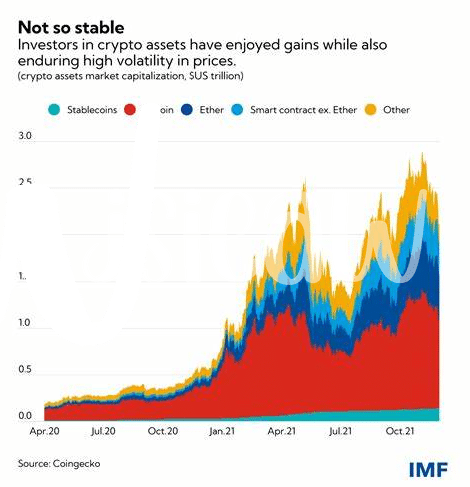

Potential Risks in investing in Bitcoin funds include market volatility, regulatory changes, and cybersecurity threats. The unpredictable nature of the cryptocurrency market can lead to substantial financial losses for investors. Moreover, the evolving regulatory environment surrounding digital assets adds a layer of uncertainty to investment decisions. Cybersecurity risks, such as hacking and theft, pose a significant threat to the security of funds stored in digital wallets. It is crucial for investors to carefully assess and manage these risks to safeguard their investments.

Future Outlook 🔮

Investors in Bitcoin investment funds in Iceland can look forward to a promising future outlook marked by evolving regulatory frameworks and growing opportunities. As the market matures and regulations continue to develop, there is increasing potential for stability and expansion within the industry. Keeping abreast of these changes will be essential for investors to navigate challenges and capitalize on emerging trends. To explore more about bitcoin investment funds regulation in other countries like Honduras, check out information on bitcoin investment funds regulation in Indonesia.