Licensing Requirements 📝

Licensing requirements for operating a cryptocurrency exchange in Iceland involve a detailed application process that mandates compliance with specific regulations set forth by the financial authorities. Applicants must demonstrate a robust business plan, financial stability, and adherence to stringent security protocols to ensure the protection of digital assets and customer funds. Additionally, proof of adequate insurance coverage and a comprehensive risk management strategy are essential components to meet the criteria for obtaining a license in this evolving industry.

To navigate the licensing landscape successfully, potential exchange operators must engage with regulatory bodies proactively, seeking guidance and clarity on the requirements to fulfill their obligations. Maintaining transparency in operations, demonstrating a commitment to customer protection, and staying abreast of regulatory updates are fundamental steps toward securing a cryptocurrency exchange license in Iceland. By prioritizing adherence to the licensing framework, operators can establish credibility and trust within the burgeoning cryptocurrency market.

Compliance Documentation 📑

When it comes to complying with regulations, having the right documentation in place is crucial. Ensuring that all required compliance documents are accurate, up-to-date, and easily accessible can streamline the licensing process and demonstrate your commitment to operating transparently and lawfully in the cryptocurrency exchange space.

Comprehensive compliance documentation not only helps you meet regulatory requirements but also serves as a valuable resource for internal reviews and audits. From policies and procedures to risk assessments and audit reports, maintaining thorough documentation is a cornerstone of a well-managed and compliant cryptocurrency exchange operation. Stay organized, stay compliant, and stay ahead in the evolving regulatory landscape.

Security Measures 🔒

Security Measures play a crucial role in safeguarding cryptocurrency exchanges from potential threats. Implementing robust encryption protocols and multi-factor authentication enhances the platform’s defense against cyber attacks. Regular security audits and penetration testing ensure vulnerabilities are identified and addressed promptly, promoting a secure trading environment for users. Continuous monitoring of the exchange’s infrastructure and swift response to any security incidents are key components in maintaining the integrity of the platform and building trust with customers. The focus on Security Measures is integral to upholding the exchange’s reputation and ensuring the safety of digital assets stored on the platform.

Anti-money Laundering Procedures 💰

When it comes to safeguarding against illegal financial activities, having robust Anti-money Laundering Procedures is paramount for cryptocurrency exchanges. Implementing stringent protocols to detect and prevent money laundering not only ensures regulatory compliance but also helps in maintaining the integrity of the exchange platform. By employing sophisticated monitoring tools, conducting thorough customer due diligence, and enhancing transaction transparency, exchanges can effectively combat money laundering risks. Staying updated on evolving industry regulations and continuously improving AML measures are essential practices in the ever-changing landscape of cryptocurrency compliance. For more insights on cryptocurrency exchange licensing requirements, check out this informative resource on successfully applying for a cryptocurrency license in Honduras.

Customer Verification Process 🔍

When it comes to ensuring compliance in cryptocurrency exchange operations, one critical aspect is the verification process for customers. This process involves verifying the identity of individuals or entities looking to engage in transactions on the platform. It typically includes collecting personal information and documentation to confirm the identity of customers. By implementing a robust customer verification process, exchanges can enhance security, mitigate risks, and uphold regulatory requirements 🔍.

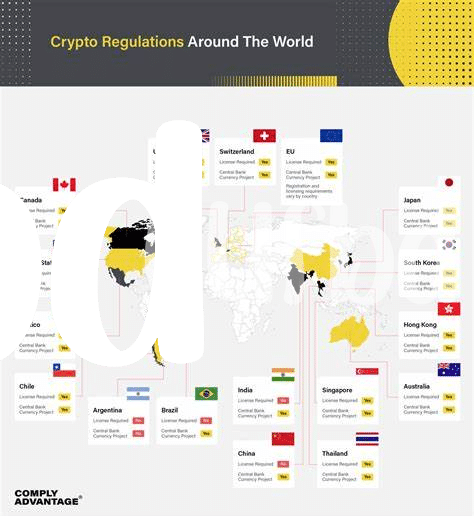

Ongoing Regulatory Updates 🌐

Navigating the ever-evolving landscape of regulatory requirements is crucial for cryptocurrency exchanges in Iceland. Staying informed about ongoing regulatory updates from authorities ensures compliance and business continuity. By proactively monitoring and implementing any changes, exchange operators can adapt their procedures effectively and maintain a seamless operation. For up-to-date information on licensing requirements in different regions, including Iceland, explore the cryptocurrency exchange licensing requirements in Iraq, and compare them with those in Honduras. This comparative analysis can provide valuable insights into the varying regulatory frameworks and help in crafting a robust compliance strategy to strengthen the exchange’s operations. Stay tuned for continuous updates to navigate the regulatory environment efficiently.